Overview of IRS Publication 970

IRS Publication 970 is a comprehensive guide that provides information on tax benefits for education. It is a valuable resource for students, parents, and educational institutions to understand the tax provisions related to education expenses.

The publication covers various topics, including the American Opportunity Credit, the Lifetime Learning Credit, and the tuition and fees deduction. It provides detailed explanations of each tax benefit, eligibility criteria, and how to claim them on your tax return.

Key Features of IRS Publication 970

1. American Opportunity Credit: This section explains the tax credit available to eligible students for qualified education expenses, such as tuition, fees, and course materials. It provides information on the maximum credit amount, income limits, and how to calculate the credit.

2. Lifetime Learning Credit: This section discusses the tax credit available to individuals who are pursuing higher education or acquiring new skills. It provides details on the eligibility requirements, credit amount, and how to claim the credit.

3. Tuition and Fees Deduction: This section explains the deduction available for qualified education expenses paid during the tax year. It covers the eligibility criteria, deductible expenses, and how to calculate the deduction.

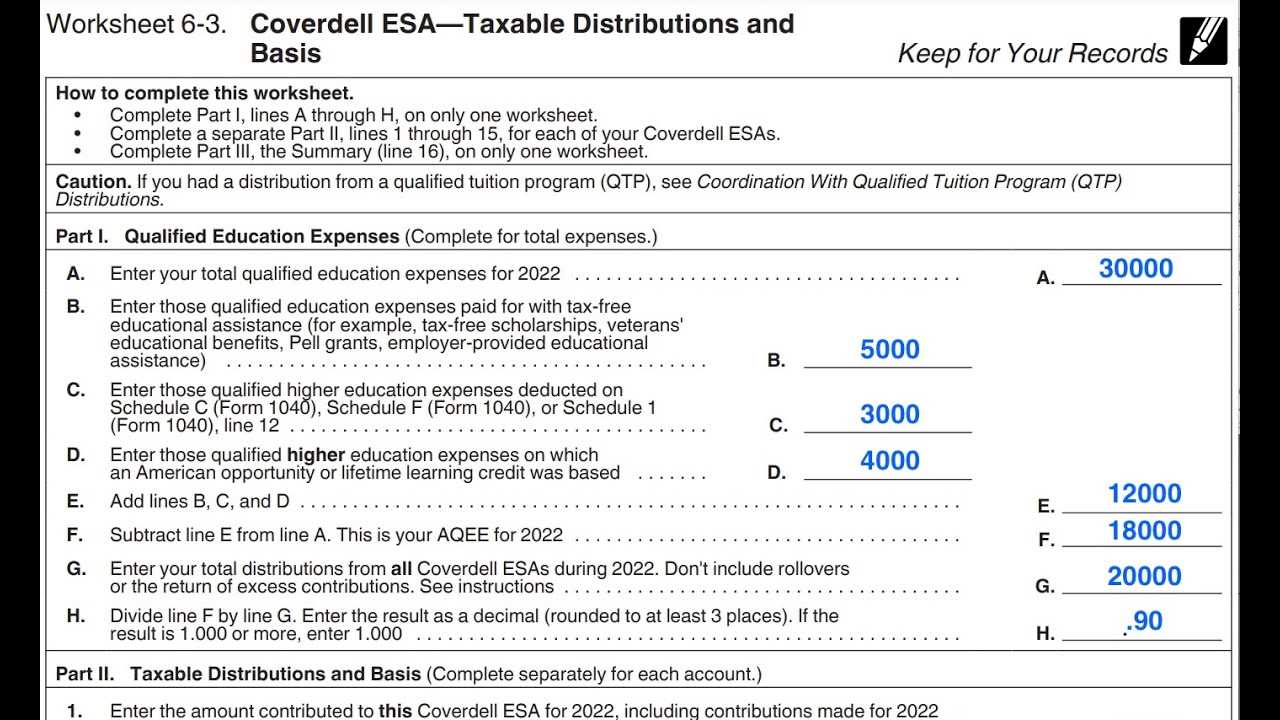

4. Coverdell Education Savings Accounts: This section provides information on the tax-advantaged savings accounts that can be used to pay for qualified education expenses. It explains the contribution limits, tax treatment of withdrawals, and eligible expenses.

Who Should Use IRS Publication 970?

IRS Publication 970 is beneficial for students, parents, and educational institutions. Students can use it to understand the tax benefits available to them and determine which credits or deductions they are eligible for. Parents can learn about the tax benefits associated with their children’s education expenses and how to claim them on their tax return.

Educational institutions can use IRS Publication 970 to provide guidance to their students and parents regarding the tax implications of education expenses. It can help them answer common questions and ensure compliance with the IRS regulations.

Tax Benefits for Education Explained

Types of Tax Benefits

There are several types of tax benefits available for education expenses, including:

- American Opportunity Credit: This credit allows eligible students to claim up to $2,500 per year for the first four years of post-secondary education.

- Lifetime Learning Credit: This credit provides up to $2,000 per year for students pursuing undergraduate, graduate, or professional degree courses.

- Tuition and Fees Deduction: This deduction allows taxpayers to deduct up to $4,000 in qualified education expenses.

- Student Loan Interest Deduction: Taxpayers may deduct up to $2,500 in interest paid on qualified student loans.

- 529 Plans: These plans allow for tax-free growth and withdrawals when funds are used for qualified education expenses.

Eligibility Criteria

To qualify for these tax benefits, certain eligibility criteria must be met. For example:

- American Opportunity Credit: The student must be pursuing a degree or other recognized educational credential and enrolled at least half-time in an eligible educational institution.

- Lifetime Learning Credit: The credit is available for both part-time and full-time students, and there is no limit on the number of years the credit can be claimed.

- Tuition and Fees Deduction: The deduction is available for all levels of education and can be claimed by the taxpayer, their spouse, or a dependent.

- Student Loan Interest Deduction: The deduction is available for interest paid on loans taken out solely for educational purposes.

- 529 Plans: Contributions to these plans are not deductible on federal tax returns, but the earnings grow tax-free, and withdrawals are tax-free when used for qualified education expenses.

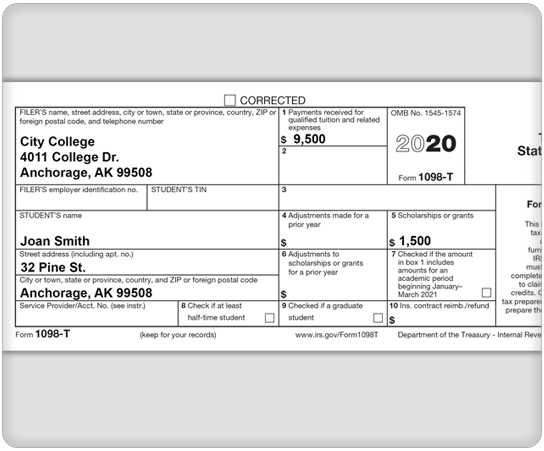

Claiming Tax Benefits

To claim tax benefits for education expenses, taxpayers must complete and submit the necessary forms, such as Form 8863 for education credits or Schedule 1 for the tuition and fees deduction. It is crucial to keep records of all education-related expenses and any supporting documentation, such as tuition statements or loan interest statements.

It is also recommended to consult a tax professional or refer to IRS Publication 970 for detailed information on eligibility requirements, calculation methods, and any updates or changes to the tax benefits for education.

By taking advantage of these tax benefits, students and their families can reduce the financial burden of education expenses and make higher education more accessible and affordable.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.