Housing Expense Ratio Explained

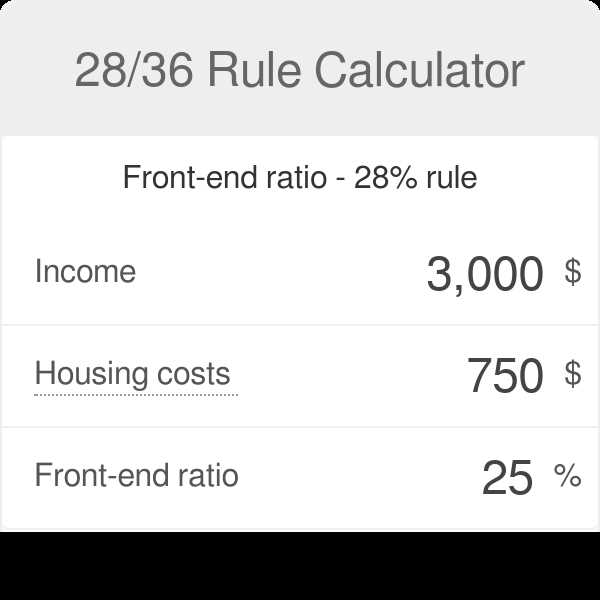

The housing expense ratio is an important factor to consider when determining your ability to afford a mortgage. It is a measure of the percentage of your gross monthly income that goes towards housing expenses, including your mortgage payment, property taxes, and homeowner’s insurance.

To calculate the housing expense ratio, you need to add up all of your monthly housing expenses and divide it by your gross monthly income. The result is expressed as a percentage. Lenders typically have a maximum housing expense ratio that they are willing to accept, which is usually around 28-30%.

Calculating your housing expense ratio is relatively simple. Start by adding up all of your monthly housing expenses, including your mortgage payment, property taxes, and homeowner’s insurance. Next, divide this total by your gross monthly income. Multiply the result by 100 to get the percentage.

For example, if your monthly housing expenses total $1,500 and your gross monthly income is $5,000, your housing expense ratio would be 30% ($1,500 / $5,000 x 100).

The housing expense ratio is a financial metric used by lenders to assess the affordability of a mortgage for a borrower. It is calculated by dividing the borrower’s total monthly housing expenses by their gross monthly income. This ratio helps lenders determine whether a borrower can comfortably afford their mortgage payments.

When applying for a mortgage, lenders typically look at the housing expense ratio along with other factors such as credit score, debt-to-income ratio, and employment history. A lower housing expense ratio indicates that a borrower has more disposable income to cover other expenses and is considered more financially stable.

To calculate the housing expense ratio, you need to add up all the monthly housing expenses, including the mortgage payment, property taxes, homeowners insurance, and any homeowners association fees. This total is then divided by the borrower’s gross monthly income.

For example, let’s say a borrower has a monthly mortgage payment of $1,500, property taxes of $300, homeowners insurance of $100, and no homeowners association fees. Their gross monthly income is $5,000. The housing expense ratio would be calculated as follows:

| Housing Expenses | Amount |

|---|---|

| Mortgage Payment | $1,500 |

| Property Taxes | $300 |

| Homeowners Insurance | $100 |

| Total Housing Expenses | $1,900 |

The housing expense ratio would be calculated as $1,900 divided by $5,000, which equals 0.38 or 38%. This means that 38% of the borrower’s gross monthly income is allocated towards housing expenses.

Lenders typically have guidelines for the maximum housing expense ratio they are willing to accept. This ratio can vary depending on the lender and the type of mortgage. In general, a housing expense ratio of 28% to 36% is considered affordable and manageable for most borrowers.

Calculating the Housing Expense Ratio

The housing expense ratio is a crucial factor in determining your eligibility for a mortgage loan. It helps lenders assess your ability to manage monthly housing expenses based on your income. To calculate the housing expense ratio, you need to follow these steps:

Gather Your Financial Information

Before calculating the housing expense ratio, gather all the necessary financial information. This includes your gross monthly income, which is the total income you earn before any deductions. Additionally, you will need to know your monthly housing expenses, such as mortgage payments, property taxes, homeowner’s insurance, and any homeowner association fees.

Calculate Your Monthly Housing Expenses

Add up all your monthly housing expenses to determine the total amount. This includes your monthly mortgage payment, property taxes, homeowner’s insurance, and any homeowner association fees. Make sure to include all relevant costs to get an accurate calculation.

Divide Monthly Housing Expenses by Gross Monthly Income

Next, divide your monthly housing expenses by your gross monthly income. This will give you a decimal number. Multiply this decimal by 100 to get the housing expense ratio as a percentage.

For example, if your monthly housing expenses amount to $2,000 and your gross monthly income is $5,000, the calculation would be as follows:

Housing Expense Ratio = (Monthly Housing Expenses / Gross Monthly Income) x 100

Housing Expense Ratio = ($2,000 / $5,000) x 100

Housing Expense Ratio = 0.4 x 100

Housing Expense Ratio = 40%

A housing expense ratio of 40% means that 40% of your gross monthly income goes towards housing expenses. Lenders typically have a maximum housing expense ratio requirement, often around 28-31%. If your housing expense ratio exceeds this limit, it may affect your ability to qualify for a mortgage loan.

[MORTGAGE catname]: What You Need to Know

![[MORTGAGE catname]: What You Need to Know](/wp-content/uploads/2023/12/housing-expense-ratio-explained-understanding-and_4.jpg)

The housing expense ratio is a financial metric that lenders use to assess your ability to afford a mortgage payment. It compares your monthly housing expenses, including your mortgage payment, property taxes, and insurance, to your gross monthly income.

To calculate the housing expense ratio, you need to add up all your monthly housing expenses and divide them by your gross monthly income. The result is expressed as a percentage, with most lenders typically requiring a housing expense ratio of no more than 28% to 36%.

For example, if your monthly housing expenses total $2,000 and your gross monthly income is $6,000, your housing expense ratio would be 33.33% ($2,000 / $6,000 = 0.3333 x 100 = 33.33%).

Having a low housing expense ratio is important because it shows lenders that you have enough income to comfortably afford your mortgage payment. If your housing expense ratio is too high, it may indicate that you are stretching your budget and could potentially struggle to make your mortgage payments.

Before applying for a mortgage, it’s a good idea to calculate your housing expense ratio to get an idea of how much you can afford to spend on housing. This will help you determine a realistic budget and avoid taking on more debt than you can handle.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.