What is Implied Volatility?

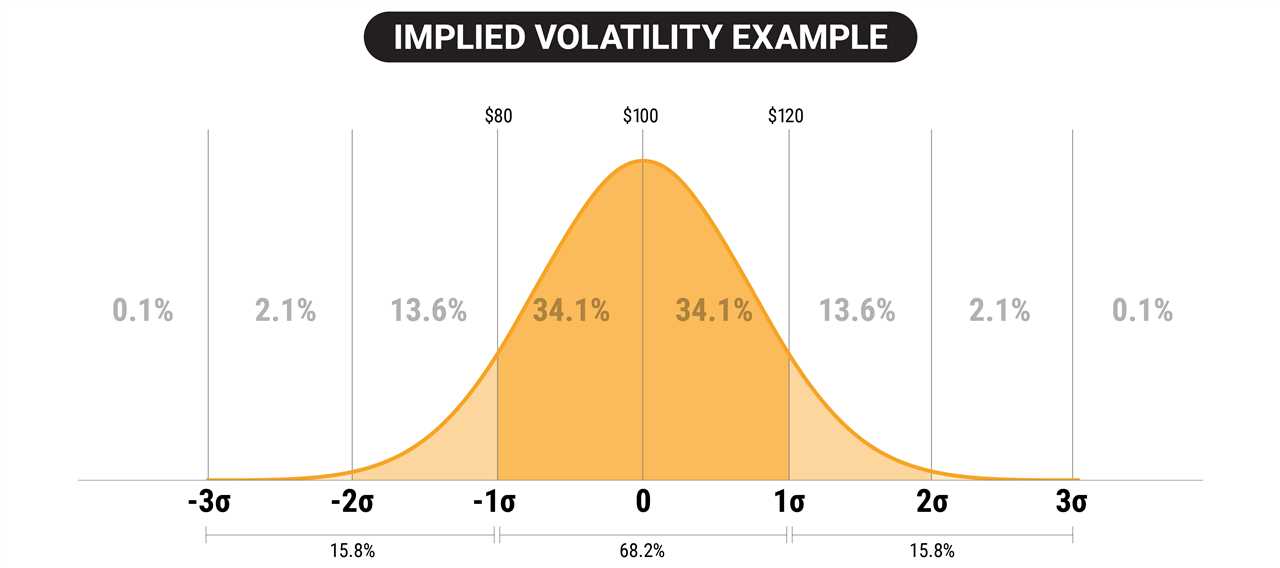

Implied volatility is a key concept in options trading that refers to the market’s expectation of the future volatility of an underlying asset. It is a measure of the perceived risk and uncertainty associated with the price movement of the asset.

Implied volatility is derived from the prices of options contracts. Options are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price (strike price) within a certain period of time (expiration date). The price of an option is influenced by various factors, including the current price of the underlying asset, the strike price, the time remaining until expiration, and the expected volatility of the underlying asset.

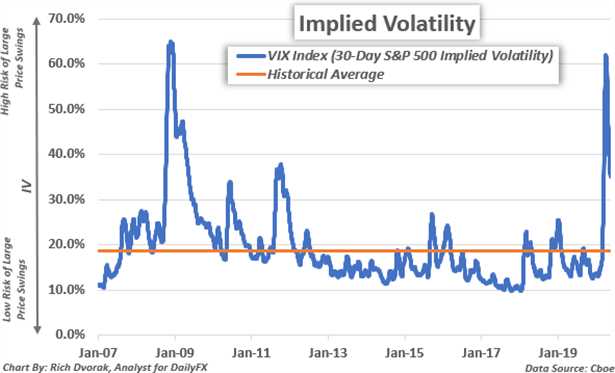

When options traders buy or sell options contracts, they are essentially making a bet on the future price movement of the underlying asset. Implied volatility reflects the collective sentiment of options traders about the potential magnitude of that price movement. If options traders expect the price of the underlying asset to experience large swings in the future, implied volatility will be high. Conversely, if options traders expect the price to remain relatively stable, implied volatility will be low.

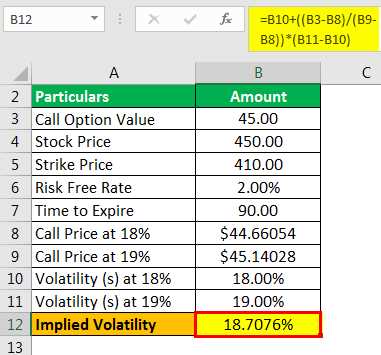

Calculation of Implied Volatility

Interpreting Implied Volatility

High implied volatility indicates that options traders expect significant price fluctuations in the underlying asset. This can be due to upcoming news or events that may impact the asset’s price, such as earnings announcements, economic reports, or geopolitical developments. High implied volatility also implies higher option prices, as traders demand more compensation for the increased risk.

