Godfather Offer: What It Is

A Godfather Offer is a strategic move made by a company to acquire another company in the M&A (mergers and acquisitions) category. It is a term used to describe a highly attractive and compelling offer made by the acquiring company to the target company, with the intention of persuading them to accept the acquisition deal.

Godfather Offers are typically characterized by their generous terms, which may include a significant premium on the target company’s stock price, favorable financial terms, and other incentives. The aim of a Godfather Offer is to make it extremely difficult for the target company to refuse the acquisition deal, hence the reference to “The Godfather” movie, where the offer that cannot be refused is a central theme.

These offers are often made by larger, more established companies to smaller companies that have valuable assets, technologies, or market positions that the acquiring company wants to gain access to. The Godfather Offer is a strategic tool used to gain a competitive advantage, expand market share, or enhance the acquiring company’s capabilities.

When a Godfather Offer is made, it typically generates significant attention and interest from investors, analysts, and industry experts. The terms and conditions of the offer are carefully analyzed, and the potential impact on both the acquiring and target companies is assessed.

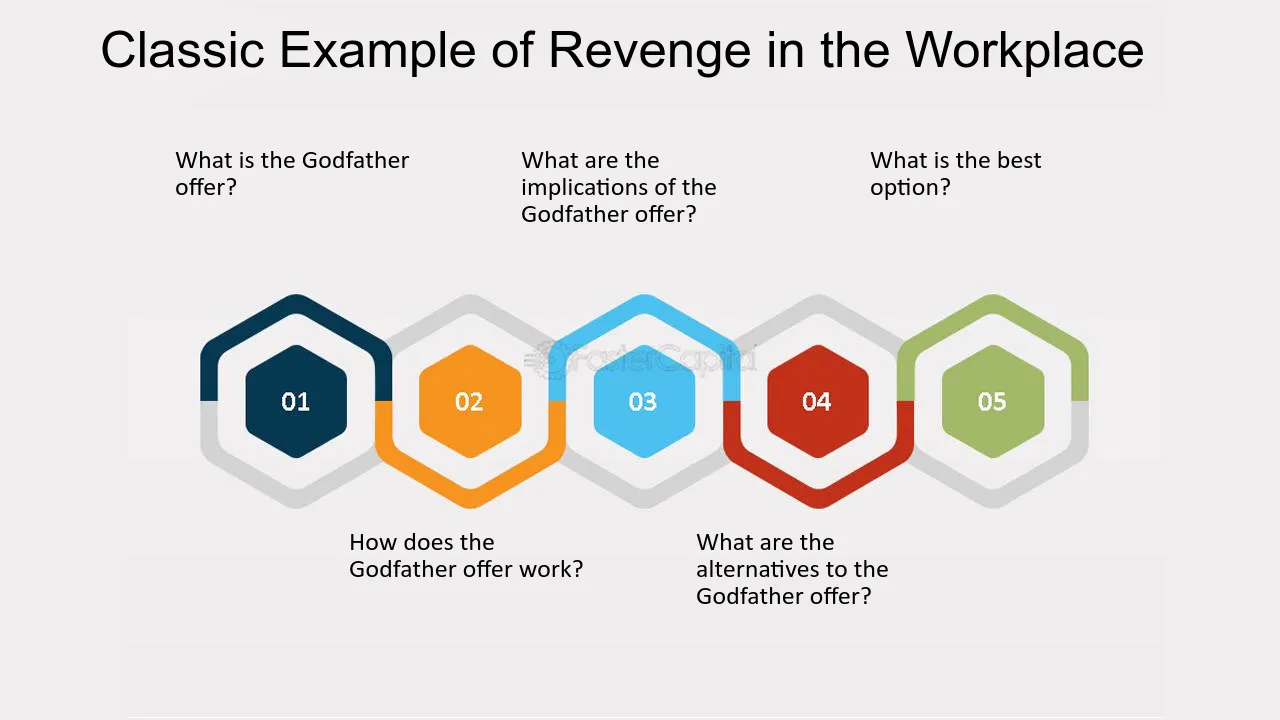

Definition and Explanation

The Godfather Offer is often characterized by its aggressive nature and the use of tactics that put significant pressure on the target company to accept the deal. It is a strategic move designed to eliminate competition, increase market share, and consolidate power in the industry.

