Hazard Rate Calculation and Example

The hazard rate is a measure used in economics to calculate the probability of an event occurring at a specific point in time. It is commonly used in survival analysis, where it represents the rate at which individuals or entities experience a certain event, such as failure or death.

The hazard rate is often used in economics to analyze the risk associated with certain events or phenomena. It can be used to assess the likelihood of default on a loan, the probability of bankruptcy for a company, or the risk of unemployment for individuals.

Economics

Economics is a social science that studies the production, distribution, and consumption of goods and services. It analyzes how individuals, businesses, governments, and societies make choices about allocating resources to satisfy their unlimited wants and needs.

There are two main branches of economics: microeconomics and macroeconomics. Microeconomics focuses on individual economic agents, such as households and firms, and how they make decisions regarding the allocation of resources. Macroeconomics, on the other hand, studies the overall economy, including factors such as inflation, unemployment, and economic growth.

Key Concepts in Economics

There are several key concepts in economics that are important to understand:

- Supply and demand: The relationship between the quantity of a good or service that producers are willing to sell and the quantity that consumers are willing to buy.

- Opportunity cost: The cost of choosing one option over another, measured in terms of the next best alternative that is foregone.

- Market equilibrium: The point at which the quantity demanded equals the quantity supplied, resulting in a stable price.

- Gross Domestic Product (GDP): The total value of all final goods and services produced within a country’s borders in a given period of time.

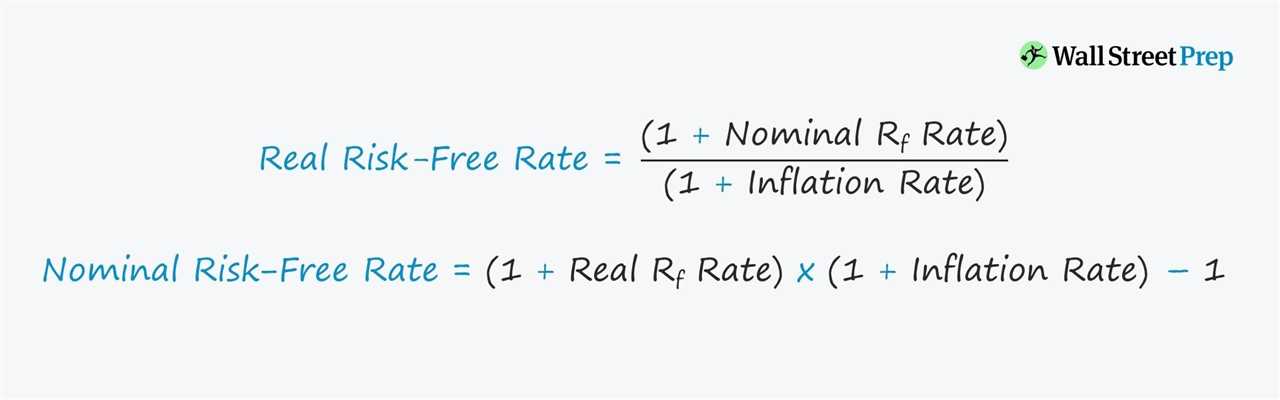

- Inflation: The rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling.

- Unemployment: The state of being without a job, often measured by the unemployment rate.

Economics is a complex field that uses mathematical models, statistical analysis, and economic theories to understand and predict human behavior in relation to the allocation of resources. It is a fundamental discipline that provides insights into how societies function and how policies can be designed to improve economic outcomes.

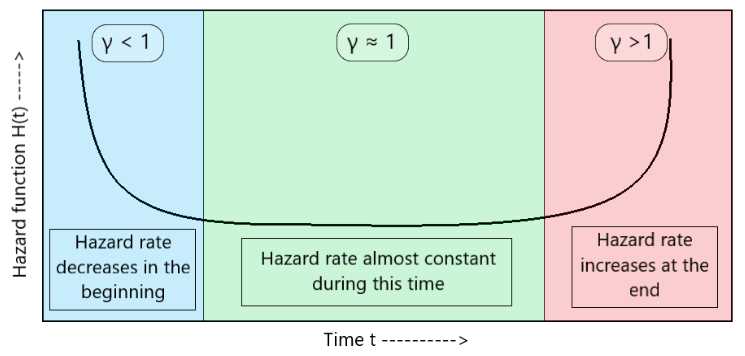

The hazard rate formula is a statistical tool used in economics to measure the probability of an event occurring within a specific time period. It is commonly used in survival analysis to calculate the likelihood of failure or death over time.

The hazard rate formula is expressed as:

H(t) = f(t) / S(t)

Where:

- H(t) is the hazard rate at time t

- f(t) is the probability density function (PDF) at time t

- S(t) is the survival function at time t

By calculating the hazard rate, economists and researchers can gain insights into the risk and uncertainty associated with various economic phenomena. For example, it can be used to analyze the hazard rate of business failures, the hazard rate of unemployment, or the hazard rate of default on loans.

