Information Coefficient IC: Definition, Example, and Formula

The Information Coefficient (IC) is a measure used in portfolio management to assess the predictive power of investment recommendations or signals. It quantifies the degree to which these recommendations are able to predict the future performance of a particular investment.

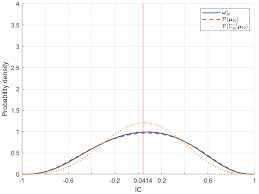

The IC is calculated by correlating the actual returns of an investment with the expected returns based on the recommendations or signals. It ranges from -1 to 1, where a value of 1 indicates a perfect predictive power, 0 indicates no predictive power, and -1 indicates a perfect inverse predictive power.

The formula for calculating the IC is as follows:

IC = Correlation(Actual Returns, Expected Returns)

For example, let’s say an investment analyst provides a recommendation to buy a particular stock, and based on historical data and analysis, the expected return for that stock is 10%. If the actual return of the stock turns out to be 12%, the IC would be calculated by correlating the actual returns of 12% with the expected returns of 10%.

The IC is an important metric in portfolio management as it helps investors and portfolio managers evaluate the quality of investment recommendations or signals. A higher IC indicates a stronger predictive power, suggesting that the recommendations are more likely to be accurate and profitable. On the other hand, a lower IC indicates a weaker predictive power, suggesting that the recommendations may not be reliable.

What is Information Coefficient IC?

The Information Coefficient (IC) is a measure used in portfolio management to assess the ability of an investment manager or analyst to generate alpha, which is the excess return of a portfolio compared to its benchmark. It quantifies the skill of the manager or analyst in making accurate predictions about the future performance of individual securities or assets.

The IC measures the correlation between the predicted returns of a security or asset and the actual returns observed in the market. A high IC indicates that the manager or analyst has a strong ability to forecast the future performance of securities, while a low IC suggests a lack of skill in making accurate predictions.

The IC is calculated by comparing the predicted returns of a security or asset to the actual returns observed over a specific time period. The correlation between these two sets of returns is then calculated using statistical methods. The resulting IC value ranges from -1 to 1, with a value of 1 indicating a perfect correlation between predicted and actual returns, and a value of -1 indicating a perfect inverse correlation.

Investment managers and analysts use the IC to evaluate the performance of their investment strategies and to identify areas where improvements can be made. A high IC suggests that the manager or analyst is able to consistently generate alpha, while a low IC may indicate the need for adjustments to the investment strategy or the need for additional research and analysis.

Overall, the Information Coefficient is an important tool in portfolio management as it helps investors assess the skill and performance of investment managers and analysts in making accurate predictions about the future performance of securities and assets.

How is Information Coefficient IC Calculated?

The Information Coefficient (IC) is a measure used in portfolio management to assess the predictive ability of an investment strategy or model. It quantifies the relationship between the predicted returns of a strategy and the actual returns observed in the market.

To calculate the Information Coefficient, you need two sets of data: the predicted returns and the actual returns. The predicted returns are generated by the investment strategy or model, while the actual returns are the realized returns in the market.

The next step is to calculate the standard deviation of the predicted returns and the standard deviation of the actual returns. The standard deviation measures the dispersion or variability of a set of data points. It gives an indication of how spread out the returns are around the mean.

Finally, the Information Coefficient is calculated by dividing the correlation coefficient by the product of the standard deviations of the predicted and actual returns. The formula for calculating the Information Coefficient is as follows:

Information Coefficient (IC) = Correlation coefficient / (Standard deviation of predicted returns * Standard deviation of actual returns)

The resulting value of the Information Coefficient ranges from -1 to 1. A positive value indicates a positive correlation between the predicted and actual returns, suggesting that the investment strategy or model has some predictive ability. A negative value indicates a negative correlation, meaning that the strategy or model is inversely related to the actual returns. A value of zero indicates no correlation.

The Information Coefficient is an important metric in portfolio management as it helps investors and portfolio managers evaluate the effectiveness of their investment strategies or models. A higher Information Coefficient suggests a stronger predictive ability, while a lower coefficient indicates a weaker relationship between the predicted and actual returns.

Example of Information Coefficient IC

The Information Coefficient (IC) is a measure used in portfolio management to assess the quality of investment research. It quantifies the relationship between the predictions made by an investment analyst and the actual performance of the investments. A high IC indicates that the analyst’s predictions are accurate and valuable, while a low IC suggests that the predictions are not reliable.

Let’s consider an example to understand how the Information Coefficient is calculated. Suppose an investment analyst makes predictions for a portfolio of stocks. The analyst provides a list of recommended stocks and their expected returns. After a certain period of time, the actual returns of these stocks are compared to the analyst’s predictions.

For example, if the correlation coefficient is 0.8, it means that there is a strong positive relationship between the analyst’s predictions and the actual returns. This suggests that the analyst’s predictions are accurate and reliable. On the other hand, if the correlation coefficient is -0.2, it means that there is a weak negative relationship between the predictions and the actual returns. This indicates that the analyst’s predictions are not reliable.

