Hysteresis in Economics: Definition, Types, and Example

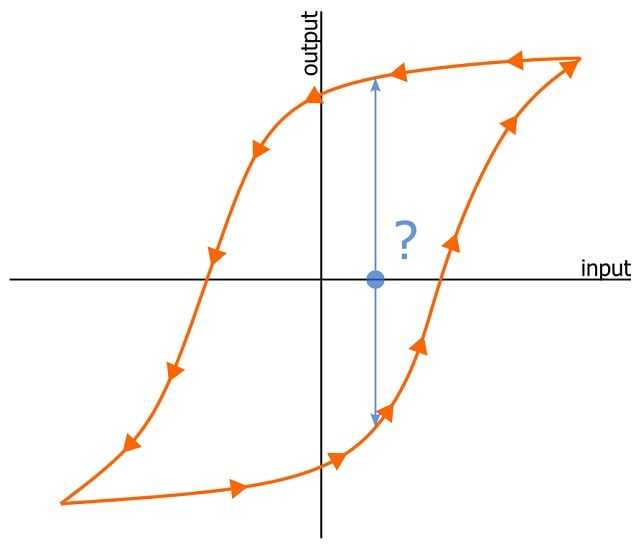

Hysteresis in economics refers to the phenomenon where the effects of past events or shocks persist and have a lasting impact on the current state of the economy. It is a concept that is widely studied in macroeconomics and has important implications for economic policy-making.

Definition of Hysteresis

Types of Hysteresis

There are several types of hysteresis that can occur in an economy:

- Unemployment Hysteresis: This type of hysteresis suggests that a temporary increase in unemployment can have long-lasting effects on the natural rate of unemployment. It implies that even after the initial shock is resolved, the unemployment rate remains higher than it was before the shock.

- Output Hysteresis: Output hysteresis refers to the idea that a temporary decline in output can have persistent effects on the economy’s productive capacity. It implies that even after the initial shock is resolved, the economy’s output remains below its potential level.

- Investment Hysteresis: Investment hysteresis suggests that a decline in investment can have long-lasting effects on the economy’s future growth potential. It implies that even after the initial shock is resolved, the level of investment remains lower than it was before the shock.

Example of Hysteresis

A classic example of hysteresis is the impact of a recession on the labor market. During a recession, many workers become unemployed. Even after the recession ends and the economy starts to recover, some of these workers may struggle to find new jobs or may drop out of the labor force altogether. This leads to a higher natural rate of unemployment, which persists even in the absence of any new shocks to the economy.

Another example is the impact of a financial crisis on investment. During a financial crisis, businesses may face difficulties in accessing credit and may cut back on their investment plans. Even after the crisis is over and credit conditions improve, businesses may remain cautious and hesitant to invest, leading to a lower level of investment than before the crisis.

These examples illustrate how hysteresis can have long-lasting effects on the economy, shaping its structure and behavior even after the initial shock has passed.

Hysteresis is a concept in macroeconomics that refers to the persistence of economic conditions or trends even after the initial shock or cause has been removed. It suggests that the economy can exhibit path dependency, where past events or conditions have a lasting impact on future outcomes.

Types of Hysteresis

There are different types of hysteresis that can occur in macroeconomics:

- Unemployment Hysteresis: As mentioned earlier, this type of hysteresis refers to the persistence of high unemployment rates even after the economy recovers from a recession.

- Output Hysteresis: This type of hysteresis suggests that a negative shock to the economy, such as a financial crisis or a recession, can have long-lasting effects on the level of output. Even after the initial shock is resolved, the economy may struggle to return to its previous level of production.

- Inflation Hysteresis: Inflation hysteresis occurs when the inflation rate becomes sticky and does not respond immediately to changes in economic conditions. For example, if there is a period of high inflation, it may persist even after the factors that initially caused it have been resolved.

Examples of Hysteresis in Economic Phenomena

There are several real-world examples of hysteresis in economic phenomena:

- The Great Depression: The severe economic downturn of the 1930s had long-lasting effects on the economy, with high unemployment rates persisting for many years even after the initial shock.

- The European Sovereign Debt Crisis: The financial crisis that began in 2009 had a lasting impact on the economies of several European countries, leading to high levels of unemployment and sluggish economic growth.

- The Phillips Curve: The Phillips Curve, which shows the relationship between inflation and unemployment, suggests that changes in the unemployment rate can have a lasting impact on inflation rates.

Definition of Hysteresis in Economics

Hysteresis in economics refers to a phenomenon where the past state or history of an economic variable influences its current and future behavior. It suggests that the path an economic variable takes is not solely determined by its current conditions, but also by its past conditions.

Hysteresis can occur in various economic variables, such as employment, output, investment, and prices. It is often associated with macroeconomic fluctuations and the persistence of economic downturns or recessions.

