What is Group Universal Life Policy?

A Group Universal Life Policy is a type of life insurance policy that is offered to a group of individuals, usually employees of a company or members of an organization. It is a form of permanent life insurance that provides both a death benefit and a cash value component.

Unlike individual life insurance policies, group universal life insurance is typically offered at a lower cost because it is purchased in bulk by the employer or organization. This makes it an attractive option for employers looking to provide life insurance coverage to their employees as part of their benefits package.

Group universal life policies are also portable, meaning that if an employee leaves the company or organization, they can typically take the policy with them and continue paying the premiums on their own. This can provide a sense of security and continuity for individuals who may change jobs frequently.

Another key feature of group universal life insurance is the cash value component. This component allows policyholders to accumulate cash value over time, which can be used for a variety of purposes, such as borrowing against the policy or supplementing retirement income.

Overall, a Group Universal Life Policy offers a combination of life insurance protection and potential financial benefits, making it a popular choice for both employers and employees.

Meaning and Definition

With a Group Universal Life Policy, the policyholder pays premiums into a group policy, and in return, the policy provides a death benefit to the beneficiaries upon the death of the insured individual. Additionally, the policy also accumulates cash value over time, which can be accessed by the policyholder during their lifetime.

How does Group Universal Life Policy work?

The cash value of the policy grows over time based on the performance of the underlying investments. The policyholder can choose from a variety of investment options offered by the insurance company, such as stocks, bonds, and mutual funds. The cash value can be accessed by the policyholder through withdrawals or loans, which may be subject to certain restrictions and fees.

Advantages of Group Universal Life Policy

Group Universal Life Policy offers several advantages to both the policyholder and the employer:

- Death benefit coverage: The policy provides a death benefit to the beneficiaries upon the death of the insured individual, providing financial protection to their loved ones.

- Cash value accumulation: The policy accumulates cash value over time, which can be accessed by the policyholder during their lifetime for various purposes, such as supplementing retirement income or paying for educational expenses.

- Portability: Group Universal Life Policy is typically portable, meaning that the policyholder can continue the coverage even if they leave the company or organization, subject to certain conditions.

- Tax advantages: The cash value growth in the policy is tax-deferred, meaning that the policyholder does not have to pay taxes on the earnings until they are withdrawn. Additionally, the death benefit is generally tax-free for the beneficiaries.

Overall, Group Universal Life Policy provides a flexible and comprehensive life insurance solution for both the policyholder and the employer, offering financial protection and potential cash value accumulation.

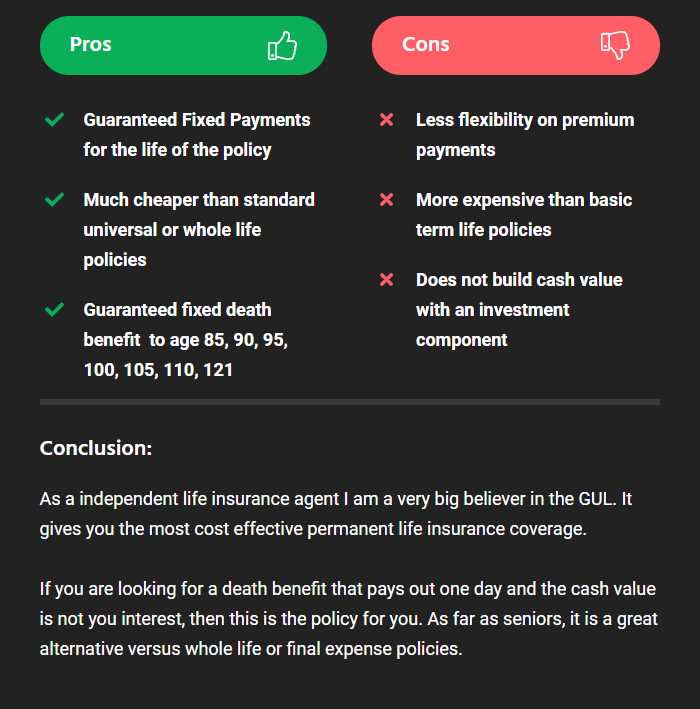

Pros of Group Universal Life Policy

A Group Universal Life Policy offers several advantages and benefits for policyholders. Here are some of the key pros of choosing this type of policy:

1. Flexible Coverage: Group Universal Life Policy provides flexible coverage options, allowing policyholders to choose the amount of coverage that best suits their needs. This flexibility ensures that individuals can customize their policy to meet their specific requirements.

2. Portability: One of the major advantages of a Group Universal Life Policy is its portability. Unlike other types of life insurance policies, this policy allows policyholders to retain their coverage even if they leave the group or change employers. This means that individuals can maintain their life insurance coverage without any disruptions or gaps.

