What is Invoice Financing?

With invoice financing, businesses can receive a percentage of the invoice amount upfront, typically around 80% to 90%, while the factor takes on the responsibility of collecting payment from the customer. Once the customer pays the invoice in full, the factor will release the remaining amount, minus a fee or discount, to the business.

This financing option provides businesses with quick access to working capital, allowing them to cover immediate expenses, invest in growth opportunities, or simply improve cash flow. It eliminates the need to wait for customers to pay their invoices, which can often take weeks or even months.

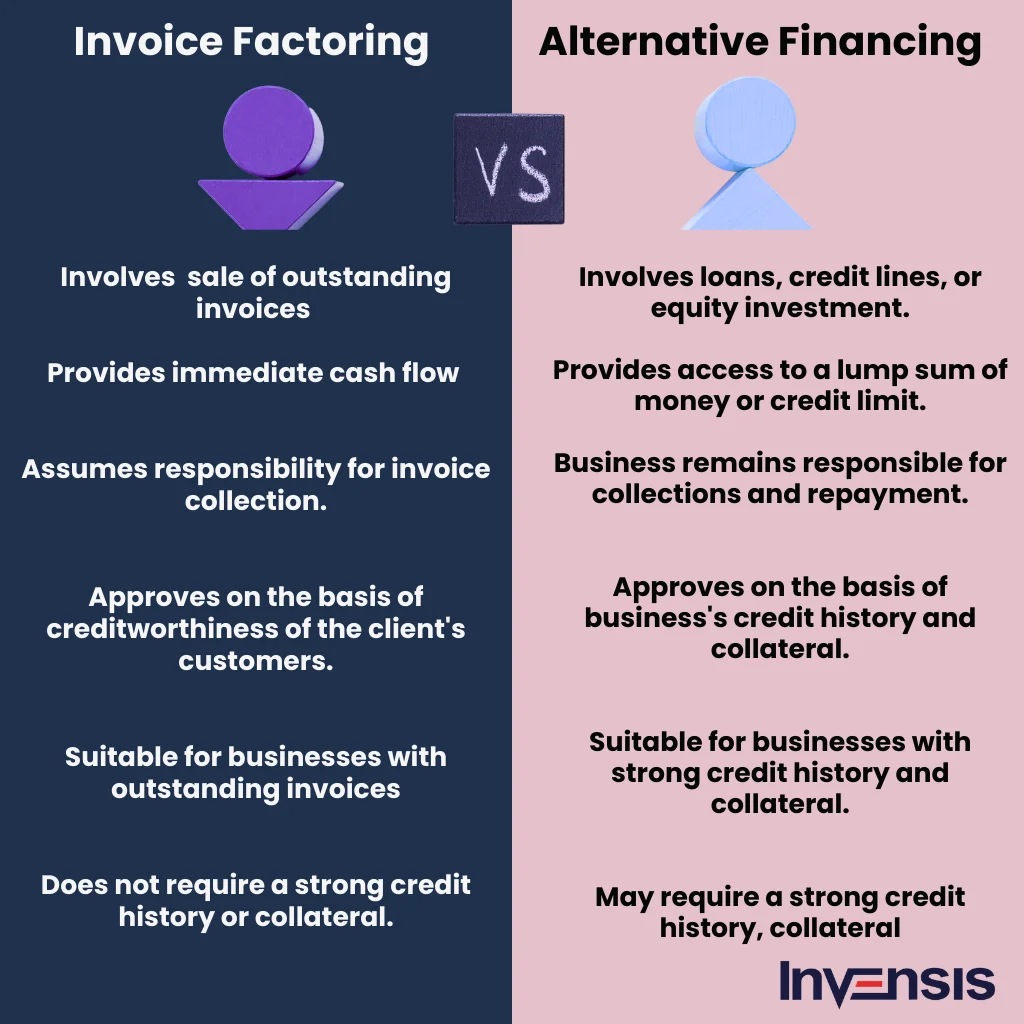

Invoice financing is different from traditional loans or lines of credit, as it is based on the value of the invoices rather than the business’s creditworthiness. This makes it an attractive option for small businesses that may have limited credit history or face challenges in obtaining traditional financing.

In summary, invoice financing is a flexible and accessible financing solution that helps small businesses bridge the gap between invoicing and receiving payment. It provides immediate cash flow and allows businesses to focus on their core operations without worrying about late payments or cash flow constraints.

Definition and Explanation

With invoice financing, businesses can bridge the gap between issuing an invoice and receiving payment from their customers. Instead of waiting for weeks or even months for their invoices to be paid, businesses can get immediate access to a percentage of the invoice amount, typically around 80-90%. The remaining balance, minus fees and interest, is paid to the business once the customer pays the invoice in full.

