Dynasty Trust: Definition, Purposes, How It Works, and Tax Rules

A dynasty trust is a powerful estate planning tool that allows individuals to pass on their wealth to future generations while minimizing estate taxes. This type of trust is designed to last for multiple generations, providing ongoing financial support and asset protection for the beneficiaries.

The primary purpose of a dynasty trust is to preserve family wealth and ensure its long-term growth. By placing assets into the trust, individuals can protect them from creditors, lawsuits, and other potential risks. Additionally, the trust can help maintain family harmony by establishing clear guidelines for the distribution of assets and minimizing potential conflicts among beneficiaries.

One key feature of a dynasty trust is that it can last for multiple generations. Unlike other types of trusts that have a limited duration, a dynasty trust can continue indefinitely, allowing wealth to be passed down from one generation to the next. This can provide financial security for future family members and ensure that the family’s legacy is preserved.

What is a Dynasty Trust?

A dynasty trust is a type of irrevocable trust that is designed to provide for multiple generations of a family. It allows for the transfer of wealth to future generations while minimizing estate taxes and protecting assets from creditors. Unlike other types of trusts, a dynasty trust can last for many generations, potentially indefinitely.

Purposes of a Dynasty Trust

The main purpose of a dynasty trust is to preserve and grow family wealth for future generations. By transferring assets into the trust, the grantor can ensure that their descendants will benefit from the trust’s income and assets for years to come. This can be especially beneficial for families with significant wealth, as it allows them to pass on their financial legacy while minimizing tax implications.

How Does a Dynasty Trust Work?

A dynasty trust is typically created by a grantor, who transfers assets into the trust. The grantor can specify the terms and conditions of the trust, including how the assets are to be managed and distributed. The trust is managed by a trustee, who is responsible for overseeing the trust’s operations and carrying out the grantor’s wishes.

The beneficiaries of a dynasty trust can include the grantor’s children, grandchildren, and future generations. The trust can be structured to provide for the beneficiaries’ needs, such as education, healthcare, and general support. The trust can also be set up to distribute income and assets at specific intervals or upon reaching certain milestones, such as reaching a certain age.

