EBIT/EV Multiple: Definition, Formula, Benefits, Example

The EBIT/EV multiple is a financial ratio used in fundamental analysis to evaluate the profitability and value of a company. It measures the relationship between a company’s earnings before interest and taxes (EBIT) and its enterprise value (EV).

Definition

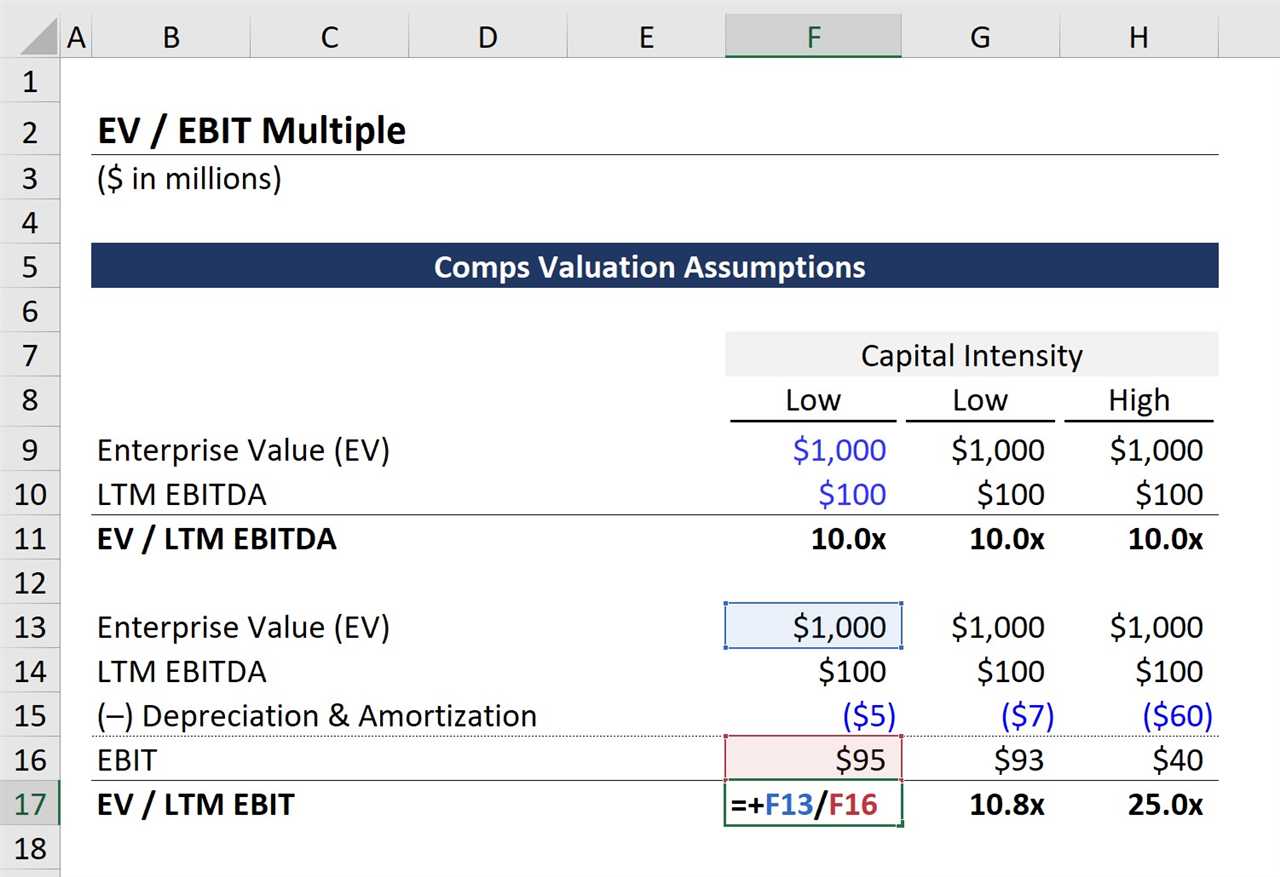

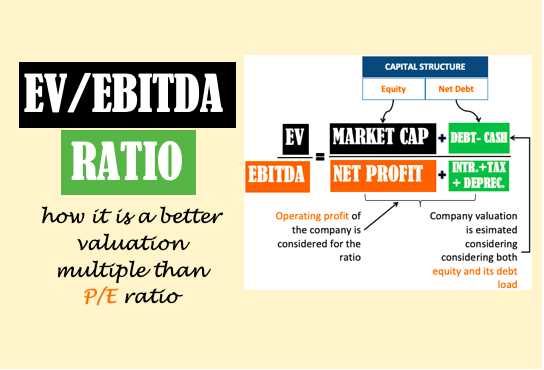

The EBIT/EV multiple is calculated by dividing a company’s EBIT by its EV. EBIT represents a company’s operating profit before considering interest and taxes, while EV is a measure of a company’s total value, including both its market capitalization and debt.

Formula

The formula for calculating the EBIT/EV multiple is as follows:

EBIT/EV Multiple = EBIT / EV

Benefits

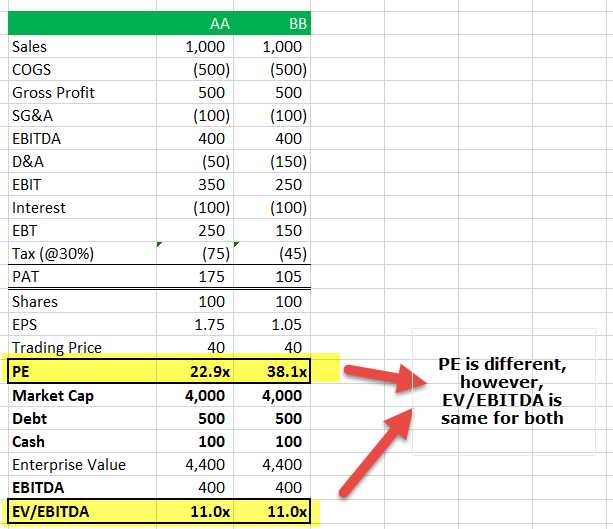

The EBIT/EV multiple provides investors and analysts with a useful tool for comparing the profitability and value of different companies within the same industry. By comparing the EBIT/EV multiples of similar companies, investors can identify potential investment opportunities and make informed decisions about which companies are undervalued or overvalued.

The EBIT/EV multiple also helps investors assess a company’s ability to generate earnings relative to its overall value. A higher EBIT/EV multiple indicates that a company is generating more earnings for each unit of its value, which suggests higher profitability and potential for growth.

Example

Let’s say Company A has an EBIT of $1 million and an EV of $10 million. The EBIT/EV multiple would be calculated as follows:

EBIT/EV Multiple = $1 million / $10 million = 0.1

This means that Company A has an EBIT/EV multiple of 0.1, indicating that it generates $0.10 of earnings for each dollar of its value.

By comparing this multiple to other companies in the industry, investors can gain insights into Company A’s profitability and value relative to its peers.

FUNDAMENTAL ANALYSIS