This financing option is particularly beneficial for small businesses that face cash flow challenges due to long payment terms or late payments from customers. It provides them with the necessary working capital to cover operational expenses, invest in growth opportunities, and meet financial obligations.

Invoice financing is different from traditional bank loans as it focuses on the value of the invoices rather than the creditworthiness of the business. This makes it an attractive option for businesses with limited credit history or poor credit scores.

Overall, invoice financing offers a flexible and accessible funding solution for small businesses, helping them manage their cash flow effectively and seize growth opportunities.

Structure of Invoice Financing

Invoice financing is a flexible funding solution that allows businesses to access working capital by using their unpaid invoices as collateral. It involves a three-party transaction between the business (seller), the customer (buyer), and the financing company (lender).

1. Invoice Submission

2. Verification and Approval

Once the invoices are received, the financing company verifies the authenticity and validity of the invoices. They also assess the creditworthiness of the business’s customers to ensure timely payment. If everything checks out, the financing company approves the funding request.

3. Advance Payment

Upon approval, the financing company provides an advance payment to the business. The amount of the advance is typically a percentage of the total value of the invoices, ranging from 70% to 90%. This allows the business to access immediate funds to cover their operational expenses.

4. Collection and Payment

After the advance payment is made, the financing company takes over the collection process. They communicate with the business’s customers and handle the payment collection. Once the customers make the payment, the financing company deducts their fees and releases the remaining funds to the business.

5. Repayment

Once the customers’ payments are received, the business is responsible for repaying the financing company. The repayment is typically made in full, including the fees charged by the financing company. The repayment terms and schedule are agreed upon between the business and the financing company.

Overall, the structure of invoice financing provides businesses with a convenient and efficient way to access working capital. It eliminates the wait for customer payments and allows businesses to maintain a steady cash flow for their operations.

Key Components and Process

| Component | Description |

|---|---|

| Invoice | An invoice is a document issued by a business to its customers, requesting payment for goods or services provided. |

| Invoice Financing Provider | An invoice financing provider is a financial institution or company that offers financing solutions to businesses in exchange for their unpaid invoices. |

| Advance Rate | The advance rate is the percentage of the invoice amount that the financing provider is willing to advance to the business upfront. This rate typically ranges from 70% to 90%. |

| Discount Fee | The discount fee is the cost of financing charged by the provider. It is usually calculated as a percentage of the invoice amount and is deducted from the remaining amount after the customer pays the invoice. |

| Verification and Approval | Before approving the financing, the provider verifies the authenticity and validity of the invoices submitted by the business. This process may involve checking the creditworthiness of the customers and assessing the likelihood of invoice payment. |

| Funding | Once the invoices are approved, the financing provider disburses the agreed-upon advance amount to the business. This funding can be received within a few days, providing immediate cash flow to the business. |

| Repayment | When the customer pays the invoice, the financing provider deducts the discount fee and any other applicable charges. The remaining amount is then released to the business, completing the repayment process. |

Alternative Solutions to Invoice Financing

While invoice financing can be a valuable tool for small businesses, it is important to explore alternative solutions to ensure you are making the best financial decisions for your company. Here are some alternative financing options to consider:

1. Business Line of Credit

A business line of credit is a flexible financing option that allows you to borrow funds as needed, up to a predetermined credit limit. This can be a good alternative to invoice financing as it provides ongoing access to funds without the need to rely on specific invoices.

2. Small Business Loans

Small business loans are a traditional financing option that can provide a lump sum of funds to be used for various business expenses. These loans typically have fixed interest rates and repayment terms, making them a predictable financing option.

Remember: When considering alternative financing options, it is important to evaluate the interest rates, repayment terms, and any additional fees associated with each option. Additionally, consider your business’s specific needs and financial situation to determine which solution is the best fit.

By exploring alternative solutions to invoice financing, you can ensure that you are making informed decisions about your business’s financial health and growth.

Exploring Other Financing Options

1. Business Loans

One alternative option to consider is a traditional business loan. This type of financing allows you to borrow a lump sum of money that you can use for various business expenses, including working capital, expansion, or purchasing equipment. Business loans typically have fixed interest rates and repayment terms, giving you more control over your finances.

2. Line of Credit

A line of credit is another financing option that provides you with access to a predetermined amount of money that you can borrow as needed. This can be a flexible solution for managing cash flow fluctuations or unexpected expenses. With a line of credit, you only pay interest on the amount you borrow, making it a cost-effective option.

Exploring other financing options can help you find the best solution for your small business. Whether it’s a business loan, a line of credit, or another alternative, make sure to evaluate your needs and choose the option that aligns with your goals and financial situation.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.