Key Person Insurance: Definition, Cost, Types, and How It Works

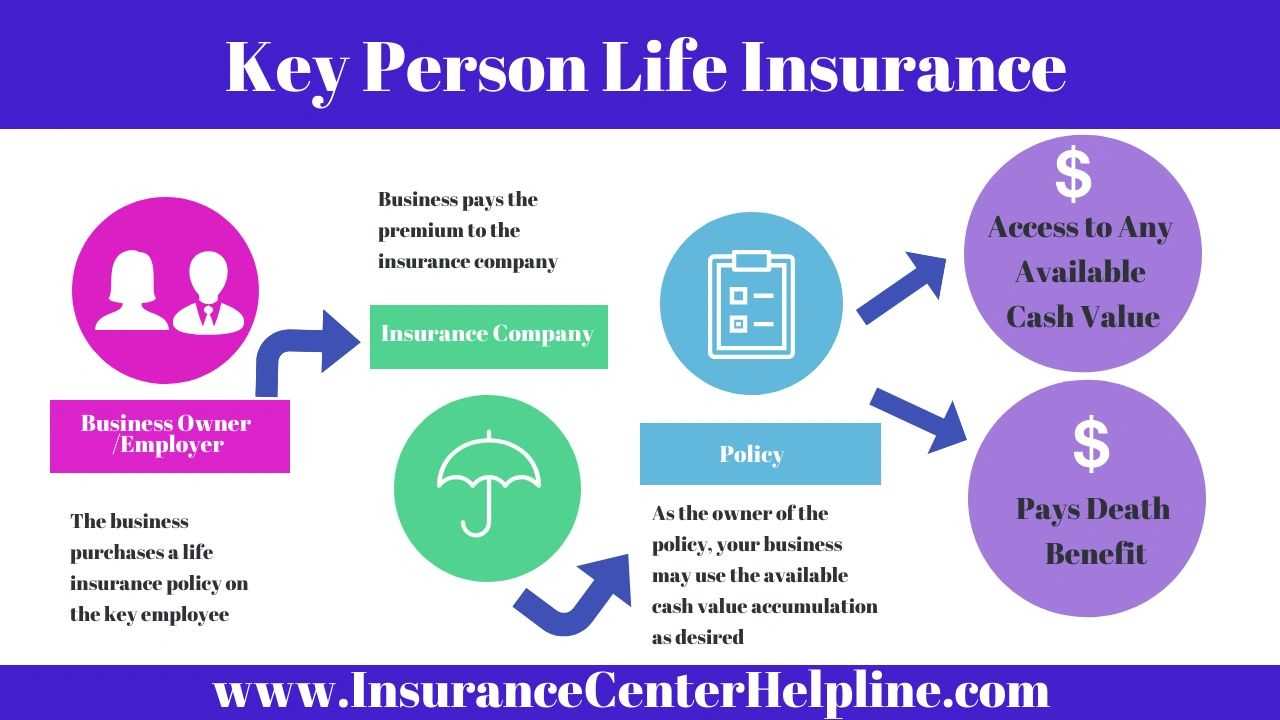

Key Person Insurance is a type of life insurance policy that provides financial protection to a business in the event of the death or disability of a key employee or owner. This insurance policy is designed to help the business recover from the loss of a key person by providing funds to cover expenses, such as hiring and training a replacement, paying off debts, or compensating for lost profits.

