Government Pension Fund of Norway (GPFN) Overview

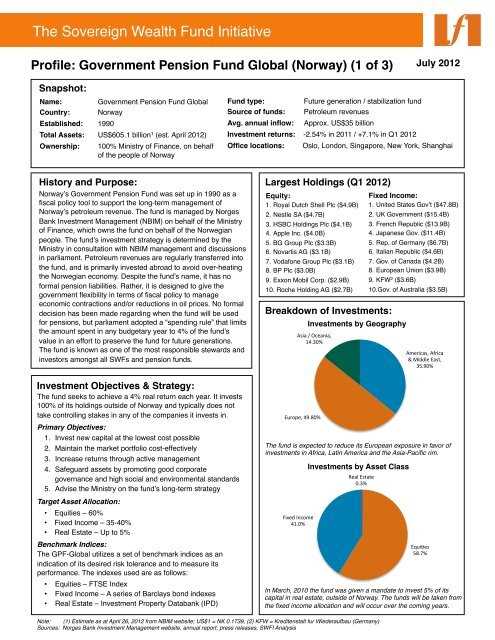

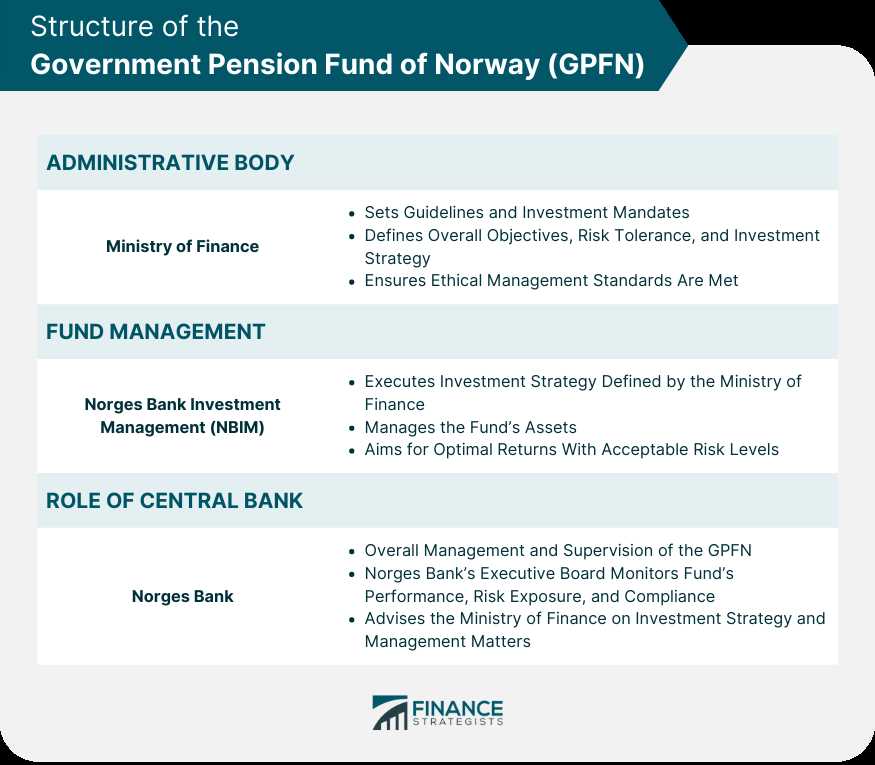

The Government Pension Fund of Norway (GPFN) is a sovereign wealth fund established by the Norwegian government in 1990. It is one of the largest pension funds in the world and is managed by Norges Bank Investment Management (NBIM).