Tax Rules for Dynasty Trusts

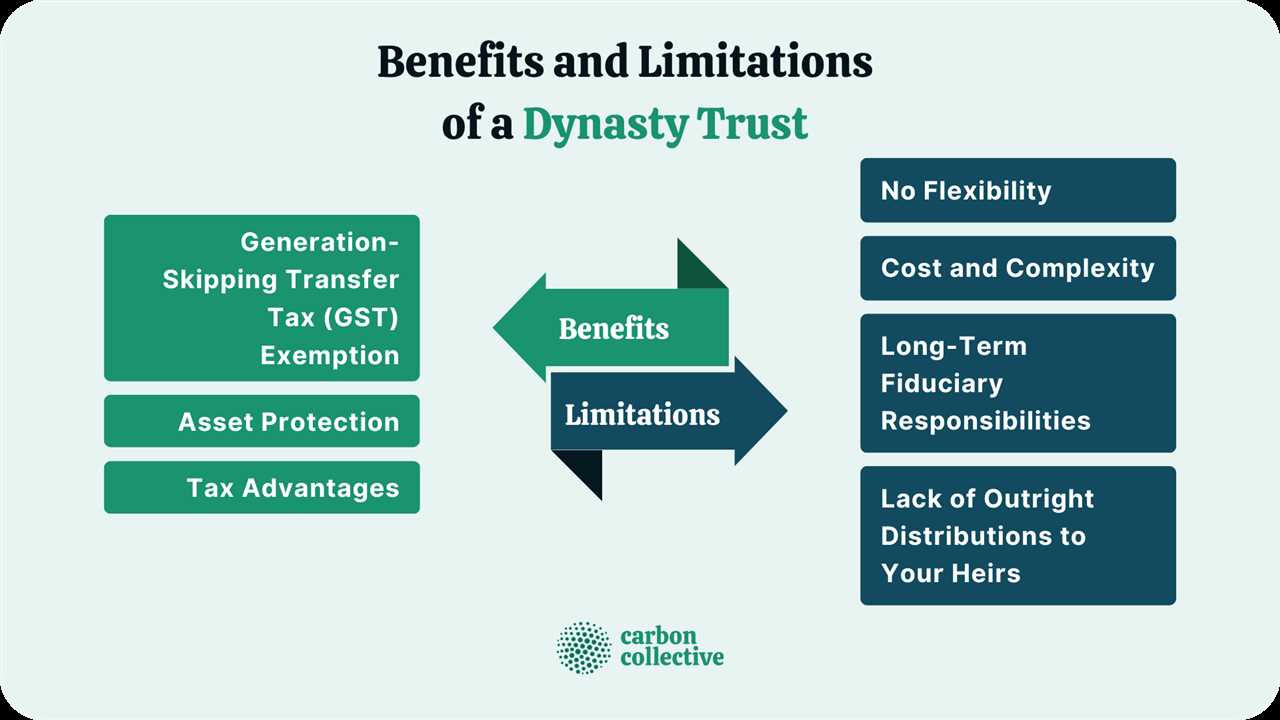

In addition, dynasty trusts can also provide tax advantages for the beneficiaries. Since the trust is considered a separate legal entity, the income generated by the trust is subject to its own tax rules. This can allow the beneficiaries to potentially pay lower taxes on the trust’s income compared to if they had received the assets directly.

Purposes of a Dynasty Trust

1. Wealth Preservation:

One of the main purposes of a dynasty trust is to preserve family wealth for multiple generations. By placing assets in a trust, individuals can ensure that their wealth is protected and can continue to grow over time. This is especially important for families with substantial assets who want to maintain their financial legacy for future generations.

2. Asset Protection:

A dynasty trust can also provide asset protection for beneficiaries. By keeping assets in a trust, individuals can shield them from potential creditors, lawsuits, and other financial risks. This can be particularly beneficial for beneficiaries who may not have the necessary financial knowledge or experience to manage large sums of money.

3. Estate Tax Minimization:

Another key purpose of a dynasty trust is to minimize estate taxes. By transferring assets to a trust, individuals can remove them from their taxable estate, reducing the overall estate tax liability. Additionally, because a dynasty trust is designed to last for multiple generations, it can take advantage of the generation-skipping transfer tax exemption, further reducing the tax burden on the family’s wealth.

4. Control and Flexibility:

A dynasty trust allows the grantor to maintain control over how their assets are distributed and managed. The grantor can specify the terms and conditions under which beneficiaries can access the trust funds, ensuring that the wealth is used in a responsible and beneficial manner. This level of control and flexibility can help protect the family’s financial legacy and prevent the dissipation of assets.

5. Charitable Giving:

In addition to benefiting future generations, a dynasty trust can also be used for charitable giving. The grantor can include provisions in the trust that allow for the distribution of funds to charitable organizations or causes that are important to them. This allows the family to leave a lasting philanthropic legacy and support causes that align with their values.

How Does a Dynasty Trust Work?

Creating a Dynasty Trust

One key feature of a dynasty trust is that it is designed to last for multiple generations. Unlike other types of trusts that have a limited lifespan, a dynasty trust can continue indefinitely, allowing wealth to be preserved and passed down through the family line.

Asset Protection and Tax Benefits

A dynasty trust provides significant asset protection for the beneficiaries. Because the trust is irrevocable, the assets are no longer considered part of the grantor’s estate and are protected from creditors. This can be especially beneficial in situations where beneficiaries may be at risk of lawsuits or other financial challenges.

In addition to asset protection, a dynasty trust offers substantial tax benefits. By transferring assets to the trust, the grantor can remove them from their taxable estate, reducing estate taxes. The assets in the trust can also grow and generate income without being subject to income taxes, allowing for further wealth accumulation.

