Hedge Ratio: Definition and Calculation

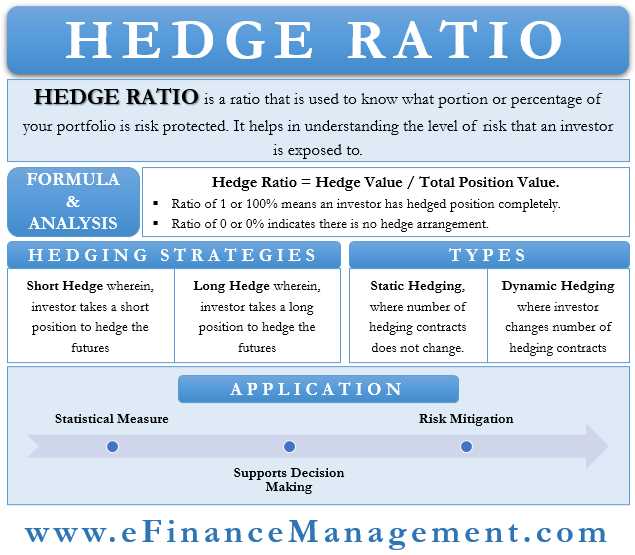

A hedge ratio is a financial metric that measures the relationship between the price movements of two related assets. It is commonly used in risk management and hedging strategies to determine the optimal amount of one asset that should be held to offset the risk of another asset.

The hedge ratio is calculated by dividing the change in the price of the hedged asset by the change in the price of the hedging asset. The result is a ratio that indicates how many units of the hedging asset are needed to hedge against one unit of the hedged asset.

There are different types of hedge ratios that can be used depending on the specific hedging strategy and the assets involved. Some common types include static hedge ratios, dynamic hedge ratios, and optimal hedge ratios.

A static hedge ratio is a fixed ratio that remains constant over time. It is often used when the correlation between the hedged asset and the hedging asset is stable. A dynamic hedge ratio, on the other hand, is adjusted periodically to reflect changes in the correlation between the assets. It is used when the correlation is expected to change over time.

What is the Hedge Ratio?

The hedge ratio can be expressed as a percentage or a decimal. For example, if the hedge ratio is 0.75, it means that for every 1% change in the price of the asset being hedged, the price of the hedging asset is expected to change by 0.75%. This indicates that 75% of the risk can be offset by holding the hedging asset.

Calculating the Hedge Ratio

To calculate the hedge ratio, historical price data of the two assets is required. The price data is used to determine the correlation between the price movements of the asset being hedged and the hedging asset. The correlation coefficient, which ranges from -1 to 1, measures the strength and direction of the relationship between the two assets.

Once the correlation coefficient is determined, it is multiplied by the ratio of the standard deviation of the asset being hedged to the standard deviation of the hedging asset. This calculation results in the hedge ratio.

Types of Hedge Ratios

There are different types of hedge ratios that can be used depending on the specific hedging strategy and the assets involved. Some common types include:

- Static Hedge Ratio: This ratio remains constant over time and is based on the long-term correlation between the two assets.

- Dynamic Hedge Ratio: This ratio adjusts over time based on the changing correlation between the two assets.

- Minimum Variance Hedge Ratio: This ratio aims to minimize the variance of the hedged portfolio by considering the covariance between the two assets.

- Optimal Hedge Ratio: This ratio aims to maximize the risk reduction of the hedged portfolio by considering both the correlation and volatility of the two assets.

Each type of hedge ratio has its own advantages and disadvantages, and the choice of which ratio to use depends on the specific investment objectives and risk tolerance of the investor.

Calculating the Hedge Ratio

The hedge ratio is a key concept in risk management and is used to determine the optimal amount of hedging that should be done to protect against potential losses. The hedge ratio is calculated by comparing the price movements of two related assets: the asset being hedged (such as a stock or commodity) and the hedging instrument (such as a futures contract).

To calculate the hedge ratio, you need to gather historical price data for both the asset being hedged and the hedging instrument. This data should cover a period of time during which the two assets have exhibited a strong correlation. The correlation coefficient is a statistical measure that quantifies the strength and direction of the relationship between two variables. A correlation coefficient of 1 indicates a perfect positive correlation, while a correlation coefficient of -1 indicates a perfect negative correlation.

Once you have the historical price data, you can calculate the hedge ratio using the following formula:

Hedge Ratio = Covariance(Asset, Hedging Instrument) / Variance(Hedging Instrument)

The covariance measures how the two assets move together, while the variance measures the variability of the hedging instrument. By dividing the covariance by the variance, you obtain the hedge ratio, which represents the amount of the hedging instrument needed to offset the price movements of the asset being hedged.

For example, let’s say you want to hedge a portfolio of stocks using S&P 500 futures contracts. You gather historical price data for both the stocks in your portfolio and the S&P 500 futures. After calculating the covariance and variance, you find that the hedge ratio is 0.8. This means that for every $1 change in the value of the stocks in your portfolio, you would need to buy or sell $0.8 worth of S&P 500 futures contracts to fully hedge your position.

Types of Hedge Ratios

- Delta Hedge Ratio: The delta hedge ratio is a commonly used ratio in options trading. It measures the sensitivity of an option’s price to changes in the price of the underlying asset. By using the delta hedge ratio, investors can offset the risk associated with changes in the underlying asset’s price.

- Beta Hedge Ratio: The beta hedge ratio is used in portfolio management to hedge against systematic risk. It measures the sensitivity of a stock or portfolio’s returns to changes in the overall market. By using the beta hedge ratio, investors can reduce their exposure to market fluctuations.

- Duration Hedge Ratio: The duration hedge ratio is used in fixed income investing to hedge against interest rate risk. It measures the sensitivity of a bond’s price to changes in interest rates. By using the duration hedge ratio, investors can protect themselves against losses caused by changes in interest rates.

- Vega Hedge Ratio: The vega hedge ratio is used in options trading to hedge against changes in implied volatility. It measures the sensitivity of an option’s price to changes in implied volatility. By using the vega hedge ratio, investors can protect themselves against losses caused by changes in volatility.

- Greeks Hedge Ratio: The Greeks hedge ratio is a combination of different ratios, including delta, gamma, vega, theta, and rho. It is used in options trading to hedge against multiple risks. By using the Greeks hedge ratio, investors can manage their risk exposure more effectively.

Each type of hedge ratio has its own unique characteristics and is used in different situations. It is important for investors to understand these ratios and how to calculate them in order to effectively manage their risk and protect their investments.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.