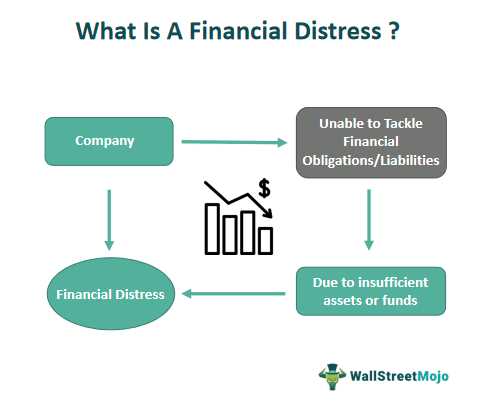

Financial Distress Definition

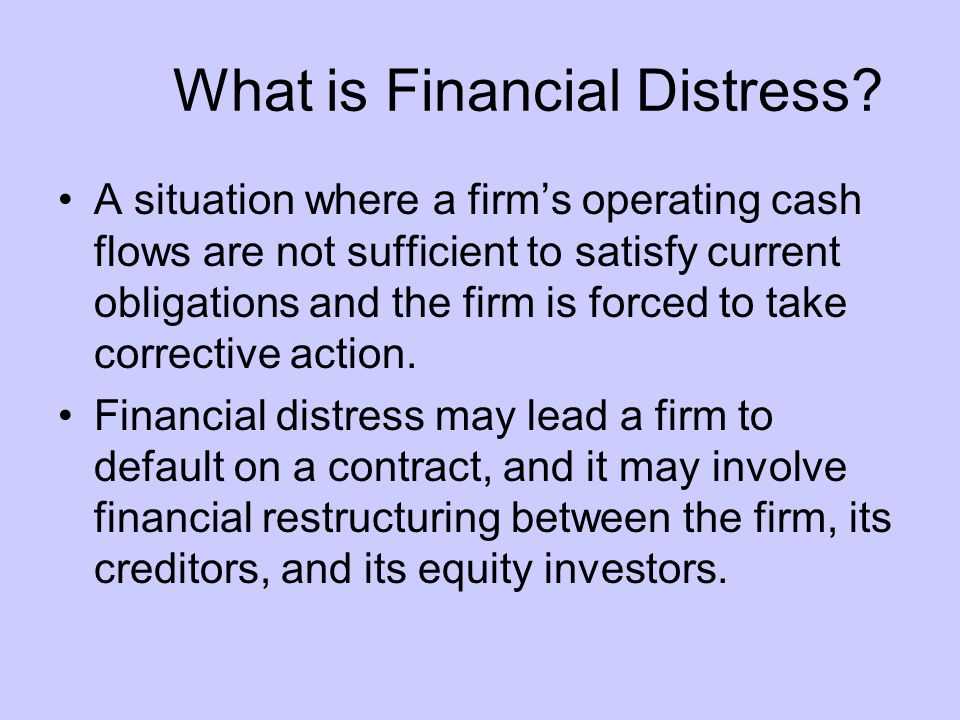

Financial distress refers to a situation in which a company or individual is unable to meet its financial obligations. It is a state of financial difficulty that can arise due to various factors such as poor financial management, economic downturns, or unexpected events.

Financial distress is a term used to describe the financial difficulties faced by individuals, businesses, or organizations. It is often characterized by a lack of liquidity, inability to pay debts, and a decline in overall financial health. Financial distress can be caused by a variety of factors, including excessive debt, poor cash flow management, economic recession, or industry-specific challenges.

When a company or individual is in financial distress, it may experience a range of negative consequences. These can include the inability to pay bills or loans, declining credit ratings, legal actions such as bankruptcy or foreclosure, and a loss of investor confidence.

Recognizing Signs of Financial Distress

There are several signs that can indicate that an individual or company is experiencing financial distress. These signs include a consistent inability to meet financial obligations, such as late payments or missed deadlines, a decline in profitability or cash flow, increasing levels of debt, and a deteriorating credit rating.

Other signs of financial distress can include a high employee turnover rate, frequent requests for extensions or renegotiation of payment terms, and a lack of access to additional financing or credit.

Common Causes of Financial Distress

Financial distress can be caused by a variety of factors, both internal and external. Internal factors can include poor financial management, excessive debt, inadequate cash flow management, or a lack of diversification in revenue streams.

External factors that can contribute to financial distress include economic recessions, changes in market conditions, industry-specific challenges, or unexpected events such as natural disasters or pandemics.

Effective Remedies for Financial Distress

When facing financial distress, it is important to take immediate action to address the underlying issues and implement effective remedies. Some common remedies for financial distress include:

- Cost-cutting measures: Identifying and reducing unnecessary expenses can help improve cash flow and reduce financial strain.

- Debt restructuring: Negotiating with creditors to modify payment terms or reduce debt obligations can provide temporary relief and improve financial stability.

