Overview of Euromarket

One of the key features of the Euromarket is its flexibility and lack of regulation compared to domestic financial markets. This makes it an attractive option for companies and individuals looking to raise capital or invest in foreign currencies. The absence of regulatory constraints allows for greater freedom in terms of interest rates, loan terms, and currency exchange rates.

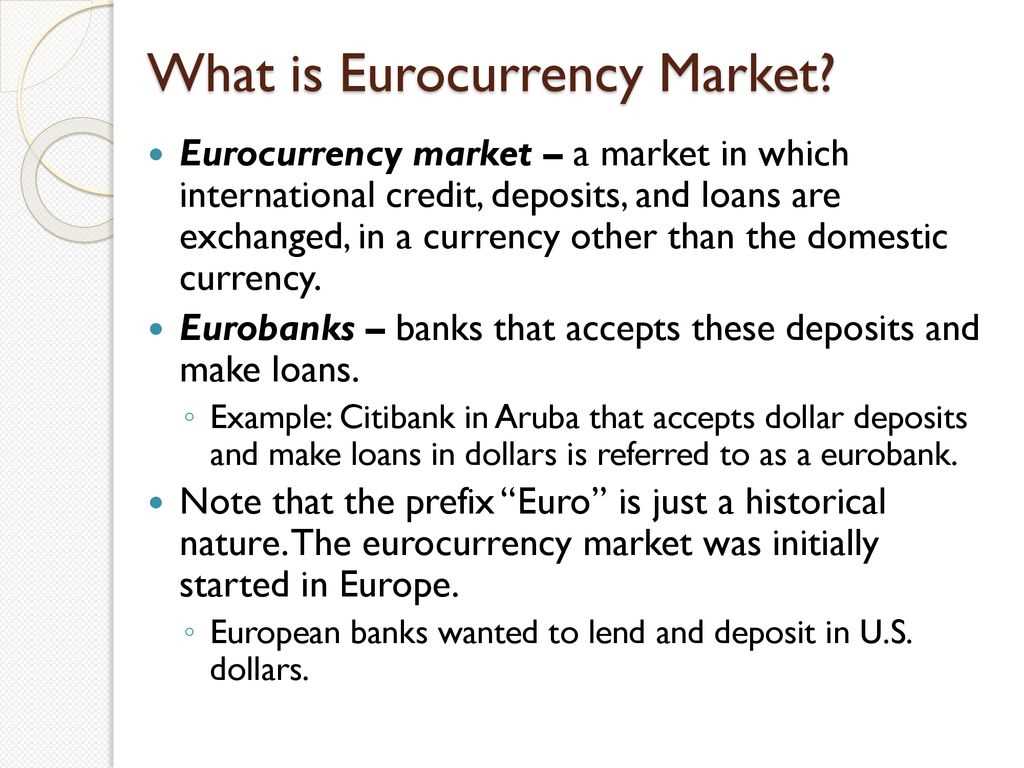

The Euromarket is primarily composed of Eurocurrency, which refers to any currency held outside its country of origin. Eurocurrency can be in the form of bank deposits, loans, or other financial instruments denominated in a currency other than the domestic currency. The most common Eurocurrencies include the Eurodollar (U.S. dollars held outside the United States), the Euroyen (Japanese yen held outside Japan), and the Eurosterling (British pounds held outside the United Kingdom).

The Euromarket operates through a network of financial institutions, including commercial banks, investment banks, and other financial intermediaries. These institutions facilitate the borrowing and lending of Eurocurrency by connecting borrowers and lenders from different countries. The transactions in the Euromarket are typically conducted through bilateral agreements, where the terms and conditions are negotiated directly between the parties involved.

In addition to providing access to foreign currencies, the Euromarket also serves as a platform for managing foreign exchange risk. Companies and individuals can use the Euromarket to hedge against fluctuations in exchange rates by entering into forward contracts or other derivative instruments. This helps to mitigate the potential impact of currency fluctuations on international trade and investments.

Historical Background of Euromarket

However, due to strict regulations and capital controls in place, European banks were unable to lend or invest these US dollars domestically. This led to the creation of the Euromarket, where US dollars held outside the United States could be freely traded and invested.

The Euromarket initially started in London, as it was a financial hub with a well-established banking system and a favorable regulatory environment. European banks began accepting US dollar deposits from non-US residents, which could then be used to finance international trade and investments.

Over time, the Euromarket expanded beyond London and became a global phenomenon. It allowed for the free flow of capital across borders, bypassing domestic regulations and restrictions. This made it attractive for multinational corporations, governments, and financial institutions to conduct their business in US dollars outside the United States.

The Euromarket played a crucial role in the development of international finance and the globalization of capital markets. It facilitated the growth of offshore banking and the emergence of new financial instruments, such as Eurobonds and Eurocurrency loans.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.