3. Cash Value Accumulation: Another benefit of a Group Universal Life Policy is the potential for cash value accumulation. As policyholders pay their premiums, a portion of the payment goes towards building cash value. Over time, this cash value can grow and be accessed by the policyholder through policy loans or withdrawals.

4. Tax Advantages: Group Universal Life Policy offers tax advantages that can be beneficial for policyholders. The cash value accumulation within the policy grows on a tax-deferred basis, meaning that policyholders do not have to pay taxes on the growth until they withdraw the funds. Additionally, the death benefit received by beneficiaries is generally income tax-free.

5. Supplemental Benefits: Many Group Universal Life Policies also offer supplemental benefits, such as accidental death and dismemberment coverage, disability income protection, and critical illness coverage. These additional benefits provide extra financial protection for policyholders and their families in case of unforeseen events.

6. Cost Savings: Group Universal Life Policy can often be more cost-effective compared to individual life insurance policies. By pooling together a large group of individuals, the policyholder can benefit from lower premiums and reduced administrative costs.

Overall, a Group Universal Life Policy offers flexibility, portability, cash value accumulation, tax advantages, supplemental benefits, and potential cost savings. It is important for individuals to carefully consider their needs and consult with an insurance professional to determine if this type of policy is the right fit for them.

Advantages and Benefits of Group Universal Life Policy

Group Universal Life Policy offers several advantages and benefits to policyholders. Here are some of the key advantages:

1. Flexible Coverage Options

Group Universal Life Policy provides flexible coverage options, allowing policyholders to choose the amount of coverage that suits their needs. This flexibility ensures that individuals can customize their policy to meet their specific financial goals and obligations.

2. Portability

One of the significant benefits of Group Universal Life Policy is its portability. Policyholders can take their coverage with them if they change jobs or leave the group. This means that individuals can maintain their life insurance coverage without interruption, even if their employment situation changes.

3. Tax Advantages

Group Universal Life Policy offers tax advantages to policyholders. The cash value growth within the policy is tax-deferred, meaning that policyholders do not have to pay taxes on the accumulated cash value until they withdraw it. Additionally, the death benefit received by beneficiaries is generally tax-free.

4. Investment Component

Group Universal Life Policy includes an investment component that allows policyholders to build cash value over time. The cash value can be invested in various options, such as stocks, bonds, or money market funds, providing the potential for growth and accumulation of wealth.

5. Employee Benefits

Group Universal Life Policy is often offered as an employee benefit, providing additional financial security to employees and their families. This benefit can attract and retain talented employees, as it demonstrates the employer’s commitment to their well-being.

6. Conversion Option

Group Universal Life Policy typically includes a conversion option, which allows policyholders to convert their group coverage into an individual policy without undergoing a medical exam. This conversion option provides flexibility and ensures that individuals can maintain coverage even if they leave the group.

Cons of Group Universal Life Policy

1. Limited Control

One of the main disadvantages of GUL policies is that the policyholder has limited control over the investment options. The insurance company typically manages the investment portfolio, which means you have less say in how your money is invested. This lack of control can be a disadvantage for individuals who prefer to have more control over their investments.

2. Premium Increases

3. Limited Portability

4. Potential Tax Implications

5. Limited Flexibility

Disadvantages and Risks

While Group Universal Life (GUL) policies offer several advantages and benefits, it is important to consider the potential disadvantages and risks associated with this type of policy.

1. Limited control: One of the main disadvantages of GUL policies is that the policyholder has limited control over the policy. Since it is a group policy, decisions regarding the policy terms and conditions are made by the group sponsor or employer. This means that the policyholder may not have the flexibility to customize the policy to their specific needs.

3. Lack of portability: Another disadvantage of GUL policies is that they are typically not portable. This means that if the policyholder leaves the group or changes employment, they may lose their coverage. In such cases, the policyholder may have to apply for a new individual life insurance policy, which can be more expensive and may require medical underwriting.

5. Group disbandment: If the group sponsoring the GUL policy disbands or terminates the policy, the policyholder may lose their coverage. This can be a significant risk, especially if the policyholder relies on the policy for their financial protection or as an investment vehicle.

6. Tax implications: GUL policies may have tax implications for the policyholder. Depending on the specific tax laws and regulations in the policyholder’s jurisdiction, the policyholder may be subject to taxes on the policy’s cash value accumulation or death benefit proceeds. It is important for the policyholder to consult with a tax advisor to understand the potential tax implications of a GUL policy.

Overall, while Group Universal Life policies offer certain advantages, it is crucial for individuals to carefully consider the disadvantages and risks associated with this type of policy before making a decision. It is advisable to compare GUL policies with other types of life insurance policies and consult with a financial advisor to determine the most suitable option for individual needs and circumstances.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.