What is a Key Ratio?

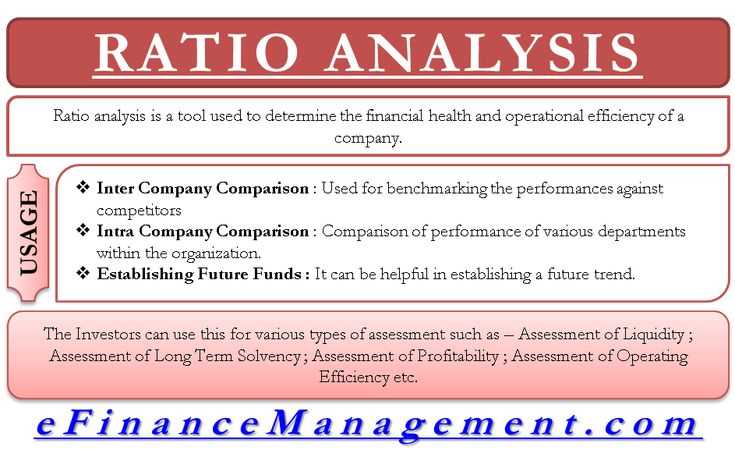

There are various types of key ratios, each focusing on a different aspect of a company’s financial performance. Some common key ratios include profitability ratios (such as gross profit margin and return on equity), liquidity ratios (such as current ratio and quick ratio), and solvency ratios (such as debt-to-equity ratio and interest coverage ratio).

Key ratios are typically expressed as a percentage or a ratio, which allows for easy comparison and benchmarking. They can be calculated using simple formulas and can be found in a company’s financial statements or financial reports.

Overall, key ratios are essential tools for financial analysis and provide valuable insights into a company’s financial performance and health. They help investors and analysts make informed decisions and assess the potential risks and rewards associated with investing in a particular company.

Example of a Key Ratio

A key ratio is a financial metric that is used to analyze and evaluate the performance and financial health of a company. It provides valuable insights into various aspects of a company’s operations and helps investors and analysts make informed decisions.

One example of a key ratio is the current ratio, which measures a company’s ability to meet its short-term obligations. It is calculated by dividing the company’s current assets by its current liabilities. For example, if a company has $100,000 in current assets and $50,000 in current liabilities, its current ratio would be 2:1.

The current ratio is an important key ratio because it indicates the company’s liquidity and ability to pay off its short-term debts. A ratio of 2:1 is generally considered healthy, as it suggests that the company has enough assets to cover its liabilities. However, a ratio below 1 may indicate financial distress and an inability to meet its obligations.

Another example of a key ratio is the return on equity (ROE), which measures a company’s profitability relative to its shareholders’ equity. It is calculated by dividing the company’s net income by its average shareholders’ equity. For example, if a company has a net income of $1 million and an average shareholders’ equity of $10 million, its ROE would be 10%.

Pros and Cons of Key Ratios

Key ratios are an essential tool for analyzing the financial health and performance of a company. They provide valuable insights into various aspects of a company’s operations, helping investors and analysts make informed decisions. However, like any tool, key ratios have their pros and cons.

Pros of Key Ratios

1. Simplifies Financial Analysis: Key ratios condense complex financial information into simple, easy-to-understand metrics. They provide a quick snapshot of a company’s financial health, allowing investors to assess its performance without delving into detailed financial statements.

2. Enables Comparison: Key ratios facilitate comparisons between different companies within the same industry or sector. By comparing key ratios, investors can identify companies that outperform their peers and make more informed investment decisions.

3. Identifies Financial Strengths and Weaknesses: Key ratios highlight a company’s financial strengths and weaknesses. For example, a high current ratio indicates a company’s ability to meet short-term obligations, while a low debt-to-equity ratio suggests a lower risk of insolvency.

4. Helps in Forecasting: Key ratios provide insights into a company’s future prospects. By analyzing trends in key ratios over time, investors can make reasonable forecasts about a company’s future financial performance.

Cons of Key Ratios

1. Limited Scope: Key ratios provide a broad overview of a company’s financial health but may not capture all aspects of its operations. They do not consider qualitative factors such as management quality, industry trends, or competitive advantages, which can significantly impact a company’s performance.

2. Industry-Specific: Key ratios may vary across industries due to differences in business models and operating dynamics. Comparing key ratios of companies from different industries may not provide accurate insights and can lead to incorrect investment decisions.

3. Historical Data: Key ratios are based on historical financial data, which may not reflect a company’s current or future performance accurately. Changes in market conditions, industry trends, or company strategies may render historical key ratios less relevant.

4. Manipulation Risk: Key ratios can be manipulated by companies to present a favorable financial picture. Companies may engage in creative accounting practices or window dressing to manipulate key ratios and deceive investors. It is essential to consider other factors and perform a comprehensive analysis to mitigate this risk.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.