- Seeking additional financing: Exploring options for securing additional funding, such as loans or investments, can help address immediate financial needs.

- Improving cash flow management: Implementing strategies to optimize cash flow, such as improving collections processes or negotiating favorable payment terms with suppliers, can help improve financial stability.

- Seeking professional assistance: Engaging the services of financial advisors, consultants, or turnaround specialists can provide expert guidance and support in navigating financial distress.

It is important to note that the effectiveness of these remedies can vary depending on the specific circumstances and underlying causes of financial distress. Seeking professional advice and developing a tailored plan of action is often crucial in successfully overcoming financial difficulties.

Importance of Financial Analysis in Managing Distress

Financial analysis plays a crucial role in managing financial distress. By conducting a thorough analysis of the financial health and performance of a company or individual, it becomes possible to identify the root causes of financial distress, assess the severity of the situation, and develop appropriate strategies for recovery.

Financial analysis can involve various techniques, such as ratio analysis, cash flow analysis, and trend analysis. These tools provide valuable insights into the financial position, liquidity, profitability, and solvency of an entity, helping to inform decision-making and guide the implementation of effective remedies.

Financial distress refers to a situation where a company or an individual is unable to meet its financial obligations and is at risk of insolvency or bankruptcy. It is a critical state that can have severe consequences for the entity’s operations, reputation, and stakeholders.

Financial distress can occur due to various factors, including poor financial management, economic downturns, excessive debt, inadequate cash flow, or unexpected events such as natural disasters or pandemics. It is crucial to understand the meaning of financial distress to effectively manage and mitigate its impact.

Signs of Financial Distress

Recognizing the signs of financial distress is essential for timely intervention and resolution. Some common indicators include:

- Increasing debt levels

- Declining sales or revenue

- Inability to pay bills or meet financial obligations

- Frequent delays in payments

- Lack of access to credit or financing

- Reduced profitability or negative cash flow

- Downward trend in key financial ratios

- Legal actions, such as lawsuits or creditor claims

By monitoring these signs, individuals and organizations can take proactive measures to address financial distress before it escalates.

Causes of Financial Distress

Financial distress can have various underlying causes. Some common factors include:

- Poor financial management and decision-making

- Excessive borrowing or high levels of debt

- Inadequate cash flow management

- Market or industry downturns

- Unexpected events, such as natural disasters or economic crises

- Failure to adapt to changing market conditions

- Weak corporate governance

Remedies for Financial Distress

When faced with financial distress, individuals and organizations can take several steps to mitigate its impact and restore financial stability. Some effective remedies include:

- Developing a comprehensive financial recovery plan

- Reducing expenses and optimizing costs

- Negotiating with creditors for favorable repayment terms

- Exploring alternative sources of financing

- Restructuring debt or seeking debt relief options

- Improving cash flow management

- Implementing strategic changes to improve profitability

- Seeking professional advice from financial experts or consultants

By implementing these remedies, individuals and organizations can navigate through financial distress and regain stability.

Recognizing Signs of Financial Distress

Financial distress refers to a situation where a company or an individual is unable to meet their financial obligations. It is important to recognize the signs of financial distress early on to take appropriate measures and prevent further deterioration of the financial situation. Here are some key indicators that can help identify financial distress:

- Liquidity Issues: One of the first signs of financial distress is a lack of liquidity. This means that the company or individual may not have enough cash on hand to meet their immediate financial obligations, such as paying bills or making loan payments.

- Increasing Debt: Another sign of financial distress is a significant increase in debt levels. This could be due to borrowing money to cover expenses or using credit cards to finance operations. High levels of debt can indicate that the company or individual is struggling to generate enough revenue to cover their expenses.

- Declining Profitability: A decline in profitability is often a red flag for financial distress. If a company’s profits are consistently decreasing or turning into losses, it indicates that they are not generating enough revenue to cover their costs.

- Delayed Payments: If a company or individual starts delaying payments to suppliers, creditors, or employees, it is a clear sign of financial distress. This could be due to a lack of funds or cash flow problems.

- Legal Issues: Legal issues such as lawsuits, liens, or judgments can also indicate financial distress. These issues can arise when a company or individual is unable to meet their financial obligations and creditors take legal action to recover their money.

- Declining Market Share: A decline in market share can be a sign of financial distress, especially if it is accompanied by a decrease in sales. It indicates that the company is losing its competitive edge and struggling to attract customers.

Recognizing these signs of financial distress is crucial for taking timely action to address the underlying issues. It is important to conduct a thorough financial analysis to understand the root causes of the distress and develop effective remedies to improve the financial situation.

Common Causes of Financial Distress

Financial distress can be caused by various factors, and it is important for businesses to understand these causes in order to effectively manage and prevent them. Here are some common causes of financial distress:

1. Poor financial management: Inadequate financial planning, budgeting, and control can lead to financial distress. Businesses that fail to monitor their cash flow, expenses, and profitability may find themselves in a precarious financial situation.

