The Evolution of the Head Trader Job

The role of a head trader has evolved significantly over the years, adapting to the changing landscape of the financial industry. In the past, a head trader was primarily responsible for executing trades on behalf of clients or the firm. However, with the advancement of technology and the increasing complexity of financial markets, the role has expanded to encompass a broader range of responsibilities.

Adapting to Technology

Expanding Responsibilities

Moreover, head traders are often involved in managing a team of traders, providing guidance and support to ensure the success of the trading desk. They may also collaborate with other departments, such as research and compliance, to ensure compliance with regulatory requirements and to stay informed about market developments.

In summary, the role of a head trader has evolved from simply executing trades to encompass a broader range of responsibilities. Today, head traders must be technologically savvy, adaptable to change, and possess strong analytical and leadership skills to thrive in the dynamic and competitive financial industry.

From Traditional Trading to Head Trader

Today, a head trader is not only responsible for executing trades, but also for developing and implementing trading strategies, managing risk, and overseeing a team of traders. This evolution in the job description of a trader has been driven by the need for more sophisticated trading techniques and the desire to maximize profits while minimizing risks.

Developing Trading Strategies

One of the key responsibilities of a head trader is to develop trading strategies that can generate profits for the firm. This involves analyzing market trends, identifying trading opportunities, and creating a plan to capitalize on those opportunities. Head traders use their expertise and knowledge of the financial markets to make informed decisions about when to buy or sell securities.

They also need to stay updated with the latest market news, economic indicators, and geopolitical events that can impact the financial markets. By staying informed, head traders can adjust their trading strategies accordingly and take advantage of market movements.

Managing Risk

Another important aspect of a head trader’s role is managing risk. Trading involves inherent risks, and it is the responsibility of the head trader to ensure that the firm’s trading activities are within acceptable risk limits. This requires monitoring the firm’s exposure to various market risks, such as market volatility, liquidity risk, and credit risk.

Head traders also need to implement risk management tools and techniques to mitigate potential losses. This can include setting stop-loss orders, diversifying the firm’s trading portfolio, and using hedging strategies to offset potential losses.

Overall, the evolution of the head trader job has transformed it from a purely execution-based role to a more strategic and analytical one. Today, head traders play a crucial role in driving profitability and managing risk for their firms. Their ability to develop effective trading strategies and navigate the complexities of the financial markets is essential for success in the ever-changing world of trading.

Example of a Head Trader’s Responsibilities

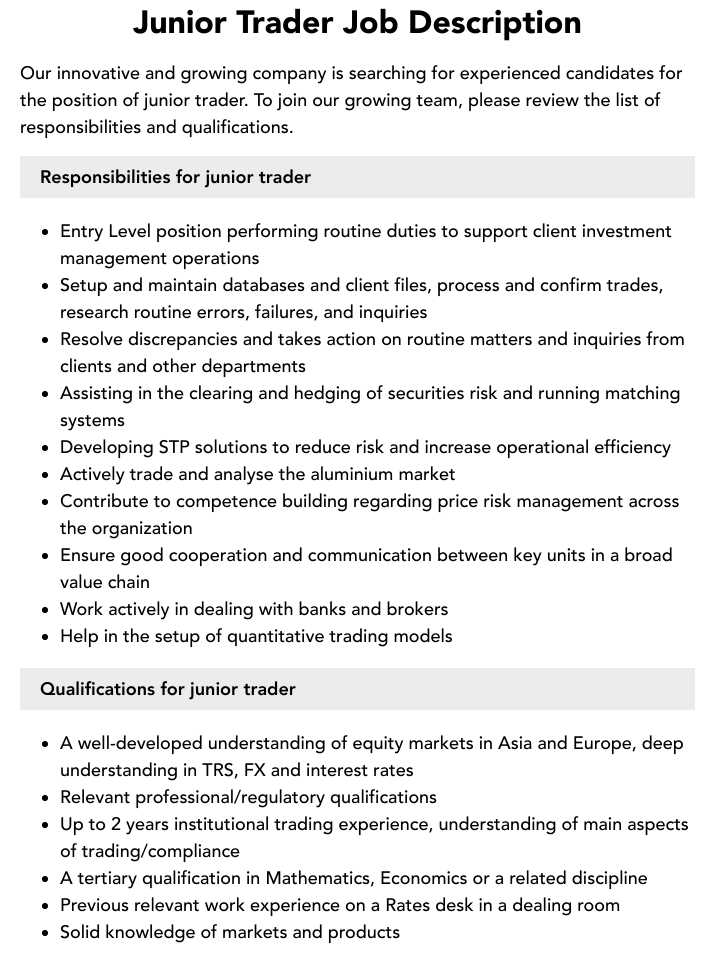

A head trader is responsible for overseeing and managing the trading activities of a financial institution or investment firm. Their role is crucial in ensuring that the trading operations are conducted efficiently and effectively. Here are some of the key responsibilities of a head trader:

- Developing and implementing trading strategies: A head trader is responsible for developing and implementing trading strategies that align with the firm’s investment objectives. They analyze market trends, assess risk factors, and make informed decisions to maximize profitability.

- Executing trades: Head traders are responsible for executing trades on behalf of the firm. They monitor market conditions, analyze pricing data, and execute trades in a timely manner to capitalize on market opportunities.

- Managing trading team: Head traders oversee a team of traders and provide guidance and support to ensure that trading activities are conducted in accordance with regulatory requirements and the firm’s policies and procedures.

- Risk management: Head traders are responsible for managing and mitigating trading risks. They monitor market volatility, assess risk exposure, and implement risk management strategies to protect the firm’s assets.

- Monitoring performance: Head traders monitor the performance of trading strategies and assess their effectiveness. They analyze trading data, evaluate performance metrics, and make necessary adjustments to optimize trading outcomes.

Overall, a head trader plays a critical role in driving the success of a financial institution or investment firm through effective trading strategies, risk management, and team leadership. Their expertise and decision-making skills are essential in navigating the complexities of the financial markets and achieving profitable outcomes.

Managing Trading Strategies

As a Head Trader, one of the key responsibilities is managing trading strategies. This involves developing and implementing effective trading strategies to maximize profits and minimize risks.

Head Traders are responsible for analyzing market trends, studying financial data, and identifying potential trading opportunities. They use their expertise and knowledge of the market to develop strategies that align with the organization’s goals and objectives.

Once the trading strategies are developed, Head Traders oversee their implementation. They monitor the performance of the strategies, making adjustments as needed to ensure optimal results. This includes analyzing trading data, evaluating the effectiveness of the strategies, and making informed decisions to improve performance.

Head Traders also collaborate with other team members, such as traders and analysts, to ensure the successful execution of the trading strategies. They provide guidance and support, sharing their expertise and insights to help the team achieve their goals.

Additionally, Head Traders stay updated on market trends and changes in regulations that may impact trading strategies. They continuously research and evaluate new trading techniques and technologies, seeking opportunities to enhance the organization’s trading capabilities.

In summary, managing trading strategies is a critical aspect of the Head Trader’s role. By developing and implementing effective strategies, they contribute to the organization’s success in the competitive financial markets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.