Modified Dietz Method: Definition and Application in Investing

The Modified Dietz Method is a popular technique used in portfolio management to calculate the rate of return on an investment portfolio. It is a variation of the Dietz Method, which was developed by Peter Dietz in the 1960s. The Modified Dietz Method takes into account the timing and size of cash flows in the portfolio, making it a more accurate measure of performance.

Definition

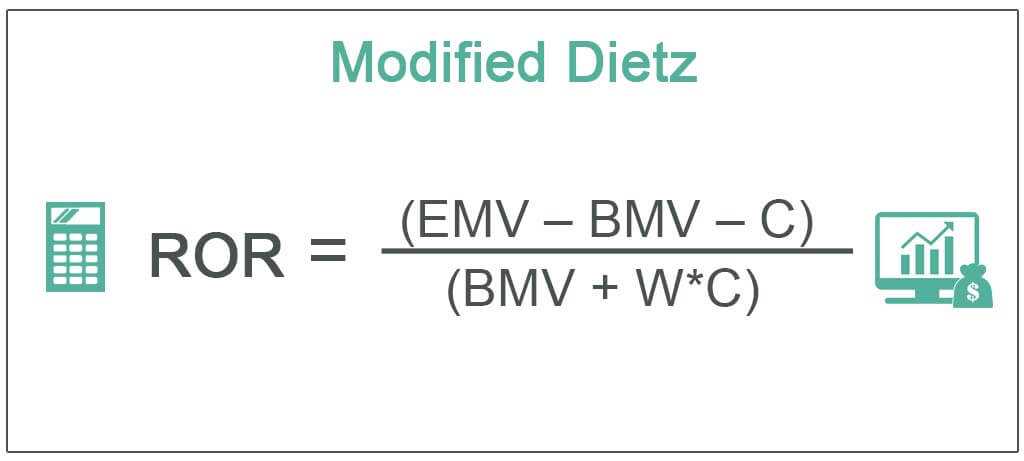

The Modified Dietz Method calculates the rate of return by considering the weighted average of the sub-period returns. It takes into account the cash flows that occur during the investment period and adjusts the returns accordingly. This method is particularly useful when there are significant cash flows in and out of the portfolio, such as contributions or withdrawals.

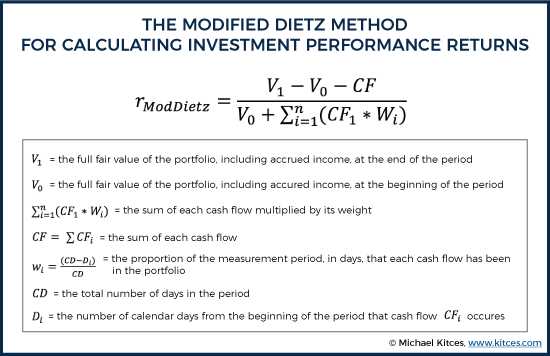

The formula for calculating the Modified Dietz Method is as follows:

Where:

- Ending Value is the value of the portfolio at the end of the investment period.

- Beginning Value is the value of the portfolio at the beginning of the investment period.

- Net Cash Flows is the sum of the cash inflows and outflows during the investment period.

Application in Investing

The Modified Dietz Method is commonly used by investment managers and analysts to accurately measure the performance of investment portfolios. It is particularly useful when there are cash flows occurring at irregular intervals or when there are significant contributions or withdrawals from the portfolio.

By taking into account the timing and size of cash flows, the Modified Dietz Method provides a more accurate measure of the portfolio’s performance. This allows investors to evaluate the success of their investment strategies and make informed decisions about their portfolios.

Additionally, the Modified Dietz Method can be used to compare the performance of different investment portfolios or to evaluate the performance of a portfolio against a benchmark. This helps investors assess the relative performance and determine if the portfolio is meeting its investment objectives.

The Modified Dietz Method is a widely used formula in the field of investing to calculate the rate of return on an investment portfolio. It takes into account the timing and size of cash flows, making it a more accurate measure of performance compared to simple returns.

The method is particularly useful for investors who regularly contribute or withdraw funds from their portfolios. By considering the impact of these cash flows, the Modified Dietz Method provides a more realistic picture of the portfolio’s performance.

To understand how the Modified Dietz Method works, let’s break it down into steps:

- Step 1: Calculate the Daily Weighted Cash Flow

- Step 2: Calculate the Daily Return

- Step 3: Calculate the Weighted Average Daily Return

- Step 4: Calculate the Modified Dietz Return

Next, you calculate the daily return by dividing the change in portfolio value by the sum of the initial portfolio value and the daily weighted cash flow. This step accounts for the impact of cash flows on the portfolio’s performance.

Finally, you calculate the Modified Dietz return by dividing the sum of the weighted average daily returns by the sum of the initial portfolio value and the daily weighted cash flow. This step provides a more accurate measure of the portfolio’s performance.

The Modified Dietz Method is widely used by investment professionals to evaluate the performance of investment portfolios. It allows for a more precise assessment of returns, especially in situations where there are frequent cash flows. By considering the timing and size of these cash flows, investors can make more informed decisions about their portfolios.

Application of the Modified Dietz Method in Investing

The Modified Dietz Method is a popular calculation technique used in portfolio management to measure the performance of an investment over a specific period of time. It takes into account the timing and size of cash flows, making it a more accurate measure of returns compared to other methods.

How does the Modified Dietz Method work?

The Modified Dietz Method calculates the rate of return by considering the cash flows into and out of the investment during the measurement period. It takes into account the weight of each cash flow based on the number of days it was invested. This method is particularly useful for investors who regularly contribute or withdraw funds from their portfolio.

Here’s how the Modified Dietz Method is applied:

- Calculate the daily return for each cash flow by dividing the cash flow by the total value of the portfolio at the time of the cash flow.

- Calculate the weighted average of the daily returns by multiplying each daily return by the number of days it was invested and summing them up.

- Divide the weighted average of the daily returns by the total number of days in the measurement period to get the average daily return.

- Multiply the average daily return by the number of days in a year to get the annualized return.

Advantages of the Modified Dietz Method

The Modified Dietz Method offers several advantages for investors:

- Accurate measurement: By considering the timing and size of cash flows, the Modified Dietz Method provides a more accurate measure of investment performance.

- Flexibility: This method can be applied to both individual investments and portfolios, making it suitable for a wide range of investors.

- Easy to calculate: The calculations involved in the Modified Dietz Method are relatively simple and can be performed using basic arithmetic.

- Useful for regular cash flows: Investors who regularly contribute or withdraw funds from their portfolio can benefit from the Modified Dietz Method’s ability to account for these cash flows.

Overall, the Modified Dietz Method is a valuable tool for investors looking to accurately measure the performance of their investments, especially when regular cash flows are involved.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.