The Information Coefficient is an important metric in portfolio management as it helps investors evaluate the performance of investment analysts and make informed decisions about their investments. A high IC indicates that the analyst’s predictions are valuable and can be used to make profitable investment decisions. On the other hand, a low IC suggests that the analyst’s predictions should be treated with caution and may not be reliable.

Importance of Information Coefficient IC in Portfolio Management

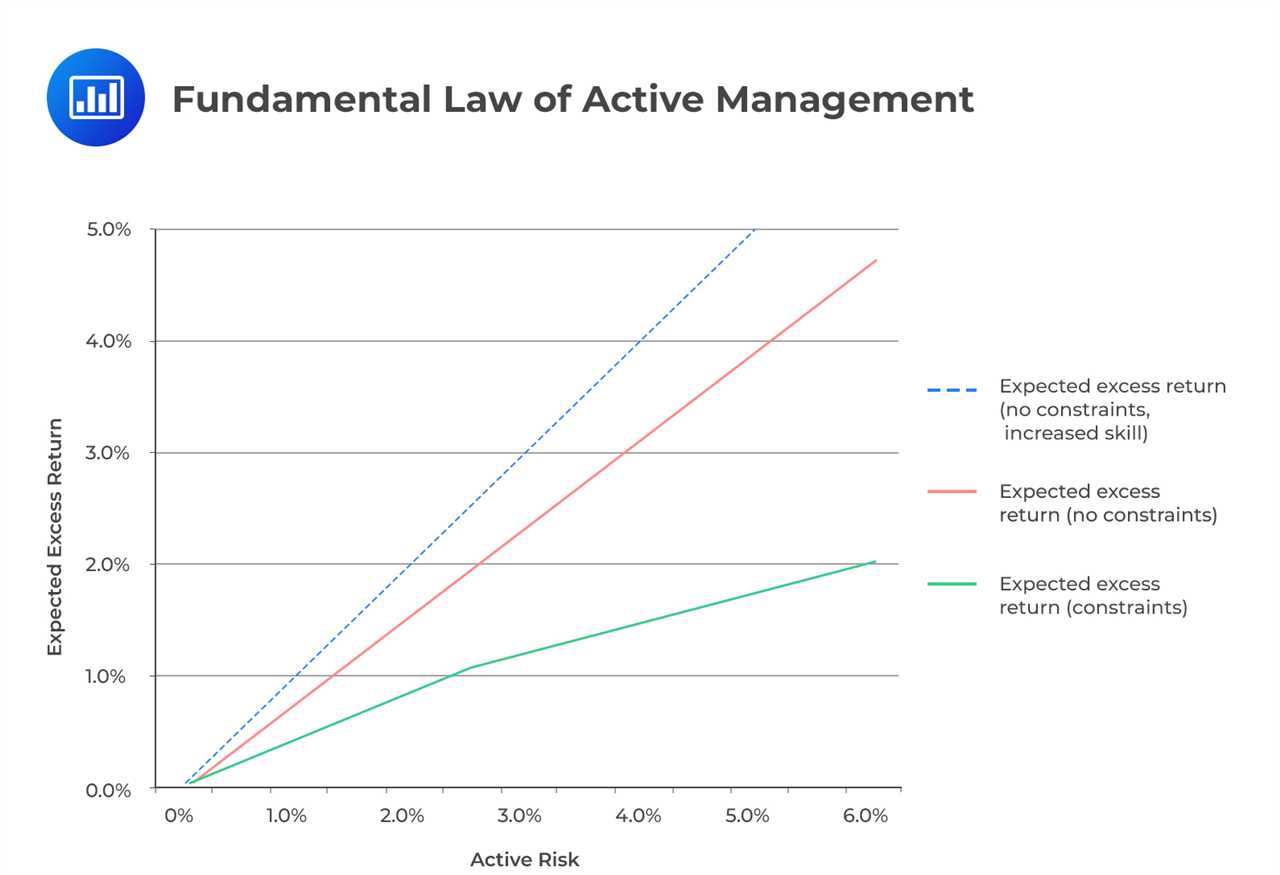

The Information Coefficient (IC) is a crucial metric in portfolio management that measures the predictive ability of an investment strategy or analyst. It provides valuable insights into the quality and reliability of the information used to make investment decisions.

One of the main reasons why the Information Coefficient is important in portfolio management is that it helps investors assess the skill level of their investment managers or analysts. A high IC indicates that the investment strategy or analyst is able to consistently generate accurate predictions about future returns. This can be a strong indicator of their expertise and ability to generate alpha.

By evaluating the IC, portfolio managers can identify which investment strategies or analysts are adding value to the portfolio and which are not. This information is crucial for making informed decisions about portfolio allocation and resource allocation within the investment team.

Furthermore, the Information Coefficient can also help portfolio managers identify potential sources of alpha and risk. By analyzing the IC of different investment strategies or analysts, managers can identify which sources of information are providing the most accurate and reliable signals. This information can be used to allocate resources and adjust the portfolio to maximize returns and minimize risk.

Additionally, the Information Coefficient can be used to evaluate the effectiveness of research and information gathering processes. If the IC is low, it may indicate that the research process needs improvement or that the information being used is not reliable. This can prompt portfolio managers to reassess their research methods and seek out better sources of information.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.