What is Engel’s Law?

Engel’s Law is an economic theory that states that as a person’s income increases, the proportion of their income spent on food decreases. This law was proposed by Ernst Engel, a German statistician, in the 19th century. Engel’s Law is based on the observation that as people’s income rises, they tend to allocate a smaller percentage of their budget to food and a larger percentage to other goods and services.

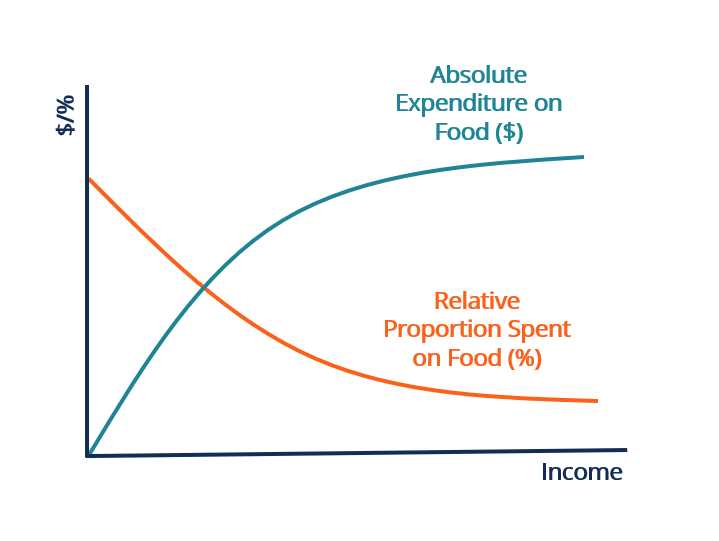

According to Engel’s Law, the percentage of income spent on food is inversely related to income. As income increases, the percentage spent on food decreases, while the percentage spent on other expenses, such as housing, transportation, and leisure activities, increases. This means that as people become wealthier, they have more disposable income to spend on non-food items.

Engel’s Law is often used to analyze the relationship between income and consumption patterns. It helps economists and policymakers understand how changes in income levels can impact consumer behavior and the overall economy. By studying Engel’s Law, economists can gain insights into income distribution, poverty levels, and the impact of economic policies on different income groups.

Explaining the Engel’s Law Curve

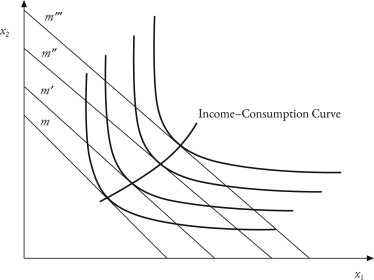

Engel’s Law is an economic theory that states that as income increases, the proportion of income spent on food decreases. This theory is represented by the Engel’s Law Curve, which shows the relationship between income and the percentage of income spent on food.

The Engel’s Law Curve is an upward-sloping curve that starts at the origin and gradually flattens out as income increases. This curve illustrates the idea that as income rises, people tend to spend a smaller percentage of their income on food.

At lower income levels, a larger proportion of income is spent on necessities such as food, while at higher income levels, a smaller proportion is allocated to food as people have more disposable income to spend on other goods and services.

The Engel’s Law Curve can vary depending on factors such as cultural differences, regional variations, and individual preferences. For example, in developing countries where food represents a larger portion of the budget, the curve may be steeper. In contrast, in developed countries where people have higher incomes and more diverse spending options, the curve may be flatter.

What is the Engel’s Law Coefficient?

The Engel’s Law coefficient is calculated by dividing the percentage change in expenditure for a particular category of goods or services by the percentage change in income. It provides a numerical value that represents the income elasticity of demand for that category. A positive coefficient indicates that the demand for that category increases as income increases, while a negative coefficient suggests that the demand decreases as income rises.

Interpreting the Engel’s Law Coefficient

The Engel’s Law coefficient can be interpreted in different ways depending on the value obtained. A coefficient close to 0 suggests that the category of goods or services is income-inelastic, meaning that changes in income have little effect on the proportion of income spent on it. A coefficient greater than 1 indicates that the category is income-elastic, meaning that changes in income have a significant impact on the proportion of income spent on it.

By analyzing the Engel’s Law coefficient for different categories of goods and services, individuals can gain insights into their spending habits and make adjustments to their budget accordingly. For example, if the coefficient for entertainment is high, it suggests that individuals may be spending a significant portion of their income on entertainment activities. In such cases, individuals can consider reducing their entertainment expenses to better manage their finances.

Lifestyle Advice for Managing Expenses

Managing expenses is an important aspect of maintaining a healthy financial life. By following some lifestyle advice, you can effectively control your spending and save money for future goals. Here are some tips to help you manage your expenses:

Create a Budget

Start by creating a budget that outlines your income and expenses. This will give you a clear picture of where your money is going and help you identify areas where you can cut back.

Track Your Expenses

Keep track of all your expenses, big and small. This will help you identify any unnecessary spending and make adjustments accordingly. Use a spreadsheet or a budgeting app to track your expenses easily.

Reduce Eating Out

Eating out can be expensive, so try to limit the number of times you eat at restaurants or order takeout. Instead, cook meals at home and pack your lunch for work. Not only will this save you money, but it will also allow you to eat healthier.

Shop Smart

When shopping for groceries or other items, compare prices and look for sales or discounts. Consider buying in bulk or using coupons to save money. Avoid impulse buying and stick to your shopping list.

Save on Utilities

Reduce your utility bills by being mindful of your energy usage. Turn off lights and appliances when not in use, unplug electronics that are not being used, and adjust your thermostat to save on heating and cooling costs.

Limit Entertainment Expenses

Entertainment can quickly add up, so find ways to enjoy yourself without spending too much. Look for free or low-cost activities in your community, such as parks, museums, or local events. Consider borrowing books or movies from the library instead of buying them.

Avoid Impulse Purchases

Before making a purchase, take some time to think about whether you really need it. Avoid impulse buying and give yourself a cooling-off period to evaluate if the purchase is necessary or if it can wait.

Set Financial Goals

Having clear financial goals can motivate you to save money and manage your expenses better. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, set specific goals and track your progress regularly.

By following these lifestyle advice tips, you can take control of your expenses and work towards a more secure financial future. Remember, small changes can add up over time and make a significant difference in your overall financial well-being.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.