What is Mortgage Insurance?

Mortgage insurance is a type of insurance that protects the lender in case the borrower defaults on their mortgage payments. It is typically required for borrowers who have a down payment of less than 20% of the home’s purchase price.

When a borrower obtains a mortgage, the lender takes on a certain level of risk. If the borrower is unable to make their monthly mortgage payments and defaults on the loan, the lender may suffer financial losses. Mortgage insurance helps mitigate this risk by providing the lender with a guarantee that they will be compensated if the borrower defaults.

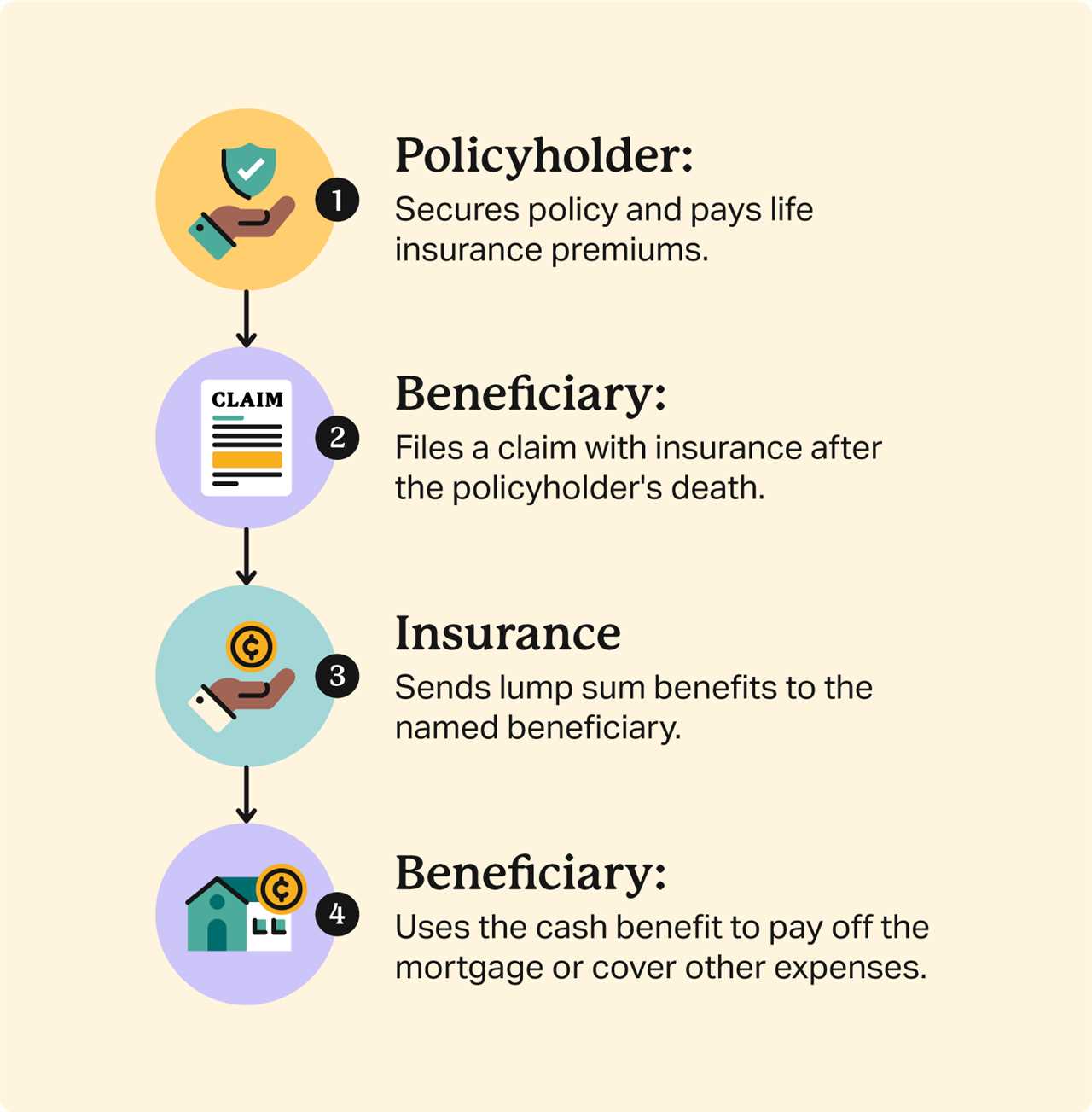

How does Mortgage Insurance Work?

