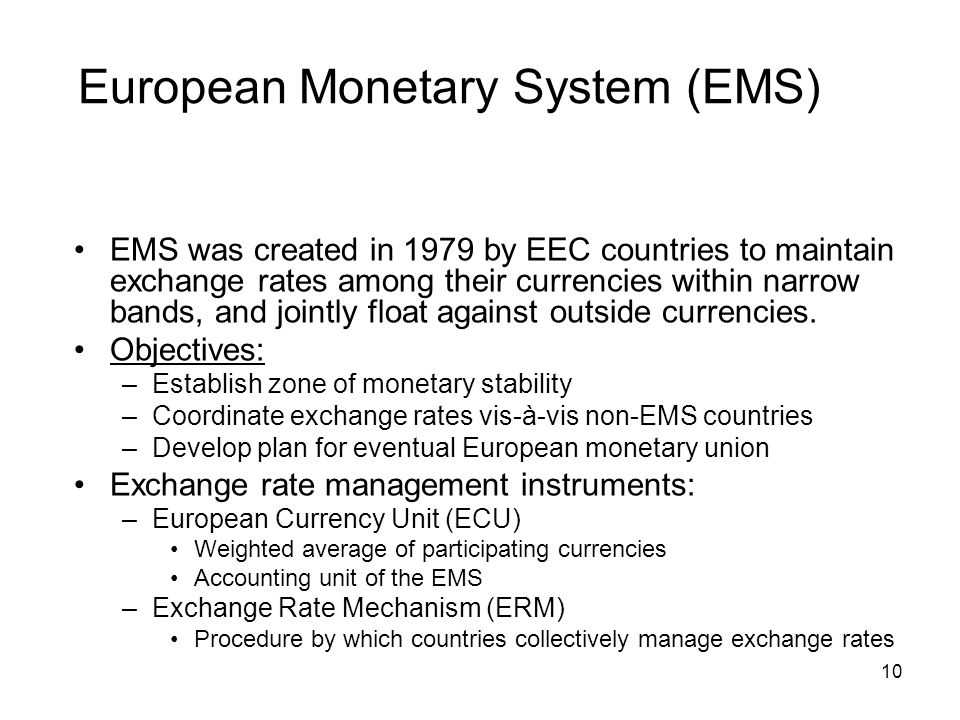

European Monetary System (EMS): Definition

The European Monetary System (EMS) was an arrangement established in 1979 by the member countries of the European Economic Community (EEC) to promote monetary stability and facilitate economic integration. It was a precursor to the establishment of the European Union and the adoption of the euro as a common currency.

The EMS aimed to create a stable exchange rate system among the participating countries by limiting fluctuations in their exchange rates. It consisted of two main components: the Exchange Rate Mechanism (ERM) and the European Currency Unit (ECU).

The European Currency Unit (ECU) was a basket currency that served as a unit of account for the EMS. It was based on a weighted average of the currencies of the participating countries. The ECU was used for accounting purposes and as a reference point for exchange rate calculations.

The EMS played a crucial role in promoting economic stability and integration in Europe. It helped to reduce exchange rate volatility, facilitate trade and investment, and foster closer economic cooperation among the member countries. It also laid the groundwork for the creation of the euro and the establishment of the European Central Bank.

What is the European Monetary System?

The European Monetary System (EMS) was an arrangement established in 1979 to promote monetary stability among the member countries of the European Union (EU). It was a precursor to the formation of the Eurozone and played a significant role in the development of the European Union’s monetary policy.

Objectives of the European Monetary System

The primary objective of the European Monetary System was to stabilize exchange rates and foster economic cooperation among the member countries. It aimed to achieve this through a system of fixed exchange rates and a common currency unit called the European Currency Unit (ECU).

The EMS sought to limit fluctuations in exchange rates between member currencies to maintain stable trading conditions and facilitate economic integration. It provided a framework for coordination and cooperation among central banks, allowing them to intervene in the foreign exchange market to stabilize exchange rates.

Components of the European Monetary System

The EMS consisted of several key components:

- European Currency Unit (ECU): The ECU was a basket currency composed of weighted amounts of the member countries’ currencies. It served as a unit of account and provided a benchmark for exchange rate stability.

- European Monetary Cooperation Fund (EMCF): The EMCF was established to provide financial assistance to member countries experiencing balance of payments difficulties. It aimed to support countries in maintaining stable exchange rates and implementing necessary economic adjustments.

- Exchange Rate Grid: The exchange rate grid was a system of bilateral exchange rate relationships among member currencies. It provided a framework for maintaining stable exchange rates and allowed for periodic realignments when necessary.

Impact and Evolution of the European Monetary System

The European Monetary System played a crucial role in fostering economic integration and preparing the groundwork for the establishment of the Eurozone. It provided stability and predictability in exchange rates, which facilitated trade and investment among member countries.

However, the EMS faced challenges and underwent significant changes over time. It experienced several currency crises, most notably the crisis in the early 1990s when speculative attacks forced some countries to devalue their currencies or exit the system temporarily.

These challenges ultimately led to the creation of the Eurozone and the adoption of the euro as a common currency for participating countries. The EMS served as a stepping stone towards the establishment of a single currency and laid the foundation for the European Central Bank’s monetary policy.

