Guppy Multiple Moving Average GMMA Formulas

The Guppy Multiple Moving Average (GMMA) is a technical analysis tool that consists of multiple moving averages of different time periods. It was developed by Daryl Guppy to identify the changing trends in the market and to provide a visual representation of the market sentiment.

The formulas for calculating the GMMA moving averages are as follows:

Short-term Group:

Short-term moving average = (Closing price of the current day + Closing price of the previous day + … + Closing price of the n-th day) / n

Long-term Group:

Long-term moving average = (Closing price of the current day + Closing price of the previous day + … + Closing price of the n-th day) / n

Where n is the number of days used to calculate the moving average.

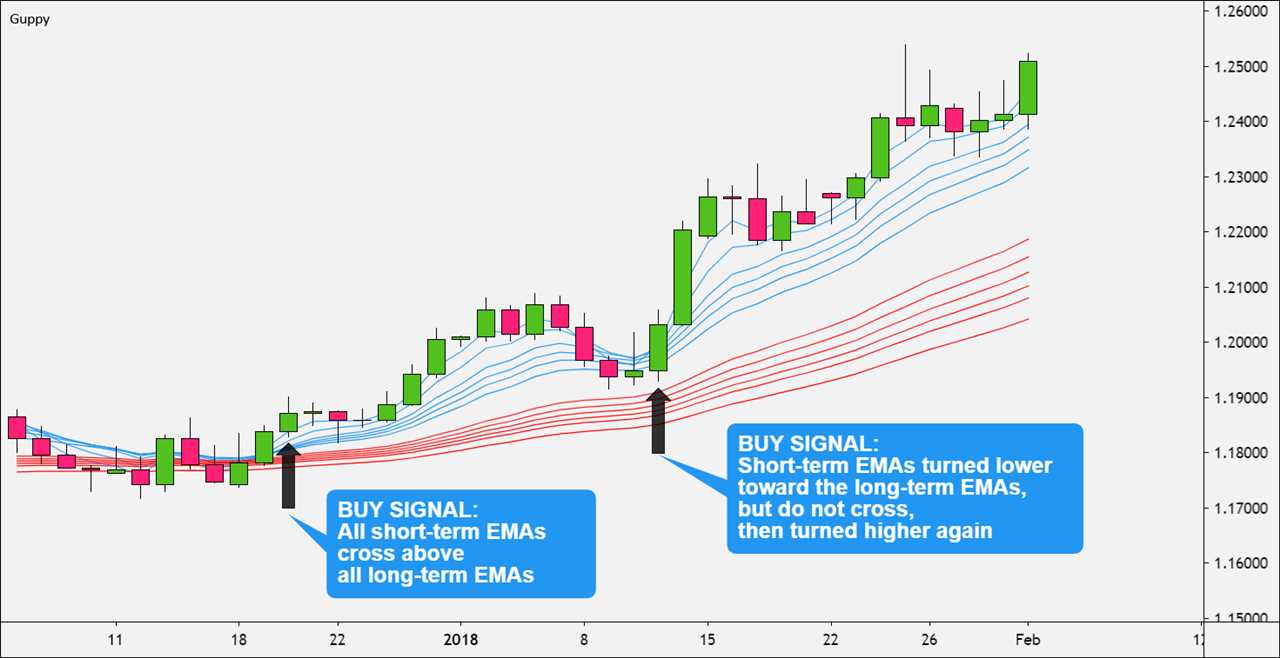

The GMMA provides traders with a visual representation of the market trends by plotting the short-term and long-term moving averages on the price chart. The short-term moving averages are more sensitive to price changes and tend to react quickly to short-term market fluctuations. The long-term moving averages, on the other hand, are less sensitive to price changes and provide a smoother representation of the overall market trend.

By analyzing the crossovers and divergences between the short-term and long-term moving averages, traders can identify potential buy and sell signals. For example, when the short-term moving averages cross above the long-term moving averages, it may indicate a bullish trend reversal and a potential buying opportunity. Conversely, when the short-term moving averages cross below the long-term moving averages, it may indicate a bearish trend reversal and a potential selling opportunity.

GMMA Calculation Methods

The Guppy Multiple Moving Average (GMMA) is a technical analysis tool that uses a combination of short-term and long-term moving averages to identify trends and potential reversals in the market. There are several calculation methods that can be used to determine the values of the moving averages in the GMMA.

1. Simple Moving Average (SMA): The SMA is the most basic calculation method used in the GMMA. It is calculated by summing up the closing prices of a specific number of periods and dividing the sum by the number of periods. For example, a 10-day SMA would be calculated by adding up the closing prices of the last 10 days and dividing the sum by 10.

2. Exponential Moving Average (EMA): The EMA is a more advanced calculation method that gives more weight to recent price data. It is calculated using a formula that takes into account the current closing price, the previous EMA value, and a smoothing factor. The smoothing factor determines the weight given to the current closing price, with higher values giving more weight to recent data.

4. Hull Moving Average (HMA): The HMA is a calculation method that aims to reduce lag and provide a smoother moving average line. It is calculated using a combination of weighted moving averages and a square root of the period. The HMA is designed to be more responsive to recent price movements while still providing a stable average.

5. Adaptive Moving Average (AMA): The AMA is a calculation method that adjusts its smoothing factor based on market volatility. It is designed to be more responsive during periods of high volatility and less responsive during periods of low volatility. The AMA uses a combination of exponential moving averages and a volatility index to determine the smoothing factor.

Each calculation method has its own strengths and weaknesses, and traders may choose to use different methods depending on their trading strategy and market conditions. It is important to understand the calculation methods used in the GMMA to effectively interpret and utilize the moving averages in technical analysis.

Benefits of Using Guppy Multiple Moving Average

The Guppy Multiple Moving Average (GMMA) is a popular technical analysis tool that can provide traders with valuable insights into market trends and potential entry and exit points. Here are some of the key benefits of using GMMA in your trading strategy:

1. Trend Identification:

GMMA consists of two sets of moving averages: short-term and long-term. The short-term moving averages are more sensitive to price changes and can help identify short-term trends, while the long-term moving averages provide a broader perspective on the overall trend. By analyzing the relationship between these moving averages, traders can identify the direction of the trend and make informed trading decisions.

2. Confirmation of Breakouts:

GMMA can be particularly useful in confirming breakouts. When the short-term moving averages cross above the long-term moving averages, it indicates a potential bullish breakout. Conversely, when the short-term moving averages cross below the long-term moving averages, it suggests a potential bearish breakout. Traders can use these signals to confirm the validity of breakouts and adjust their trading strategies accordingly.

3. Support and Resistance Levels:

The GMMA can also help identify support and resistance levels. When the short-term moving averages are tightly packed together and move horizontally, it suggests a consolidation phase and potential support or resistance levels. Traders can use these levels to set their stop-loss orders or take-profit targets.

4. Enhancing Risk Management:

By using GMMA, traders can better manage their risk. For example, when the short-term moving averages are far apart, it indicates a strong trend and higher volatility. Traders can adjust their position sizes or use tighter stop-loss orders to mitigate potential risks. Conversely, when the short-term moving averages are close together, it suggests a lack of trend and lower volatility. Traders can reduce their position sizes or widen their stop-loss orders to accommodate for potential market noise.

5. Versatility:

GMMA can be applied to various financial markets and timeframes, making it a versatile tool for traders. Whether you are trading stocks, forex, commodities, or cryptocurrencies, GMMA can provide valuable insights into market trends and help you make more informed trading decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.