Types of Hysteresis

There are two main types of hysteresis in economics:

- Classical Hysteresis: This type of hysteresis suggests that the current state of an economic variable is influenced by its past values. It implies that the variable exhibits a memory effect, where its current value depends on its previous values.

- Structural Hysteresis: This type of hysteresis suggests that the current state of an economic variable is influenced by structural factors or shocks. These structural factors can include changes in technology, institutions, or regulations, which can lead to persistent changes in the variable.

Example of Hysteresis in Economic Phenomena

An example of hysteresis in economics is the concept of long-term unemployment. During an economic downturn or recession, the unemployment rate tends to increase. However, even after the economy recovers and starts growing again, the unemployment rate may remain high for an extended period. This is due to the hysteresis effect, where the past high unemployment rate has a lasting impact on the current and future unemployment rate.

Another example is the output gap, which measures the difference between actual output and potential output in an economy. If the economy experiences a prolonged period of below-potential output, it can lead to a permanent loss of productive capacity. This loss can result in a lower potential output even after the economy recovers, demonstrating the hysteresis effect.

Types of Hysteresis in Macroeconomics

Hysteresis is a concept in macroeconomics that refers to the idea that the effects of a shock or disturbance to an economy can persist even after the initial cause of the shock has been removed. This means that the economy does not quickly return to its previous state, but instead experiences a long-lasting impact.

There are several types of hysteresis that can occur in macroeconomics:

1. Unemployment Hysteresis: This type of hysteresis occurs when a temporary increase in unemployment leads to a permanent increase in the natural rate of unemployment. For example, during an economic recession, many workers may lose their jobs. Even after the economy recovers, some of these workers may remain unemployed for an extended period, leading to a higher overall unemployment rate.

2. Output Hysteresis: This type of hysteresis occurs when a temporary decrease in output leads to a permanent decrease in the potential output of an economy. For example, during a financial crisis, businesses may reduce their investments and cut back on production. Even after the crisis is over, these businesses may be hesitant to increase their production capacity, resulting in a lower overall level of output.

3. Investment Hysteresis: This type of hysteresis occurs when a temporary decline in investment leads to a long-term decrease in the level of investment in an economy. For example, during a period of economic uncertainty, businesses may delay or cancel their investment plans. Even after the uncertainty is resolved, these businesses may be reluctant to resume their investment activities, leading to a lower overall level of investment.

4. Wage Hysteresis: This type of hysteresis occurs when a temporary decrease in wages leads to a long-term decrease in the level of wages in an economy. For example, during an economic downturn, businesses may reduce wages in order to cut costs. Even after the economy recovers, these businesses may be resistant to increasing wages, resulting in a lower overall level of wages.

5. Price Hysteresis: This type of hysteresis occurs when a temporary change in prices leads to a long-term change in the level of prices in an economy. For example, during a period of high inflation, businesses may increase their prices to maintain their profit margins. Even after the inflation rate decreases, these businesses may be hesitant to lower their prices, resulting in a higher overall level of prices.

Hysteresis effects can have significant implications for macroeconomic policy. If hysteresis is present in an economy, policymakers may need to take proactive measures to address the underlying causes of the hysteresis in order to restore the economy to its previous state. This could involve implementing policies to stimulate investment, reduce unemployment, or promote wage growth, depending on the specific type of hysteresis that is present.

Examples of Hysteresis in Economic Phenomena

Hysteresis, a concept borrowed from physics, has found its application in economics to explain certain economic phenomena. Here are some examples of hysteresis in economic contexts:

1. Unemployment Hysteresis

Unemployment hysteresis refers to the idea that past levels of unemployment can have a lasting impact on current and future unemployment rates. This means that a temporary increase in unemployment can lead to a persistent increase in the overall unemployment rate, even after the initial shock has subsided.

For example, during an economic recession, when many people lose their jobs, the long-term unemployed may become discouraged and drop out of the labor force. When the economy starts recovering, these discouraged workers may not immediately reenter the labor market, resulting in a higher unemployment rate than what would be expected based on the current economic conditions alone.

2. Investment Hysteresis

Investment hysteresis suggests that past levels of investment can influence current and future investment decisions. It implies that a period of low investment can lead to a long-lasting decrease in the overall level of investment, even when economic conditions improve.

For instance, during an economic downturn, businesses may cut back on their investment plans due to reduced demand and uncertainty. Even when the economy starts recovering, businesses may remain cautious and hesitant to increase their investment levels, leading to a slower recovery in investment compared to other economic indicators.

3. Exchange Rate Hysteresis

Exchange rate hysteresis refers to the idea that past exchange rate levels can affect the current and future exchange rate dynamics. It suggests that exchange rates may not always adjust immediately to changes in economic fundamentals, but instead, they can exhibit a path-dependent behavior.

For example, if a currency experiences a significant depreciation, it may take some time for the exchange rate to appreciate even when the economic conditions improve. This delay in adjustment can be attributed to various factors, such as market expectations, investor sentiment, and policy interventions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.