When a borrower purchases a home with a down payment of less than 20%, they are typically required to obtain mortgage insurance. The cost of the insurance is usually added to the borrower’s monthly mortgage payment.

If the borrower defaults on their mortgage, the lender can file a claim with the mortgage insurance company to recover their losses. The insurance company will then pay the lender a certain percentage of the outstanding loan balance.

Types of Mortgage Insurance

There are two main types of mortgage insurance: private mortgage insurance (PMI) and government-backed mortgage insurance.

The Process of Obtaining Mortgage Insurance

Obtaining mortgage insurance is an essential step in the home buying process for many borrowers. It provides protection for lenders in case the borrower defaults on their loan. Here is a step-by-step guide on how to obtain mortgage insurance:

1. Research and Compare Insurance Providers

The first step is to research and compare different mortgage insurance providers. Look for reputable companies with a track record of providing reliable insurance coverage. Compare their rates, terms, and conditions to find the best option for your needs.

2. Contact the Chosen Insurance Provider

Once you have selected an insurance provider, contact them to start the application process. They will provide you with the necessary forms and information to proceed.

3. Complete the Application

Fill out the application form provided by the insurance provider. Be sure to provide accurate and complete information about your financial situation, including your income, assets, and liabilities.

4. Submit Required Documents

In addition to the application form, you will need to submit several documents to support your application. These may include proof of income, bank statements, tax returns, and other financial documents. Make sure to gather all the required documents and submit them in a timely manner.

5. Wait for Approval

Once you have submitted your application and supporting documents, you will need to wait for the insurance provider to review and process your application. The approval process can take some time, so be patient.

6. Pay the Premium

7. Receive Confirmation

After paying the premium, you will receive confirmation of your mortgage insurance coverage. This confirmation will outline the terms and conditions of the insurance policy, including the coverage amount and duration.

By following these steps, you can successfully obtain mortgage insurance to protect your lender and secure your home loan. Remember to carefully review the terms and conditions of the insurance policy and ask any questions you may have before signing the agreement.