Definition

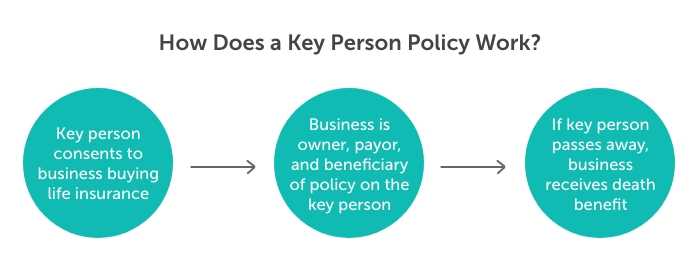

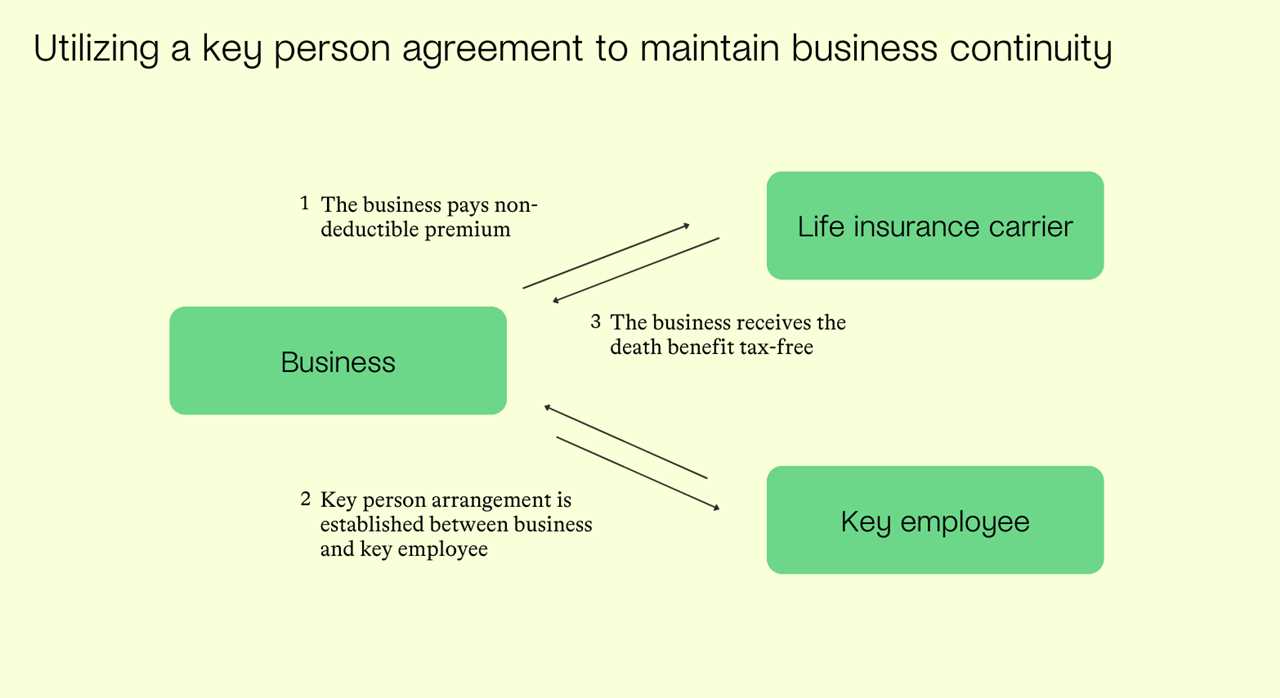

Key Person Insurance is a policy that is taken out by a business on the life of a key employee or owner. The policy pays out a death benefit to the business in the event of the key person’s death or disability. The business is the beneficiary of the policy and can use the funds in any way it sees fit to help mitigate the financial impact of losing a key person.

Cost

Types

There are two main types of Key Person Insurance: term life insurance and whole life insurance. Term life insurance provides coverage for a specific period of time, such as 10 or 20 years, and pays out a death benefit if the key person dies during that term. Whole life insurance, on the other hand, provides coverage for the entire lifetime of the key person and also accumulates a cash value over time.

How It Works

When a business decides to purchase Key Person Insurance, it typically involves the following steps:

- Identifying the key person or persons who are essential to the success and profitability of the business.

- Determining the amount of coverage needed to protect the business in the event of the key person’s death or disability.

- Applying for the insurance policy and providing the necessary information, such as medical history and financial details.

- Paying the premiums on the policy, which are typically tax-deductible for the business.

- In the event of the key person’s death or disability, filing a claim with the insurance company and providing the necessary documentation.

