Exploring the History of National Banks

Early Origins

The concept of national banks can be traced back to ancient times, where various civilizations had their own systems of banking and financial institutions. However, the modern concept of a national bank emerged during the 17th and 18th centuries, as countries began to recognize the need for a centralized banking system.

One of the earliest examples of a national bank is the Bank of England, which was established in 1694. The Bank of England played a crucial role in financing the British government’s activities and became a model for other countries looking to establish their own national banks.

Development and Expansion

During the 19th and 20th centuries, national banks became more prevalent as countries sought to modernize their financial systems. These banks played a crucial role in facilitating economic development, providing stability to the financial sector, and supporting government policies.

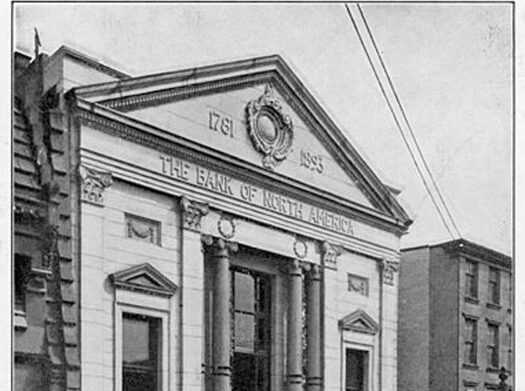

In the United States, the establishment of the First Bank of the United States in 1791 marked the beginning of a national banking system. The bank was created to stabilize the country’s financial system and manage government finances. It was followed by the creation of the Second Bank of the United States in 1816, which also served as a central bank.

Over time, national banks expanded their functions and services. They began to offer a wide range of financial products and services, including loans, savings accounts, and investment opportunities. They also played a role in regulating the banking industry and implementing monetary policies to control inflation and promote economic growth.

Modern National Banks

Examples of modern national banks include the Federal Reserve System in the United States, the European Central Bank in the Eurozone, and the Bank of Japan in Japan. These institutions have the authority to issue currency, regulate commercial banks, and implement monetary policies to maintain price stability and promote economic growth.

| Country | National Bank |

|---|---|

| United States | Federal Reserve System |

| Germany | Deutsche Bundesbank |

| France | Banque de France |

| United Kingdom | Bank of England |

Examining Examples of National Banks

1. Federal Reserve System (United States)

One of the key functions of the Federal Reserve System is to control the money supply and interest rates in order to promote economic growth and stability. Through its open market operations, the Fed buys and sells government securities to influence the amount of money in circulation. It also sets the target federal funds rate, which is the interest rate at which banks lend to each other overnight.

2. European Central Bank (Eurozone)

Similar to the Federal Reserve System, the ECB is responsible for conducting monetary policy and ensuring the stability of the financial system. It sets interest rates, conducts open market operations, and provides liquidity to banks. The ECB also plays a crucial role in overseeing the banking sector and promoting financial stability within the Eurozone.

3. Bank of England (United Kingdom)

| Central Bank | Country | Year Established |

|---|---|---|

| Federal Reserve System | United States | 1913 |

| European Central Bank | Eurozone | 1998 |

| Bank of England | United Kingdom | 1694 |

These examples demonstrate the importance of national banks in maintaining financial stability, conducting monetary policy, and supporting economic growth. They play a crucial role in the functioning of the global economy and have a significant impact on the lives of individuals and businesses.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.