Liquidity Coverage Ratio (LCR) Calculation and Definition

The Liquidity Coverage Ratio (LCR) is a financial ratio that measures a bank’s ability to meet its short-term liquidity needs. It is a regulatory requirement introduced by the Basel III framework to ensure that banks maintain a sufficient level of high-quality liquid assets to withstand a significant stress event.

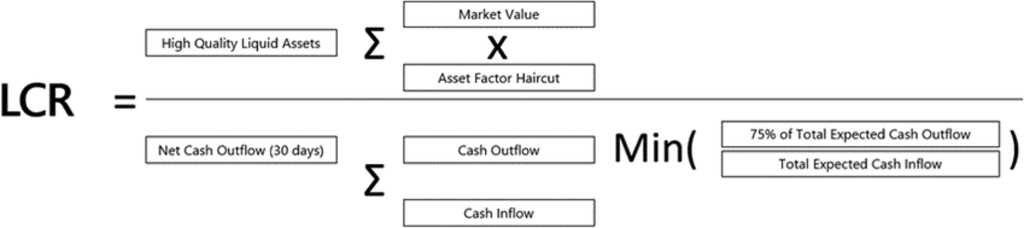

The LCR is calculated by dividing a bank’s stock of high-quality liquid assets (HQLA) by its total net cash outflows over a 30-day stress period. The ratio must be equal to or greater than 100%, indicating that the bank has enough liquid assets to cover its potential cash outflows during a stress event.

High-quality liquid assets include cash, central bank reserves, and certain government and corporate bonds that are easily convertible into cash with minimal loss of value. These assets are considered to be highly liquid and low-risk, ensuring that the bank can easily access funds in times of financial stress.

The total net cash outflows represent the expected cash outflows that a bank may experience during a 30-day stress period. This includes both expected and contingent outflows, such as customer withdrawals, loan drawdowns, and derivative exposures. The LCR calculation takes into account various scenarios to assess the bank’s liquidity position under different stress conditions.

The LCR is an important measure of a bank’s liquidity risk management and is closely monitored by regulators. It helps ensure that banks have sufficient liquidity buffers to withstand market disruptions and maintain confidence in the financial system. Banks with a higher LCR are considered to be more resilient and less vulnerable to liquidity shocks.

The Liquidity Coverage Ratio (LCR) is a financial ratio that measures a bank’s ability to meet its short-term liquidity needs. It is an important metric for regulators and investors to assess a bank’s liquidity risk and ensure its ability to withstand financial stress.

Definition of Liquidity Coverage Ratio (LCR)

To calculate the LCR, a bank needs to determine its HQLA, which includes cash, central bank reserves, and high-quality government and corporate bonds. These assets are considered highly liquid and can be easily converted into cash without significant loss of value.

The total net cash outflows represent the expected cash outflows during the stress period, taking into account both contractual and non-contractual obligations. This includes cash withdrawals by depositors, funding commitments, and other potential outflows that may occur during a period of financial stress.

Importance of the Liquidity Coverage Ratio (LCR)

The LCR is an important measure of a bank’s liquidity risk management. It ensures that banks have sufficient liquid assets to meet their short-term obligations and withstand financial stress. By maintaining a high LCR, banks can reduce the risk of liquidity shortages and potential funding difficulties.

The LCR also provides transparency to regulators and investors, allowing them to assess a bank’s ability to manage liquidity risk. It helps identify potential vulnerabilities in a bank’s liquidity profile and enables regulators to take appropriate measures to maintain financial stability.

In addition, a high LCR can enhance a bank’s reputation and investor confidence. It demonstrates the bank’s ability to manage liquidity risk effectively and signals its financial strength and stability.

| Advantages | Disadvantages |

|---|---|

| Ensures banks have sufficient liquid assets | May limit banks’ ability to invest in higher-yielding assets |

| Reduces the risk of liquidity shortages | Can increase costs for banks |

| Enhances transparency for regulators and investors | May not capture all liquidity risks |

| Strengthens bank’s reputation and investor confidence | May not reflect actual liquidity needs during a crisis |

Calculating the Liquidity Coverage Ratio (LCR)

The Liquidity Coverage Ratio (LCR) is a financial ratio that measures a bank’s ability to meet its short-term liquidity needs. It is an important metric for regulators and investors to assess the financial health and stability of a bank.

To calculate the LCR, you need to determine the bank’s high-quality liquid assets (HQLA) and its net cash outflows over a 30-day period. The LCR is calculated by dividing the bank’s HQLA by its net cash outflows.

High-quality liquid assets include cash, central bank reserves, and certain types of government securities. These assets are considered highly liquid and can be easily converted into cash without significant loss in value.

Net cash outflows are calculated by assessing the expected cash outflows and inflows over a 30-day period. Cash outflows include customer withdrawals, loan drawdowns, and other funding needs, while cash inflows include customer deposits, loan repayments, and other sources of funding.

Once you have determined the bank’s HQLA and net cash outflows, you can calculate the LCR by dividing the HQLA by the net cash outflows and multiplying the result by 100 to get a percentage.

The LCR is typically expressed as a percentage, with a minimum requirement set by regulators. For example, if a bank has an LCR of 120%, it means that it has 120% of the required high-quality liquid assets to cover its net cash outflows over a 30-day period.

Importance of the Liquidity Coverage Ratio (LCR)

The Liquidity Coverage Ratio (LCR) is a crucial financial ratio that measures a bank’s ability to meet its short-term liquidity needs. It is an important tool for regulators and investors to assess a bank’s liquidity risk and ensure its stability in times of financial stress.

The LCR requires banks to hold a sufficient amount of high-quality liquid assets (HQLA) to cover their net cash outflows over a 30-day period under a severe stress scenario. This ensures that banks have enough liquid assets to meet their obligations and withstand potential liquidity shocks.

One of the main reasons why the LCR is important is that it helps prevent a repeat of the 2008 financial crisis. During the crisis, many banks faced liquidity problems and were unable to meet their obligations, leading to a collapse of the financial system. The LCR acts as a safeguard by ensuring that banks maintain a minimum level of liquidity, reducing the risk of a liquidity crisis.

Furthermore, the LCR promotes financial stability by encouraging banks to hold a diversified portfolio of liquid assets. By diversifying their holdings, banks reduce their reliance on a single type of asset and minimize the risk of a sudden loss in value. This helps protect the overall stability of the banking system and reduces the likelihood of contagion during times of financial stress.

In addition, the LCR enhances transparency and accountability in the banking sector. By requiring banks to disclose their liquidity positions and report their LCR calculations, regulators and investors can assess the health of individual banks and make informed decisions. This promotes market discipline and helps prevent excessive risk-taking by banks.

Overall, the Liquidity Coverage Ratio (LCR) plays a crucial role in maintaining the stability and resilience of the banking system. It ensures that banks have enough liquid assets to meet their short-term obligations, reduces the risk of a liquidity crisis, promotes financial stability, and enhances transparency and accountability. By monitoring and enforcing the LCR, regulators can mitigate the potential risks associated with liquidity mismatches and protect the interests of depositors and investors.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.