2. High levels of debt: Excessive borrowing and a heavy debt burden can put a strain on a company’s finances. If a business is unable to meet its debt obligations, it may face financial distress. This can be particularly problematic if the company’s revenue declines or if interest rates increase.

3. Economic downturns: Economic recessions or downturns can have a significant impact on businesses, especially those that are heavily dependent on consumer spending. During a recession, consumers may cut back on their purchases, leading to a decrease in revenue for businesses and potentially causing financial distress.

4. Competition: Intense competition in the market can put pressure on businesses, especially smaller ones. If a company is unable to differentiate itself or keep up with competitors, it may struggle to generate sufficient revenue and may experience financial distress as a result.

5. Changes in industry or market conditions: Industries and markets are constantly evolving, and businesses need to adapt to these changes in order to remain competitive. Failure to anticipate or respond to changes in customer preferences, technology advancements, or regulatory requirements can lead to financial distress.

6. Poor sales and revenue growth: If a company experiences a decline in sales or struggles to generate revenue growth, it may face financial distress. This can be due to various factors, such as a decline in demand for the company’s products or services, ineffective marketing strategies, or pricing issues.

7. Legal or regulatory issues: Non-compliance with laws and regulations can result in fines, penalties, and legal expenses, which can put a strain on a company’s finances. Legal or regulatory issues can also damage a company’s reputation, leading to a loss of customers and revenue.

It is important for businesses to be proactive in identifying and addressing these causes of financial distress. By implementing effective financial management practices, monitoring market conditions, and adapting to changes, businesses can reduce the risk of financial distress and ensure their long-term sustainability.

Effective Remedies for Financial Distress

Financial distress is a challenging situation that many businesses and individuals may face at some point. It can be caused by various factors such as economic downturns, poor financial management, excessive debt, or unexpected events. When faced with financial distress, it is crucial to take immediate action to address the issues and find effective remedies to overcome the situation.

1. Cut Costs and Reduce Expenses

One of the first steps in remedying financial distress is to evaluate and cut unnecessary costs and expenses. This can include reducing discretionary spending, renegotiating contracts with suppliers, and eliminating non-essential services. By reducing expenses, businesses and individuals can free up cash flow and allocate resources towards essential needs and debt repayment.

2. Increase Revenue

Another effective remedy for financial distress is to focus on increasing revenue. This can be achieved through various strategies such as expanding the customer base, improving marketing efforts, introducing new products or services, or exploring new markets. By generating more revenue, businesses and individuals can improve their financial position and have more resources to address their financial obligations.

3. Renegotiate Debt and Payment Terms

When facing financial distress, it is important to communicate with creditors and lenders to renegotiate debt terms and payment schedules. This can involve negotiating lower interest rates, extending repayment periods, or even seeking debt forgiveness or restructuring. By working with creditors, businesses and individuals can alleviate some of the financial burden and create a more manageable repayment plan.

4. Seek Professional Help

In some cases, financial distress may require the assistance of professionals such as financial advisors, accountants, or lawyers. These professionals can provide expert advice and guidance on how to navigate through the challenging financial situation. They can help analyze the financial position, develop a strategic plan, negotiate with creditors, and provide legal support if needed. Seeking professional help can greatly increase the chances of successfully overcoming financial distress.

5. Improve Financial Management

Financial distress often highlights the need for better financial management practices. It is important to develop and implement effective financial management strategies to prevent future financial difficulties. This can include creating a budget, monitoring cash flow, improving financial reporting and analysis, and implementing risk management strategies. By improving financial management practices, businesses and individuals can better anticipate and address potential financial challenges.

Importance of Financial Analysis in Managing Distress

Financial analysis plays a crucial role in managing financial distress. It provides valuable insights into the financial health of a company and helps identify potential risks and opportunities for improvement. By analyzing financial data, businesses can make informed decisions and take necessary actions to mitigate financial distress.

One of the key benefits of financial analysis is that it helps identify the root causes of financial distress. By examining financial statements, cash flow statements, and other financial data, analysts can pinpoint areas of weakness or inefficiency that may be contributing to the company’s financial difficulties. This allows management to address these issues directly and implement strategies to improve financial performance.

Furthermore, financial analysis helps in monitoring the progress of implemented remedies. By regularly analyzing financial data, businesses can track the effectiveness of their actions and make necessary adjustments if needed. This allows management to stay proactive and responsive to changes in the financial landscape, ensuring that the company remains on track towards financial stability.

Financial analysis also provides valuable information for stakeholders, such as investors, lenders, and suppliers. By presenting accurate and comprehensive financial reports, businesses can build trust and confidence with these stakeholders, which is crucial during times of financial distress. This transparency helps maintain relationships and can even attract new sources of funding or support.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.