What is Time-Weighted Rate of Return?

The Time-Weighted Rate of Return (TWR) is a measure used in portfolio management to calculate the performance of an investment portfolio over a specific period of time. It is a method that takes into account the effect of cash flows on the return of the portfolio.

The TWR is calculated by dividing the ending value of the portfolio by the beginning value and subtracting 1. This calculation is then multiplied by 100 to express the return as a percentage. The TWR is often used by investors and portfolio managers to evaluate the performance of their investments and compare them to benchmarks or other portfolios.

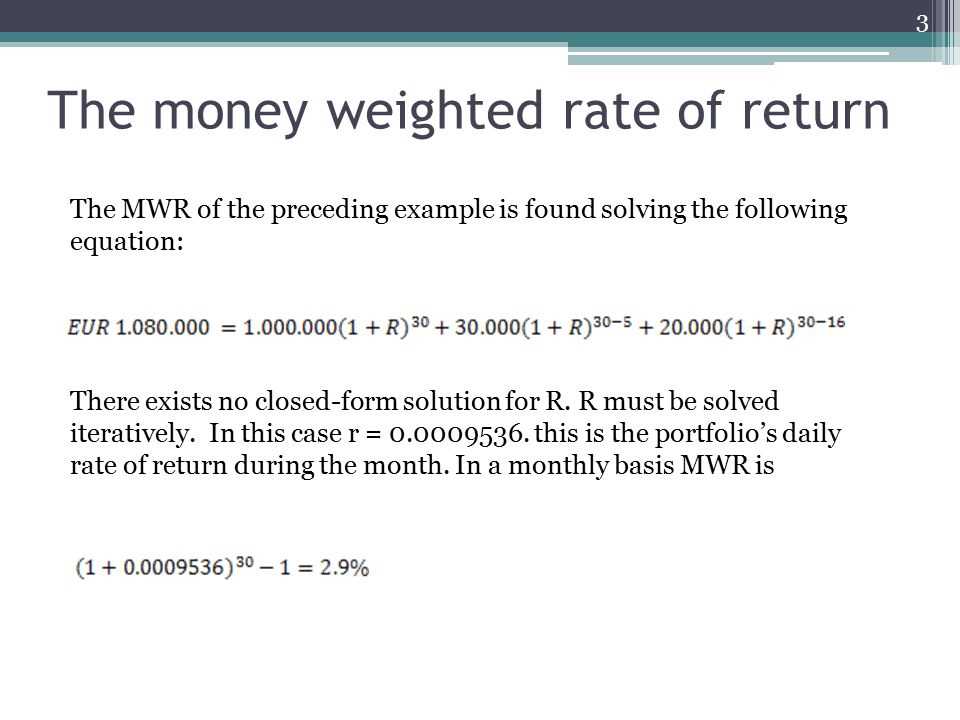

Unlike the Money-Weighted Rate of Return (MWRR), which takes into account the timing and amount of cash flows, the TWR focuses solely on the investment returns. This makes it a useful measure for evaluating the performance of the investment strategy and the skill of the portfolio manager.

The TWR is a time-weighted measure, meaning that it gives equal weight to each period in the calculation. This allows for a fair comparison of the performance of the portfolio over time, regardless of the timing and size of cash flows.

Overall, the Time-Weighted Rate of Return is an important metric in portfolio management as it provides a standardized measure of investment performance that can be used to evaluate the effectiveness of investment strategies and compare the performance of different portfolios.

Why is Time-Weighted Rate of Return Important for Portfolio Management?

The Time-Weighted Rate of Return (TWR) is a crucial metric in portfolio management as it provides a standardized way to measure the performance of an investment portfolio over a specific period of time. It is particularly important for comparing the performance of different portfolios or investment strategies.

Here are some key reasons why the Time-Weighted Rate of Return is important:

1. Objective Performance Measurement

The TWR allows portfolio managers to objectively measure the performance of their investment portfolios, regardless of external factors such as cash flows or contributions. By excluding the impact of these factors, the TWR provides a more accurate representation of the portfolio’s performance over time.

2. Fair Comparison

When comparing the performance of different portfolios or investment strategies, it is essential to use a standardized measure like the TWR. This ensures that the comparison is fair and eliminates any bias caused by differences in cash flows or contributions.

3. Evaluation of Investment Managers

The TWR is commonly used to evaluate the performance of investment managers. It allows investors to assess how well a manager has performed in generating returns for their clients, taking into account the specific time period and any external factors that may have influenced the results.

4. Benchmarking

The TWR is often used as a benchmark for comparing the performance of a portfolio against a specific market index or other investment benchmarks. This helps investors and portfolio managers determine whether their investment strategy is outperforming or underperforming the market.

5. Risk Assessment

The TWR can also be used to assess the risk-adjusted performance of a portfolio. By comparing the TWR of different portfolios with similar risk profiles, investors can determine which portfolio has achieved better returns relative to the level of risk taken.

How to Calculate Time-Weighted Rate of Return Easily?

Calculating the time-weighted rate of return (TWR) is an essential skill for portfolio management. It allows investors to accurately assess the performance of their investment over a specific period of time, regardless of any cash flows that may have occurred during that period. Here is a step-by-step guide on how to calculate the TWR:

Step 1: Gather the necessary data

Before you can calculate the TWR, you need to gather the necessary data, including the beginning value of the portfolio, the ending value of the portfolio, and any cash flows that occurred during the period. This data can typically be obtained from your brokerage or investment platform.

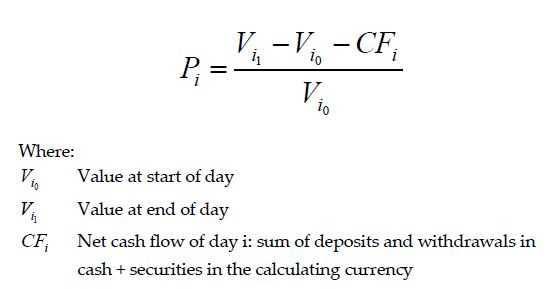

Step 2: Calculate the sub-period returns

Next, you need to calculate the sub-period returns. To do this, divide the ending value of the portfolio by the beginning value of the portfolio and subtract 1. This will give you the return for each sub-period.

Step 3: Calculate the geometric mean

Once you have the sub-period returns, you can calculate the geometric mean. To do this, multiply all of the sub-period returns together and then raise the result to the power of 1 divided by the number of sub-periods. This will give you the geometric mean return.

Step 4: Calculate the TWR

Finally, you can calculate the TWR by adding 1 to the geometric mean return and subtracting 1. This will give you the time-weighted rate of return for the period.

By following these steps, you can easily calculate the time-weighted rate of return for your portfolio. This will allow you to make informed decisions about your investments and track your performance over time.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.