Fisher Effect: Definition and Relationship to Inflation

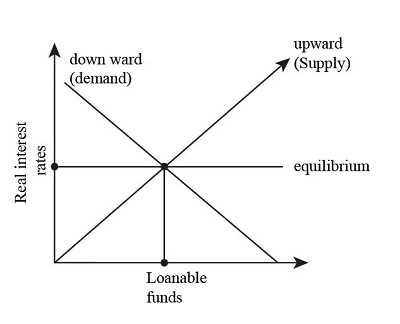

The Fisher Effect is an economic theory that describes the relationship between interest rates and inflation. It suggests that nominal interest rates are determined by two factors: the real interest rate and the expected inflation rate. According to the Fisher Effect, nominal interest rates will increase or decrease in response to changes in the expected inflation rate.

The real interest rate represents the return on investment adjusted for inflation. It is the rate at which an investor’s purchasing power increases over time. The expected inflation rate, on the other hand, is the rate at which prices are expected to rise in the future. When the expected inflation rate is high, investors demand higher nominal interest rates to compensate for the loss of purchasing power.

For example, let’s say the real interest rate is 3% and the expected inflation rate is 2%. According to the Fisher Effect, the nominal interest rate should be 5% (3% + 2%) to maintain the purchasing power of the investment. If the expected inflation rate increases to 4%, the nominal interest rate should also increase to 7% (3% + 4%) to account for the higher inflation rate.

The Fisher Effect has important implications for both borrowers and lenders. Borrowers need to consider the expected inflation rate when deciding on the interest rate they are willing to pay. Lenders, on the other hand, need to adjust the interest rates they charge to account for changes in the expected inflation rate.

The Fisher Effect is an economic theory that describes the relationship between nominal interest rates, real interest rates, and inflation. It was developed by economist Irving Fisher in the early 20th century. According to the Fisher Effect, there is a direct relationship between nominal interest rates and expected inflation.

At its core, the Fisher Effect states that when inflation is expected to increase, nominal interest rates will also increase. This is because lenders and investors demand compensation for the loss in purchasing power caused by inflation. In other words, they want to earn a real rate of return on their investments, which is the nominal interest rate minus the expected inflation rate.

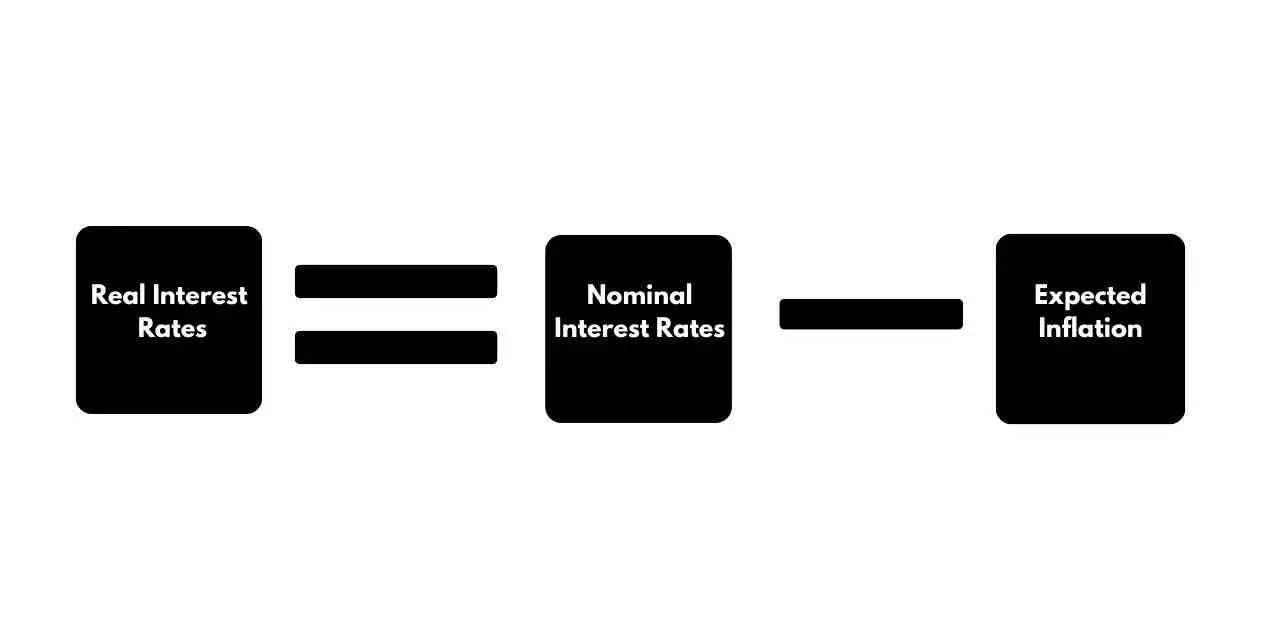

The Fisher Effect can be explained using the following formula:

Nominal Interest Rate = Real Interest Rate + Expected Inflation Rate

For example, let’s say the real interest rate is 2% and the expected inflation rate is 3%. According to the Fisher Effect, the nominal interest rate would be 5% (2% + 3%). This means that lenders and investors would require a 5% return on their investments to account for both the real interest rate and the expected inflation rate.

The Fisher Effect has important implications for monetary policy and financial markets. Central banks often use interest rates as a tool to control inflation. If inflation is expected to increase, central banks may raise interest rates to counteract it. This can have a significant impact on borrowing costs, investment decisions, and overall economic activity.

Furthermore, the Fisher Effect suggests that investors should take inflation into account when making investment decisions. They should consider the expected inflation rate and adjust their required rate of return accordingly. This can help them make more informed investment choices and protect their purchasing power over time.

The Relationship between the Fisher Effect and Inflation

The Fisher Effect is an economic theory that describes the relationship between interest rates and inflation. According to the Fisher Effect, there is a direct relationship between the nominal interest rate, the real interest rate, and the expected inflation rate.

The nominal interest rate is the stated interest rate on a loan or investment, while the real interest rate is the nominal interest rate adjusted for inflation. The expected inflation rate is the rate at which prices are expected to rise in the future.

According to the Fisher Effect, when the expected inflation rate increases, the nominal interest rate will also increase. This is because lenders and investors will demand a higher nominal interest rate to compensate for the expected loss in purchasing power due to inflation.

For example, if the expected inflation rate is 2% and the real interest rate is 3%, the nominal interest rate would be 5%. If the expected inflation rate increases to 4%, the nominal interest rate would also increase to 7% to maintain the same real interest rate of 3%.

Conversely, when the expected inflation rate decreases, the nominal interest rate will also decrease. This is because lenders and investors will be willing to accept a lower nominal interest rate since the expected loss in purchasing power due to inflation is lower.

The Fisher Effect has important implications for monetary policy and financial markets. Central banks often use interest rates as a tool to control inflation. By increasing interest rates, central banks can reduce borrowing and spending, which can help to decrease inflation. Conversely, by decreasing interest rates, central banks can encourage borrowing and spending, which can help to stimulate economic growth.

Financial markets also closely monitor inflation and interest rates. Changes in inflation expectations can have a significant impact on bond yields, stock prices, and currency exchange rates. Investors use the Fisher Effect to make informed decisions about their investment portfolios and to manage their exposure to inflation risk.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.