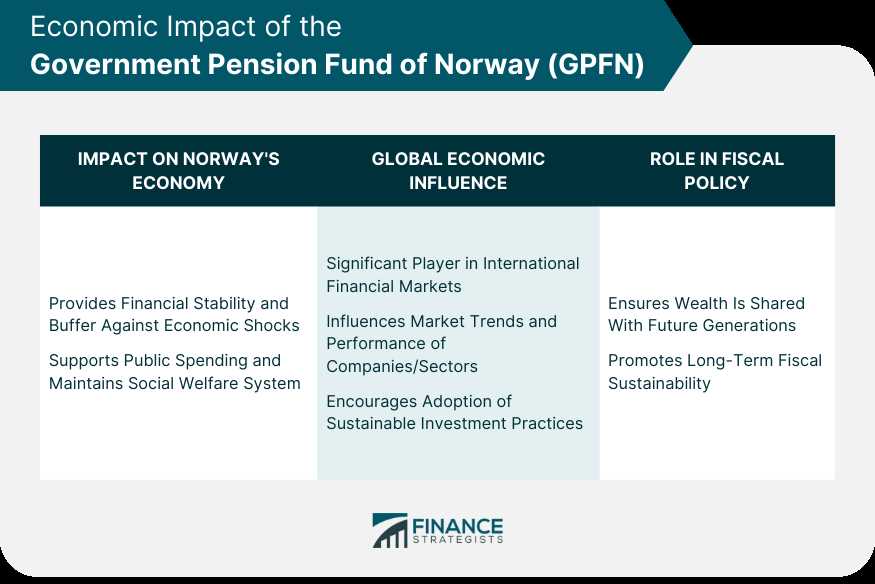

The main objective of the GPFN is to ensure the long-term financial stability of the Norwegian welfare state by investing the country’s oil and gas revenues. The fund is funded by the surplus revenues from Norway’s petroleum sector, primarily from oil and gas production in the North Sea.

The GPFN operates under strict ethical guidelines and has a responsible investment strategy. It aims to generate high returns on its investments while also considering environmental, social, and governance factors. The fund is committed to sustainable and responsible investing, and it actively engages with companies to promote good corporate governance practices.

As of 2021, the GPFN has a diversified investment portfolio that includes stocks, bonds, real estate, and alternative investments. The fund invests globally and has holdings in thousands of companies around the world. It is known for its long-term investment approach and has a low turnover rate in its portfolio.

The GPFN also plays a significant role in the Norwegian economy. It invests domestically to support local businesses and industries, and it has a separate fund, the Government Pension Fund Global, which focuses on international investments.

Key Features of Government Pension Fund of Norway

The Government Pension Fund of Norway (GPFN) is a sovereign wealth fund established by the Norwegian government in 1990. It is one of the largest pension funds in the world, with assets under management exceeding $1 trillion. The fund’s primary objective is to ensure long-term financial stability and provide a sustainable source of income for future generations of Norwegians.

1. Ownership and Governance

The GPFN is owned and managed by Norges Bank Investment Management (NBIM), a subsidiary of the Norwegian central bank. The fund operates under strict guidelines and is subject to oversight by the Ministry of Finance. The governance structure ensures transparency, accountability, and adherence to ethical standards.

2. Investment Strategy

The GPFN follows a diversified investment strategy to maximize returns while managing risk. The fund invests in a wide range of asset classes, including equities, fixed income, real estate, and infrastructure. It has a long-term investment horizon and aims to generate sustainable and responsible returns over time.

3. Ethical Guidelines

The GPFN has implemented strict ethical guidelines for its investments. It excludes companies involved in activities such as tobacco production, weapons manufacturing, and severe environmental damage. The fund also considers environmental, social, and governance (ESG) factors in its investment decisions, promoting sustainable and responsible business practices.

4. Long-Term Focus

The GPFN takes a long-term approach to investing, focusing on generating returns over several decades. It aims to preserve and grow the fund’s capital to meet the future pension obligations of the Norwegian government. This long-term perspective allows the fund to withstand short-term market fluctuations and volatility.

5. Contribution and Withdrawal

The GPFN receives contributions from the Norwegian government, primarily from petroleum revenues. These contributions are invested in various assets to generate returns. The fund also has a withdrawal mechanism, allowing the government to withdraw funds when needed to cover pension obligations. The withdrawal rate is determined by the Ministry of Finance based on the long-term sustainability of the fund.