Control and Flexibility

While the grantor cannot have direct control over the assets in a dynasty trust, they can still maintain a level of control and flexibility through the trust’s terms. The grantor can specify how and when distributions are made to beneficiaries, ensuring that the wealth is used in accordance with their wishes. This can include provisions for education, healthcare, and other specific needs.

Succession Planning

A dynasty trust is an excellent tool for succession planning, as it allows for the seamless transfer of wealth from one generation to the next. By establishing a dynasty trust, individuals can ensure that their family’s financial legacy is preserved and protected for future generations.

Overall, a dynasty trust offers numerous benefits for individuals looking to pass on wealth to future generations while minimizing taxes and protecting assets. Consulting with an experienced estate planning attorney is crucial to ensure that a dynasty trust is properly structured and aligned with the individual’s goals and objectives.

Tax Rules for Dynasty Trusts

1. Generation-Skipping Transfer Tax

One of the main tax considerations for dynasty trusts is the generation-skipping transfer (GST) tax. This tax is imposed on transfers of wealth that skip a generation, such as when assets are passed directly to grandchildren or great-grandchildren.

The GST tax is designed to prevent individuals from avoiding estate taxes by transferring assets to future generations without incurring any tax liability. However, dynasty trusts can be structured in a way that minimizes or eliminates the GST tax.

2. Estate and Gift Taxes

In addition to the GST tax, dynasty trusts are also subject to estate and gift taxes. These taxes are imposed on the transfer of assets during an individual’s lifetime or at their death.

By utilizing a dynasty trust, individuals can transfer assets to future generations while minimizing the impact of estate and gift taxes. This is because the assets held in the trust are not considered part of the grantor’s estate and are therefore not subject to estate taxes upon their death.

3. Income Taxes

Another important tax consideration for dynasty trusts is income taxes. The income generated by the assets held in the trust may be subject to income taxes, depending on how the trust is structured.

It is important to carefully consider the tax implications of the trust’s investment strategy and distribution policies in order to minimize the overall tax burden on the trust and its beneficiaries.

Overall, dynasty trusts offer significant tax advantages for individuals looking to transfer wealth to future generations. However, it is important to work with a qualified estate planning attorney or tax advisor to ensure that the trust is structured in a way that maximizes these tax benefits.

Trust & Estate Planning: Dynasty Trust Category

A dynasty trust is a powerful estate planning tool that allows individuals to pass wealth down through multiple generations while minimizing estate taxes. This type of trust is designed to last for many generations, providing financial security and asset protection for the beneficiaries.

Definition of a Dynasty Trust

A dynasty trust is a type of irrevocable trust that is created to hold and manage assets for the benefit of multiple generations. Unlike other types of trusts, a dynasty trust does not have a limited lifespan and can continue for hundreds of years. This allows the trust to accumulate wealth and provide ongoing financial support to future generations.

Purposes of a Dynasty Trust

The main purpose of a dynasty trust is to preserve wealth for future generations. By placing assets in a dynasty trust, individuals can ensure that their wealth will be protected and distributed according to their wishes. Additionally, a dynasty trust can provide asset protection from creditors, lawsuits, and divorces, ensuring that the beneficiaries are financially secure.

Another important purpose of a dynasty trust is to minimize estate taxes. By transferring assets to a dynasty trust, individuals can remove them from their taxable estate, reducing the amount of estate tax that will be owed upon their death. This can result in significant tax savings for the family.

How Does a Dynasty Trust Work?

Tax Rules for Dynasty Trusts

Dynasty trusts offer significant tax benefits. One of the main advantages is the ability to transfer assets out of the grantor’s taxable estate, reducing estate taxes. Additionally, any income generated by the trust is not subject to income tax at the grantor’s tax rate. Instead, the income is taxed at the trust’s tax rate, which may be lower.

Another tax advantage of a dynasty trust is the ability to allocate the generation-skipping transfer tax exemption. This exemption allows individuals to transfer a certain amount of assets to future generations without incurring additional taxes. By utilizing this exemption, individuals can transfer a substantial amount of wealth to their grandchildren and beyond, while minimizing tax consequences.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.