What Is Inheritance?

Inheritance is the process by which an individual receives assets or property from a deceased person. It is a legal and financial term that refers to the transfer of wealth, property, or other assets from one generation to another. Inheritance can take various forms, including money, real estate, stocks, bonds, businesses, and personal possessions.

When someone passes away, their assets and property are typically distributed according to their will or the laws of intestacy if there is no will. The person who receives the inheritance is called an heir or a beneficiary. Inheritance can be a significant financial windfall for the recipient, providing them with financial security and the ability to achieve their goals.

However, inheritance is not always a straightforward process. Disputes and conflicts can arise among family members over the distribution of assets, especially if there is no clear will or if the deceased person’s wishes are not clearly communicated. In such cases, legal intervention may be necessary to resolve the issues and ensure a fair distribution of the inheritance.

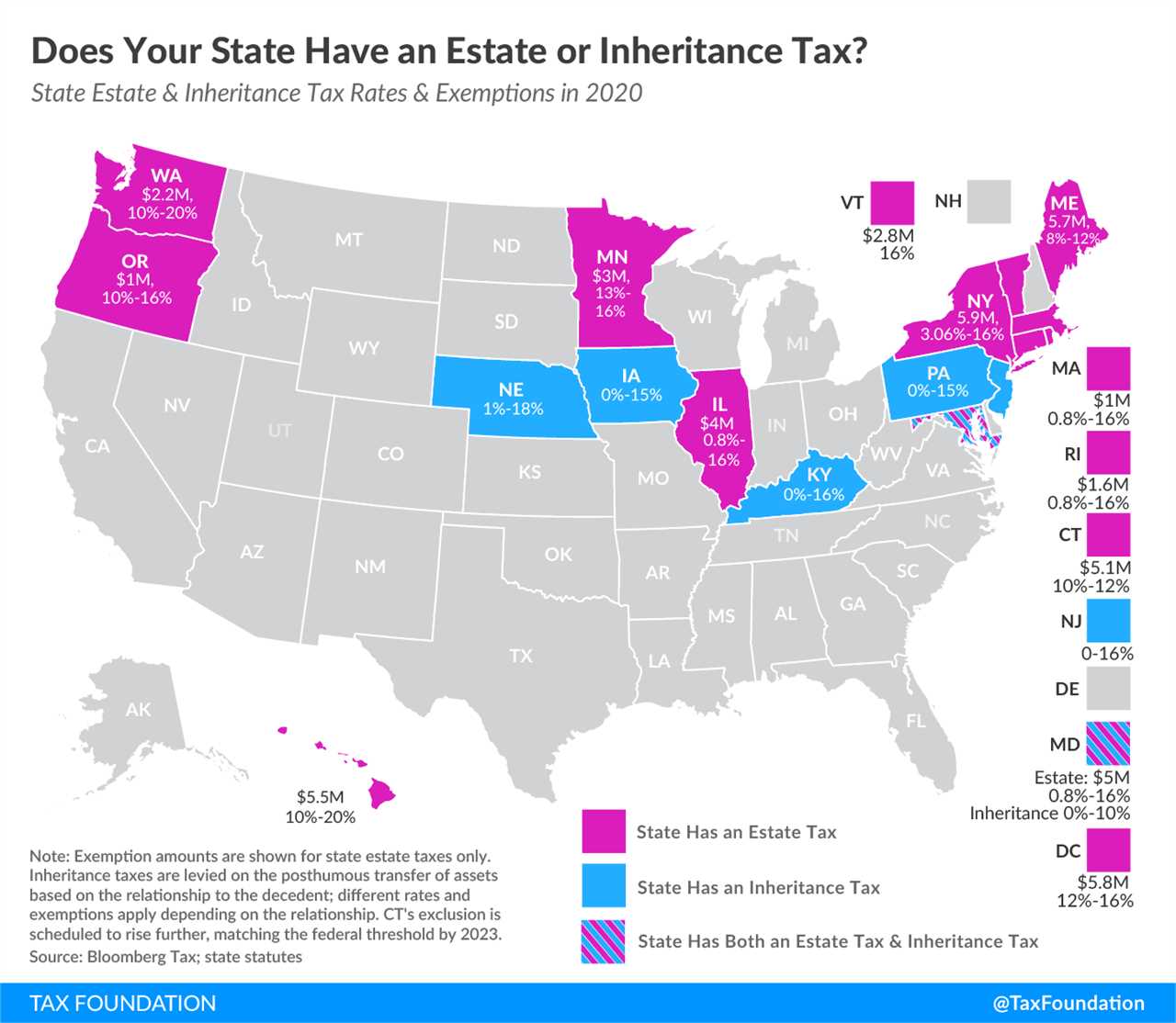

Inheritance can also have important tax implications. Depending on the jurisdiction and the value of the assets being inherited, the recipient may be required to pay inheritance taxes or estate taxes. These taxes can significantly reduce the amount of the inheritance received.

Overall, inheritance is a complex and multifaceted concept that involves legal, financial, and emotional considerations. It is important for individuals to understand the implications of inheritance and to engage in proper estate planning to ensure the smooth transfer of assets and minimize potential conflicts.

