Gross Yield Meaning

Gross yield is a financial term that refers to the total return on an investment before any expenses or taxes are deducted. It is expressed as a percentage and is often used to evaluate the profitability of bonds, stocks, and other financial instruments.

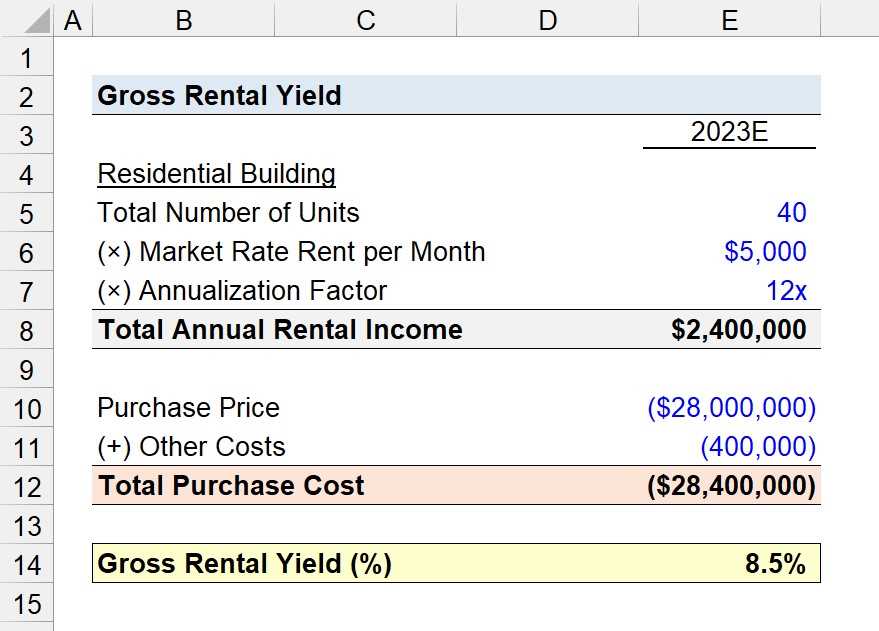

To calculate the gross yield, you need to divide the annual income generated by the investment by the initial investment amount and then multiply the result by 100. This will give you the gross yield percentage.

Gross yield is an important metric for investors as it provides them with a clear picture of the potential returns they can expect from their investments. It helps them compare different investment options and make informed decisions based on their risk tolerance and financial goals.

Overall, gross yield is a useful tool for investors to assess the potential profitability of an investment. However, it should be used in conjunction with other financial metrics and considerations to make well-informed investment decisions.

Overview

Gross yield is a financial term that refers to the total income generated by an investment before deducting any expenses or taxes. It is commonly used to evaluate the performance of fixed-income securities, such as bonds. Gross yield provides investors with a measure of the potential return on their investment and helps them compare different investment options.

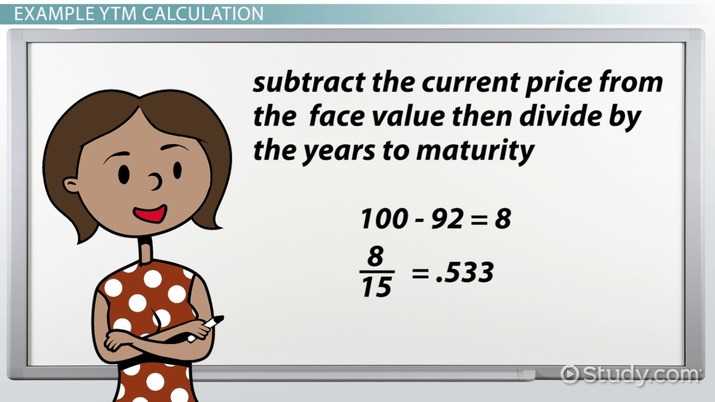

When calculating the gross yield of a bond, the annual interest or coupon payment is divided by the bond’s current market price and expressed as a percentage. This percentage represents the yield that an investor would earn if they held the bond until maturity and reinvested all coupon payments at the same rate.

Gross yield is an important metric for bond investors because it allows them to assess the attractiveness of a particular bond relative to others in the market. A higher gross yield indicates a potentially higher return on investment, while a lower gross yield suggests a lower return.

Examples of Gross Yield in Bonds

Gross yield is an important concept in the world of bonds. It is a measure of the total return on an investment in a bond, expressed as a percentage of the bond’s face value. Here are some examples to help illustrate the concept:

Example 1: Corporate Bond

Example 2: Government Bond

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.