European Monetary System (EMS): Historical Overview

The European Monetary System (EMS) was established in 1979 as an initiative to promote stability and economic integration among European countries. It was a precursor to the creation of the Eurozone and played a crucial role in the development of the European Union’s monetary policy.

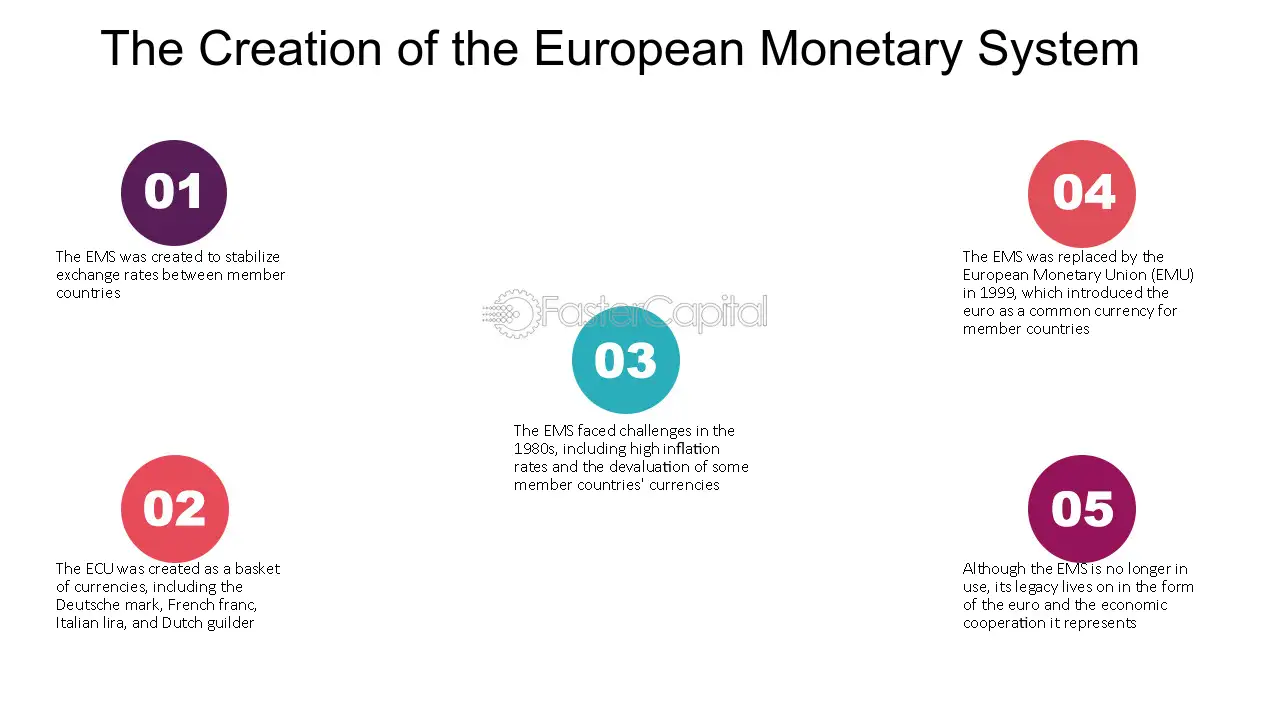

Creation of the EMS

The EMS was created in response to the economic instability and currency fluctuations experienced by European countries in the 1970s. The system aimed to stabilize exchange rates and foster economic cooperation among its member states.

The EMS consisted of two main components: the Exchange Rate Mechanism (ERM) and the European Currency Unit (ECU). The ERM was designed to maintain stable exchange rates between member countries’ currencies by setting bilateral central rates and allowing limited fluctuations around these rates. The ECU, on the other hand, was a basket currency used for accounting purposes and as a unit of account within the EMS.

Role and Functioning of the EMS

The EMS played a crucial role in promoting economic stability and integration among its member countries. It provided a framework for cooperation and coordination of monetary policies, facilitating the convergence of economic performance and inflation rates across Europe.

Furthermore, the EMS fostered closer economic integration through the coordination of monetary policies. Member countries had to align their interest rates and fiscal policies to ensure compatibility and avoid imbalances within the system.

Evolution and Dissolution of the EMS

The EMS went through various stages of evolution and faced several challenges throughout its existence. In the 1980s, the system experienced significant currency crises, most notably the European Exchange Rate Mechanism (ERM) crisis in 1992. This crisis led to the devaluation and withdrawal of several currencies from the ERM, exposing the vulnerabilities of the system.

Despite these challenges, the EMS played a crucial role in laying the groundwork for the creation of the Eurozone. The experience gained from the EMS helped shape the design and functioning of the Eurozone’s monetary policy framework.

Evolution of the European Monetary System

The European Monetary System (EMS) has undergone significant changes since its establishment in 1979. The system was created with the goal of promoting monetary stability and facilitating economic integration among European Union (EU) member states.

Overall, the evolution of the EMS reflects the ongoing process of European economic integration. The system has played a crucial role in promoting monetary stability and facilitating trade and investment within the EU. However, it has also faced challenges and required reforms to adapt to changing economic conditions. The future of the EMS will likely be shaped by ongoing debates about the optimal balance between national sovereignty and supranational integration in the EU.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.