Key Elements of a Godfather Offer

- Financial Incentives: The Godfather Offer usually includes attractive financial incentives, such as a premium price for the target company’s shares or a lucrative merger agreement.

- Threat of Hostile Takeover: The Godfather may also threaten to initiate a hostile takeover if the target company does not accept the offer. This creates a sense of urgency and fear among the target company’s shareholders.

- Strategic Benefits: The Godfather often highlights the strategic benefits of the deal, such as access to new markets, synergies, and increased competitiveness.

- Limited Alternatives: The Godfather may present the target company with limited alternatives, making it difficult for them to find a better deal or escape the offer.

How It Works

The Godfather Offer is a strategic approach used in mergers and acquisitions (M&A) to gain control over a target company. It involves making an offer that the target company cannot refuse, similar to the famous line from the movie “The Godfather.”

When implementing a Godfather Offer, the acquiring company presents the target company’s shareholders with an offer they cannot resist. This offer typically includes a premium price for their shares, along with other attractive terms and conditions.

The goal of the Godfather Offer is to convince the target company’s shareholders that accepting the offer is in their best interest. This can be achieved by highlighting the potential benefits of the merger or acquisition, such as increased market share, synergies, cost savings, or access to new technologies or markets.

Once the offer is presented, the acquiring company may also employ various tactics to put pressure on the target company’s management and board of directors to accept the offer. This can include public statements, shareholder activism, or even the threat of a hostile takeover.

It is important to note that the Godfather Offer is a controversial strategy and may not always be successful. The target company’s management and board of directors may reject the offer if they believe it undervalues the company or if they have alternative plans for the company’s future.

Step-by-Step Process

The Godfather Offer follows a step-by-step process to ensure a smooth and successful merger or acquisition. Here are the key steps involved:

- Identify the Target: The first step is to identify the target company that you wish to acquire or merge with. This could be a competitor, a complementary business, or a company in a related industry.

- Conduct Due Diligence: Once the target company is identified, a thorough due diligence process is conducted. This involves analyzing the financials, operations, assets, liabilities, and other relevant information of the target company.

- Negotiate and Finalize the Deal: The next step is to negotiate with the target company to reach a mutually beneficial agreement. This involves discussing and resolving any differences or concerns, and finalizing the terms of the deal.

- Obtain Regulatory Approvals: After the deal is finalized, the acquiring company must obtain the necessary regulatory approvals. This may include approvals from government agencies, industry regulators, or competition authorities.

- Execute the Transaction: Once all the approvals are obtained, the transaction is executed. This involves the transfer of ownership, assets, and liabilities from the target company to the acquiring company.

- Integrate and Synergize: After the transaction is completed, the acquiring company focuses on integrating the operations, systems, and teams of the target company. The goal is to achieve synergies and maximize the value of the combined entity.

By following this step-by-step process, the Godfather Offer ensures a systematic approach to mergers and acquisitions, leading to successful outcomes and value creation for all parties involved.

Example [M&A catname]

Let’s take a look at an example to better understand how the Godfather Offer works in the context of mergers and acquisitions.

Company A

Company A is a well-established player in the technology industry, specializing in software development and digital solutions. They have a strong customer base and a solid reputation in the market.

Company B

Company B is a smaller company operating in the same industry. They have innovative products and a talented team, but they lack the resources and market presence to scale their business effectively.

Company A recognizes the potential of Company B and sees an opportunity for growth through acquisition. They believe that by combining their resources and expertise, they can create a stronger and more competitive entity in the market.

The Godfather Offer

Company A approaches Company B with a Godfather Offer, presenting them with a compelling proposition. The offer includes a generous cash payment, along with the opportunity for Company B’s shareholders to become part of the new entity and benefit from its future success.

The Godfather Offer also includes a detailed plan for integrating Company B into Company A, ensuring a smooth transition and maximizing synergies between the two organizations.

The Benefits

By accepting the Godfather Offer, Company B gains access to Company A’s extensive resources, including financial backing, technological expertise, and a larger customer base. This allows them to accelerate their growth and expand their market reach.

Company A, on the other hand, benefits from the acquisition by acquiring innovative products and talented employees from Company B. This enhances their competitive advantage and positions them as a market leader in the industry.

Overall, the Godfather Offer creates a win-win situation for both companies, enabling them to achieve their strategic objectives and drive long-term success.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.