How Does Inheritance Work?

Inheritance is the process by which assets, property, or wealth is passed down from one generation to another after the death of the owner. It is a legal and financial concept that plays a crucial role in estate planning and wealth transfer.

When a person passes away, their assets and liabilities are evaluated, and their estate is created. The estate includes all the assets, such as real estate, investments, bank accounts, and personal belongings, as well as any debts or liabilities. The estate is then distributed to the heirs according to the deceased person’s wishes, as stated in their will or determined by the laws of intestacy if there is no will.

The process of inheritance involves several steps:

| Step 1: | Identification of heirs |

| Step 2: | Estate administration |

| Step 3: | Asset valuation |

| Step 4: | Debt settlement |

| Step 5: | Asset distribution |

During the identification of heirs, it is determined who will inherit the assets of the deceased. This can be specified in the will or determined by the laws of intestacy if there is no will. The heirs may include immediate family members, such as spouses, children, or grandchildren, as well as other relatives or individuals named in the will.

Next, the assets of the estate are valued. This includes determining the worth of real estate, investments, bank accounts, and any other assets. The valuation process may involve hiring professionals, such as appraisers or accountants, to assess the value of the assets accurately.

After the assets are valued, the debts and liabilities of the deceased are settled. This includes paying off any outstanding debts, such as mortgages, loans, or credit card bills. The remaining assets are then available for distribution to the heirs.

Finally, the assets are distributed to the heirs according to the wishes of the deceased or the laws of intestacy. This may involve transferring ownership of real estate, dividing financial assets, or distributing personal belongings. The distribution process may be overseen by the executor or personal representative of the estate.

It is important to note that the process of inheritance can be complex, especially when dealing with large or complicated estates. In such cases, it is advisable to seek the assistance of professionals, such as estate planning attorneys or financial advisors, to ensure that the inheritance process is carried out smoothly and in compliance with applicable laws and regulations.

Types of Inheritance

Inheritance refers to the transfer of assets, property, or wealth from one individual to another after the death of the original owner. There are several types of inheritance that can occur, each with its own characteristics and implications.

1. Intestate Inheritance

2. Testate Inheritance

Testate inheritance occurs when a person dies with a valid will. The will specifies how the assets should be distributed and who the beneficiaries are. The executor of the will is responsible for carrying out the wishes of the deceased and ensuring that the assets are distributed according to the terms of the will.

3. Specific Bequests

Specific bequests refer to the inheritance of specific assets or properties that are explicitly mentioned in the will. For example, a person may leave a specific piece of jewelry to a family member or a particular piece of artwork to a friend. These specific bequests take priority over other types of inheritance and are distributed first.

4. Residuary Inheritance

Residuary inheritance refers to the remaining assets that are not specifically mentioned in the will. These assets are distributed among the beneficiaries after the specific bequests have been fulfilled. The residuary inheritance may include cash, investments, real estate, or any other assets that were not designated to a specific individual.

5. Joint Tenancy with Right of Survivorship

Joint tenancy with right of survivorship is a type of inheritance that applies to jointly owned property. When one owner dies, their share of the property automatically passes to the surviving owner(s) without going through probate. This type of inheritance is commonly used for real estate and bank accounts held in joint names.

These are just a few examples of the types of inheritance that can occur. The specific type of inheritance will depend on various factors, including the presence of a will, the nature of the assets, and the laws of the jurisdiction. It is important to consult with an attorney or estate planner to ensure that your assets are distributed according to your wishes and in the most tax-efficient manner.

Inheritance and Taxes

There are different types of taxes that may apply to an inheritance, depending on the jurisdiction. One common form of taxation is the inheritance tax, which is levied on the value of the inherited assets. The tax rate and threshold vary from country to country and can also depend on the relationship between the deceased and the beneficiary.

Planning for Inheritance Taxes

Proper estate planning can help minimize the impact of taxes on an inheritance. One common strategy is to establish a trust, which can provide tax advantages and allow for more control over the distribution of assets. By placing assets in a trust, they may be shielded from certain taxes, and the trust can outline specific instructions for how the assets should be managed and distributed.

Another option is to gift assets during your lifetime, rather than waiting for them to be inherited. In many jurisdictions, gifts are subject to different tax rules than inheritances, and there may be annual or lifetime gift tax exemptions that can be utilized to reduce the tax burden.

Trust and Estate Planning for Inheritance

One of the main benefits of trust and estate planning is the ability to minimize taxes. By setting up a trust, you can potentially reduce the amount of estate taxes that your beneficiaries will have to pay. This can help preserve more of your wealth for future generations.

Additionally, trust and estate planning allows you to protect your assets from potential creditors or legal disputes. By placing your assets in a trust, you can ensure that they are shielded from any claims or judgments that may arise in the future. This can provide peace of mind knowing that your hard-earned assets are safeguarded.

Another important aspect of trust and estate planning is the ability to designate guardians for minor children. If you have young children, it is essential to name a guardian who will take care of them in the event of your untimely passing. By including this provision in your estate plan, you can ensure that your children are in good hands.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.