| Key Features | Description |

|---|---|

| Ownership and Governance | The GPFN is owned and managed by Norges Bank Investment Management (NBIM) under the oversight of the Ministry of Finance. |

| Investment Strategy | The fund follows a diversified investment strategy, investing in equities, fixed income, real estate, and infrastructure. |

| Ethical Guidelines | The GPFN has strict ethical guidelines, excluding companies involved in tobacco, weapons, and severe environmental damage. |

| Long-Term Focus | The fund takes a long-term approach, aiming to preserve and grow capital over several decades. |

| Contribution and Withdrawal | The GPFN receives contributions from the Norwegian government and has a withdrawal mechanism for pension obligations. |

Investment Strategy of Government Pension Fund of Norway

The Government Pension Fund of Norway (GPFN) has a well-defined investment strategy aimed at maximizing long-term returns while managing risk. The fund follows a diversified investment approach, allocating its assets across different asset classes and geographical regions.

The fund’s investment strategy is based on three key principles:

- Long-term perspective: The GPFN takes a long-term view when making investment decisions. It focuses on generating sustainable returns over time, rather than chasing short-term gains.

- Global diversification: The fund diversifies its investments across a wide range of asset classes, including equities, fixed income, real estate, and alternative investments. It also invests in both developed and emerging markets to spread risk and capture opportunities.

- Ethical considerations: The GPFN has a responsible investment approach that takes into account environmental, social, and governance (ESG) factors. It aims to invest in companies that adhere to high ethical standards and contribute to sustainable development.

The fund’s asset allocation is determined by its strategic benchmark index, which sets the target allocation for each asset class. The actual allocation may deviate from the benchmark due to market conditions and active management decisions.

The GPFN follows a passive investment strategy for a significant portion of its equity investments. It aims to replicate the performance of broad market indices by investing in a diversified portfolio of stocks. This approach helps reduce costs and ensures broad market exposure.

In addition to passive investments, the fund also engages in active management strategies. It seeks to add value through stock selection, sector allocation, and other active investment strategies. The fund has a dedicated team of investment professionals who analyze market trends, conduct research, and make investment decisions.

The GPFN also considers sustainability and ethical factors in its investment decisions. It excludes companies involved in certain activities, such as tobacco production and severe environmental damage. The fund also engages with companies to promote responsible business practices and improve their ESG performance.

Overall, the investment strategy of the Government Pension Fund of Norway aims to generate sustainable long-term returns while managing risk and considering ethical considerations. The fund’s diversified approach, long-term perspective, and responsible investment approach contribute to its success as one of the world’s largest sovereign wealth funds.

Benefits of Government Pension Fund of Norway

The Government Pension Fund of Norway (GPFN) offers a range of benefits to its participants. These benefits make it an attractive option for individuals looking to secure their financial future.

1. Stable and Secure Retirement Income: One of the key benefits of the GPFN is that it provides a stable and secure source of retirement income. The fund is managed by professionals who aim to generate long-term returns, ensuring that participants receive a steady stream of income during their retirement years.

2. Diversification: The GPFN follows a diversified investment strategy, which helps to mitigate risk and protect the fund against market fluctuations. By investing in a wide range of asset classes, including stocks, bonds, and real estate, the fund aims to achieve stable and sustainable returns over time.

3. Long-Term Focus: The GPFN has a long-term investment horizon, which allows it to take advantage of opportunities that may arise over time. This focus on the long-term helps to ensure that the fund can weather short-term market volatility and deliver consistent returns over the years.

4. Ethical Investment Practices: The GPFN is committed to responsible and ethical investment practices. The fund has strict guidelines in place to ensure that it only invests in companies that meet certain environmental, social, and governance criteria. This commitment to sustainability and ethical investing makes the GPFN an attractive option for individuals who want their investments to align with their values.

5. Global Exposure: The GPFN invests in companies and assets around the world, providing participants with exposure to global markets. This global diversification helps to spread risk and capture opportunities in different regions, ensuring that the fund can generate returns even in challenging economic conditions.

6. Transparency: The GPFN operates with a high level of transparency, providing regular updates and reports on its investment activities. Participants can access detailed information about the fund’s holdings, performance, and investment strategy, allowing them to make informed decisions about their retirement savings.

7. Government Backing: The GPFN is backed by the Norwegian government, which provides an additional layer of security. This government guarantee ensures that participants’ retirement savings are protected, even in the event of financial market downturns or economic crises.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.