Mastering Morning Stars: A Guide to Trading the Morning Star Candlestick Pattern

Are you interested in learning how to trade the Morning Star candlestick pattern? Look no further! Our comprehensive guide will teach you everything you need to know about this powerful pattern and how to profit from it.

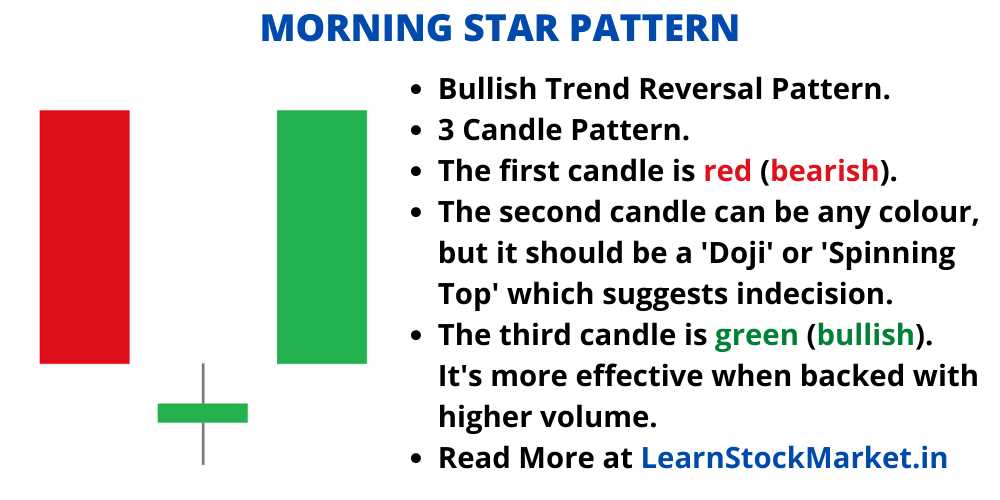

The Morning Star pattern is a bullish reversal pattern that can signal a potential trend reversal from bearish to bullish. It consists of three candles: a long bearish candle, followed by a small bullish or bearish candle, and finally a long bullish candle. This pattern is a strong indication that the bears are losing control and the bulls are taking over.

In our guide, we will walk you through the anatomy of the Morning Star pattern, explaining each candle and its significance. We will also teach you how to identify this pattern on different timeframes and in various markets, so you can take advantage of it no matter what you trade.

But that’s not all! We will also cover advanced trading strategies that you can use with the Morning Star pattern, including entry and exit points, stop-loss placement, and profit targets. We will share real-life examples and case studies to help you understand how to apply these strategies in the real market.

Whether you are a beginner or an experienced trader, our guide is designed to help you master the Morning Star pattern and improve your trading skills. Don’t miss out on this opportunity to learn from industry experts and take your trading to the next level.

Sign up now and get instant access to our Mastering Morning Stars guide. Start trading with confidence and increase your profits today!

What is the Morning Star Pattern?

The Morning Star pattern is a three-candlestick pattern that forms at the end of a downtrend. It consists of the following components:

- Bearish candlestick: The first candlestick in the pattern is a long bearish candlestick, indicating that sellers are in control of the market.

- Doji or small-bodied candlestick: The second candlestick is a doji or a small-bodied candlestick that indicates indecision in the market. This candlestick shows that the selling pressure is starting to weaken.

- Bullish candlestick: The third candlestick is a long bullish candlestick that confirms the reversal. This candlestick indicates that buyers have taken control of the market and the downtrend is likely to reverse.

How to Identify the Morning Star Pattern?

To identify the Morning Star pattern, traders should look for the following criteria:

- The pattern should occur after a prolonged downtrend.

- The first candlestick should be a long bearish candlestick.

- The second candlestick should be a doji or a small-bodied candlestick.

- The third candlestick should be a long bullish candlestick that closes above the midpoint of the first candlestick.

Trading Strategies Using the Morning Star Pattern

The Morning Star pattern can be used to develop trading strategies for both short-term and long-term traders. Here are a few strategies that traders can consider:

- Reversal strategy: Traders can take a long position when the Morning Star pattern is confirmed and place a stop-loss order below the low of the pattern. They can then target a profit by setting a take-profit order at a predetermined level.

- Confirmation strategy: Traders can use the Morning Star pattern as a confirmation signal for other technical indicators or patterns. For example, if the pattern forms near a key support level or a trendline, it can provide additional confirmation for a potential reversal.

It is important for traders to practice proper risk management and use other technical analysis tools to confirm the signals provided by the Morning Star pattern. By combining the pattern with other indicators, traders can increase the probability of successful trades.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.