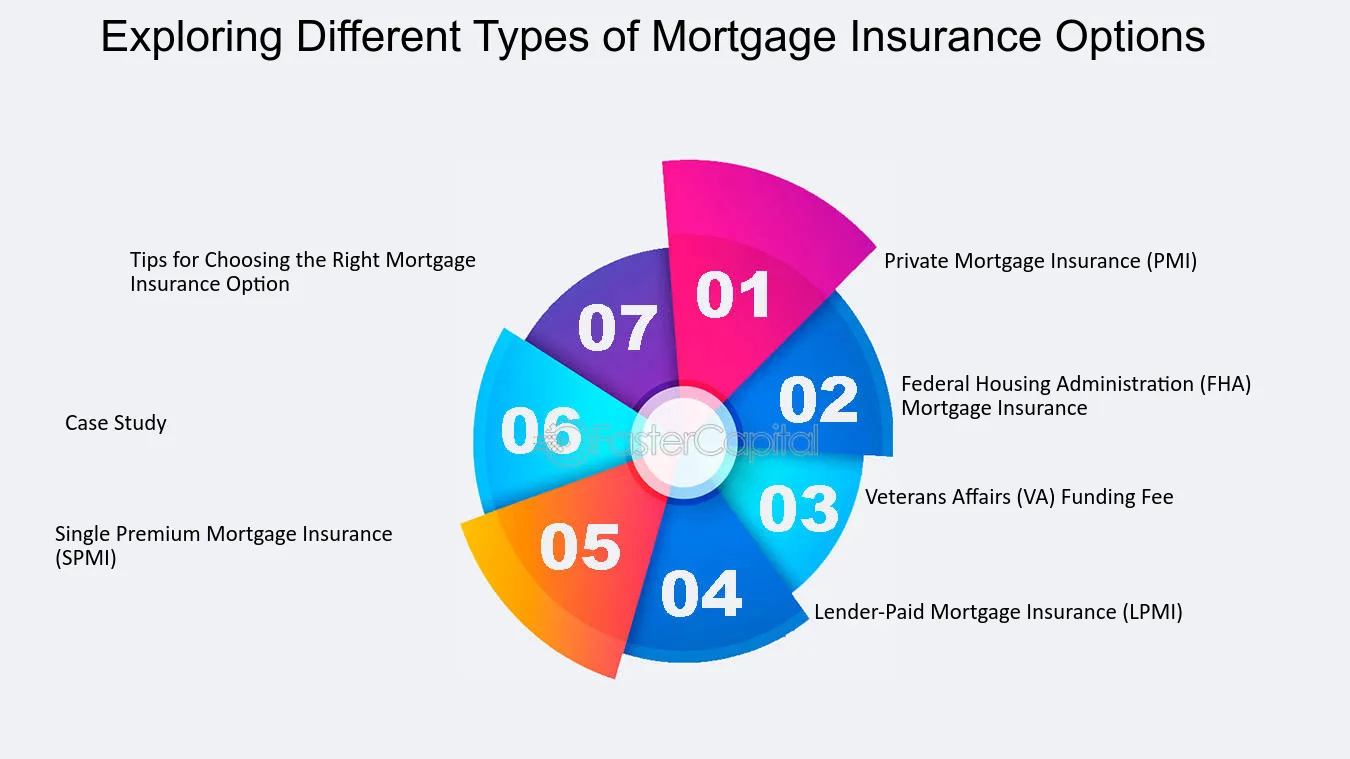

Different Types of Mortgage Insurance

1. Private Mortgage Insurance (PMI): PMI is the most common type of mortgage insurance and is typically required for borrowers who make a down payment of less than 20% on their home. PMI protects the lender in case the borrower defaults on the loan.

2. Federal Housing Administration (FHA) Mortgage Insurance: FHA mortgage insurance is required for borrowers who obtain an FHA loan, which is a government-backed loan program. FHA mortgage insurance protects the lender in case the borrower defaults on the loan.

3. Department of Veterans Affairs (VA) Mortgage Insurance: VA mortgage insurance is required for borrowers who obtain a VA loan, which is a loan program available to eligible veterans and active-duty military personnel. VA mortgage insurance protects the lender in case the borrower defaults on the loan.

4. United States Department of Agriculture (USDA) Mortgage Insurance: USDA mortgage insurance is required for borrowers who obtain a USDA loan, which is a loan program available for rural and suburban homebuyers. USDA mortgage insurance protects the lender in case the borrower defaults on the loan.

5. Lender-Paid Mortgage Insurance (LPMI): LPMI is a type of mortgage insurance where the lender pays the premiums upfront in exchange for a higher interest rate on the loan. This allows borrowers to avoid paying a separate mortgage insurance premium.

Benefits of Mortgage Insurance

Mortgage insurance offers several benefits to both lenders and borrowers. Here are some key advantages:

1. Increased Access to Homeownership

Mortgage insurance allows borrowers to purchase a home with a lower down payment, typically as low as 3%. This makes homeownership more accessible to individuals who may not have enough savings for a large down payment.

2. Lower Interest Rates

With mortgage insurance, lenders are more willing to offer lower interest rates to borrowers. This is because the insurance coverage reduces the lender’s risk of financial loss in case the borrower defaults on the loan.

3. Flexibility in Loan Options

Mortgage insurance provides flexibility in loan options, allowing borrowers to choose from various mortgage programs. Whether you’re a first-time homebuyer or looking to refinance, mortgage insurance can help you find a loan that suits your needs.

4. Protection for Lenders

By providing a layer of protection to lenders, mortgage insurance encourages them to extend loans to borrowers with less-than-perfect credit or a higher debt-to-income ratio. This protection mitigates the risk for lenders and promotes a healthy lending environment.

5. Faster Loan Approval Process

With mortgage insurance, the loan approval process is often faster compared to conventional loans. The insurance coverage provides additional reassurance to lenders, enabling them to streamline the underwriting process and expedite loan approvals.

6. Potential for Tax Deductions

Overall, mortgage insurance offers numerous advantages for both borrowers and lenders. It helps individuals achieve their dream of homeownership while providing financial security to lenders. Consider exploring mortgage insurance options to make your home buying journey smoother and more affordable.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.