Low implied volatility, on the other hand, suggests that options traders anticipate relatively stable price movement in the underlying asset. This may occur during periods of market stability or when there is a lack of significant news or events that could impact the asset’s price. Low implied volatility results in lower option prices, as traders require less compensation for the lower perceived risk.

Using Implied Volatility in Options Trading

Implied volatility is a crucial factor in options trading strategies. Traders can use implied volatility to assess the attractiveness of options contracts. If the implied volatility is relatively low, options may be undervalued, presenting an opportunity for traders to buy options at a lower price. Conversely, if the implied volatility is high, options may be overvalued, leading traders to consider selling options to take advantage of the inflated prices.

Additionally, options traders can use implied volatility to gauge the market’s expectations for future price movements. By comparing the implied volatility of different options contracts, traders can identify potential opportunities for profit. For example, if the implied volatility of a call option is significantly higher than that of a put option, it may indicate that the market expects the underlying asset’s price to rise in the future.

| Advantages of Implied Volatility | Disadvantages of Implied Volatility |

|---|---|

| Provides insight into market expectations | Can be difficult to interpret accurately |

| Helps identify mispriced options | Subject to changes in market sentiment |

| Useful for developing options trading strategies | Does not guarantee future price movements |

How Does Implied Volatility Impact Options?

Implied volatility plays a crucial role in options trading as it directly affects the price of options. It is a measure of the market’s expectations for future price fluctuations of the underlying asset. When implied volatility is high, options tend to be more expensive, and when it is low, options tend to be cheaper.

Implied volatility reflects the uncertainty and risk associated with the underlying asset. It is influenced by various factors such as market conditions, supply and demand dynamics, and investor sentiment. Traders and investors use implied volatility to assess the potential profitability and risk of options positions.

Impact on Option Premium

Implied volatility is a key component in the calculation of option premiums. Option premiums are the prices that traders pay to purchase options contracts. The higher the implied volatility, the higher the option premium, and vice versa.

Impact on Option Greeks

Implied volatility also affects the option Greeks, which are measures of an option’s sensitivity to changes in various factors. The most important Greek related to implied volatility is Vega.

Vega measures the sensitivity of an option’s price to changes in implied volatility. When implied volatility increases, Vega increases, causing option prices to rise. Conversely, when implied volatility decreases, Vega decreases, leading to a decrease in option prices.

Conclusion

Implied volatility is a critical factor in options trading as it impacts option premiums and the option Greeks. Traders and investors need to understand how changes in implied volatility can affect their options positions and overall portfolio. By monitoring and analyzing implied volatility, traders can make informed decisions and potentially profit from changes in market expectations.

| Advantages | Disadvantages |

|---|---|

| Opportunity for higher profits during periods of high implied volatility | Potential for larger losses during periods of high implied volatility |

| Ability to take advantage of changes in market expectations | Increased complexity and risk in options trading |

| Provides insights into market sentiment and expectations | Requires continuous monitoring and analysis |

Examples of Implied Volatility in Options Trading

Here are a few examples that illustrate the role of implied volatility in options trading:

Example 1:

Let’s say Company XYZ is set to release its quarterly earnings report. Traders anticipate that the stock price will experience significant volatility following the announcement. As a result, the implied volatility of options contracts on Company XYZ increases. Traders who expect a large price swing may choose to buy options contracts to capitalize on potential profits.

Example 2:

During times of uncertainty or market turmoil, implied volatility tends to rise. This is because investors are unsure about the future direction of the market and are willing to pay higher premiums for options contracts to protect their portfolios. Traders who anticipate increased volatility may sell options contracts to take advantage of the higher premiums.

Example 3:

Suppose a pharmaceutical company is awaiting FDA approval for a new drug. Traders speculate that the stock price will experience a significant move depending on the outcome of the approval. As a result, the implied volatility of options contracts on the pharmaceutical company increases. Traders who have a strong opinion on the FDA decision may choose to buy or sell options contracts accordingly.

Example 4:

Implied volatility can also vary across different expiration dates and strike prices. Traders can analyze the implied volatility surface, which shows how implied volatility changes based on these factors. By identifying patterns or anomalies in the implied volatility surface, traders can find opportunities to profit from mispriced options contracts.

Example 5:

During periods of low implied volatility, options premiums tend to be cheaper. This may present an opportunity for traders who anticipate an increase in volatility to buy options contracts at a lower cost. If the anticipated volatility materializes, the value of the options contracts may increase, resulting in potential profits.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.