To calculate the hazard rate, one needs to have data on the occurrence of the event of interest and the time at which it occurs. This data can then be used to estimate the probability density function and the survival function, which are necessary inputs for the hazard rate formula.

Overall, the hazard rate formula is a valuable tool for economists and researchers to understand and quantify the risk and uncertainty associated with various economic events. By calculating the hazard rate, they can make informed decisions and predictions based on the likelihood of an event occurring within a specific time period.

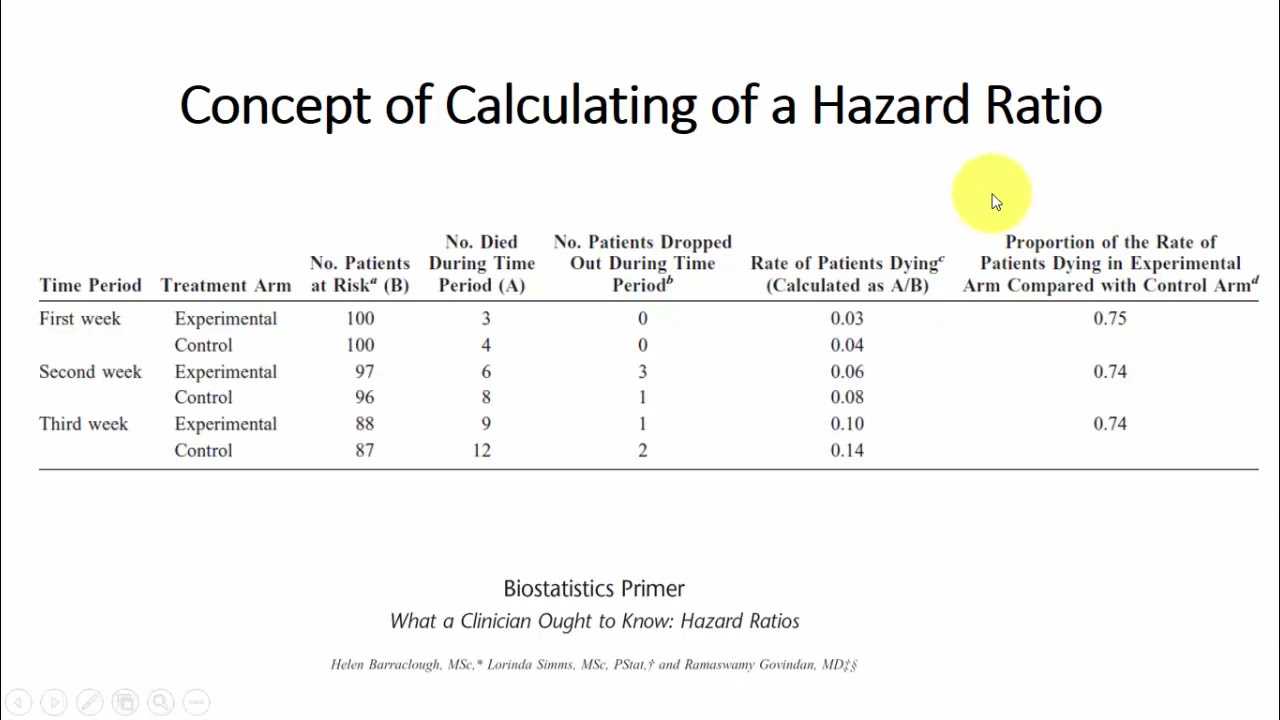

Example of Hazard Rate Calculation

Step 1: Gather Data

First, we need to gather the necessary data for our calculation. This includes the number of events that have occurred and the corresponding times at which they occurred.

For example, let’s say we are studying the failure rate of a certain type of machine. We have data on the number of machines that have failed and the time at which each failure occurred.

Step 2: Calculate the Hazard Rate

Next, we can calculate the hazard rate using the formula:

Hazard Rate = Number of Events / Total Time at Risk

For each time interval, we divide the number of events that occurred during that interval by the total time at risk for that interval. The hazard rate gives us an estimate of the instantaneous failure rate at each point in time.

Step 3: Interpret the Results

Once we have calculated the hazard rate, we can interpret the results to gain insights into the underlying process. A high hazard rate indicates a higher risk of failure at a given point in time, while a low hazard rate indicates a lower risk.

Additionally, we can compare the hazard rates at different points in time to identify any trends or patterns. This can help us understand how the failure rate changes over time and make predictions about future failures.

By analyzing the hazard rate, we can make informed decisions about maintenance schedules, product design improvements, and other factors that can impact the reliability and performance of the machine.

Overall, the hazard rate calculation provides a valuable tool for economists and researchers to analyze and understand the dynamics of various processes, such as failure rates, survival rates, and event occurrence.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.