- Receiving the death benefit from the insurance company, which can then be used by the business to cover expenses and mitigate the financial impact of losing a key person.

Key Person Insurance is an important tool for businesses to protect themselves against the financial consequences of losing a key employee or owner. By providing a financial safety net, this type of insurance can help ensure the continued success and stability of the business.

What is Key Person Insurance?

A key person is someone who plays a crucial role in the success and profitability of a business. This could be a founder, owner, executive, or any employee who possesses unique skills, knowledge, experience, or relationships that are vital to the company’s operations and revenue generation. The loss of such an individual can have a significant impact on the business, including loss of clients, decreased productivity, and increased expenses.

Key Person Insurance provides a financial safety net to the company by paying a lump sum benefit in the event of the death or disability of the insured key person. The policy proceeds can be used to cover various expenses, such as hiring and training a replacement, paying off debts, compensating for lost profits, or even funding the search for a suitable successor.

There are different types of Key Person Insurance policies available, including term life insurance, whole life insurance, and disability insurance. Each type has its own benefits and considerations, and it is important for businesses to carefully evaluate their needs and consult with an insurance professional to determine the most suitable policy.

Cost of Key Person Insurance

When considering key person insurance, one of the most important factors to consider is the cost. The cost of key person insurance can vary depending on several factors, including the age and health of the key person, the amount of coverage needed, and the type of policy chosen.

Typically, key person insurance is purchased as a life insurance policy, which means that the cost will be based on the key person’s age and health. Younger and healthier individuals generally have lower premiums, while older individuals or those with pre-existing health conditions may have higher premiums.

The amount of coverage needed is another factor that can affect the cost of key person insurance. The coverage amount should be sufficient to cover any financial losses that may occur if the key person were to pass away or become disabled. This can include lost revenue, the cost of hiring and training a replacement, and any outstanding debts or obligations that the key person may have.

Finally, the type of policy chosen can also impact the cost of key person insurance. There are two main types of key person insurance policies: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period of time, such as 10 or 20 years, while permanent life insurance provides coverage for the entire lifetime of the key person. Permanent life insurance policies generally have higher premiums than term life insurance policies.

It is important to carefully consider the cost of key person insurance and weigh it against the potential financial impact of losing a key person. While the cost may seem high, the financial protection provided by key person insurance can be invaluable in the event of a loss.

| Factors | Impact on Cost |

|---|---|

| Age and health of key person | Younger and healthier individuals generally have lower premiums |

| Amount of coverage needed | Higher coverage amounts may result in higher premiums |

| Type of policy chosen | Permanent life insurance policies generally have higher premiums than term life insurance policies |

Types of Key Person Insurance

Key person insurance is a type of life insurance policy that provides financial protection to a business in the event of the death or disability of a key employee. There are several types of key person insurance policies available, each designed to meet the specific needs of a business.

1. Traditional Key Person Insurance

Traditional key person insurance is the most common type of policy and provides coverage for the death or disability of a key employee. In the event of the insured person’s death or disability, the policy pays out a lump sum benefit to the business to help cover expenses such as hiring and training a replacement, paying off debts, or compensating for lost profits.

2. Key Employee Replacement Insurance

Key employee replacement insurance is a type of policy that focuses on the cost of finding and training a replacement for a key employee. This policy provides coverage for the expenses associated with recruiting, hiring, and training a new employee to fill the role of the insured person.

This type of policy is particularly useful for businesses that rely heavily on the skills and expertise of a specific individual and would face significant challenges in finding a suitable replacement.

3. Key Employee Disability Insurance

Key employee disability insurance is designed to provide coverage in the event that a key employee becomes disabled and is unable to work. This type of policy pays out a monthly benefit to the business to help cover ongoing expenses and compensate for lost profits during the insured person’s disability.

Key employee disability insurance can be especially important for businesses that rely on the unique skills and knowledge of a key employee and would suffer significant financial losses if that individual were unable to work due to a disability.

Conclusion:

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.