Fundamental analysis is a method used by investors to evaluate the intrinsic value of a company and its stock. It involves analyzing various factors such as financial statements, industry trends, and economic conditions to determine the true worth of a company.

Importance of Fundamental Analysis

Fundamental analysis is crucial for investors as it helps them make informed decisions about which stocks to buy or sell. By examining a company’s financial health, growth prospects, and competitive position, investors can identify undervalued stocks and avoid overvalued ones.

Some of the key benefits of fundamental analysis include:

- Identifying undervalued stocks: By analyzing a company’s financial statements, investors can determine if a stock is trading below its intrinsic value. This provides an opportunity to buy the stock at a discounted price and potentially earn profits when the market recognizes its true value.

- Evaluating growth prospects: Fundamental analysis helps investors assess a company’s growth potential by examining its revenue and earnings growth rates, as well as its market share. This information can be used to identify companies that are likely to experience future growth and generate higher returns.

- Assessing financial health: By analyzing a company’s financial statements, investors can evaluate its financial health and stability. This includes examining factors such as debt levels, liquidity ratios, and profitability margins. A financially healthy company is more likely to withstand economic downturns and generate consistent returns.

Conclusion

Fundamental analysis is a vital tool for investors looking to make informed decisions in the stock market. By examining a company’s financial statements, growth prospects, and competitive position, investors can identify undervalued stocks and avoid overvalued ones. This analysis provides valuable insights into a company’s true worth and helps investors make profitable investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.