What is a Diversified Company?

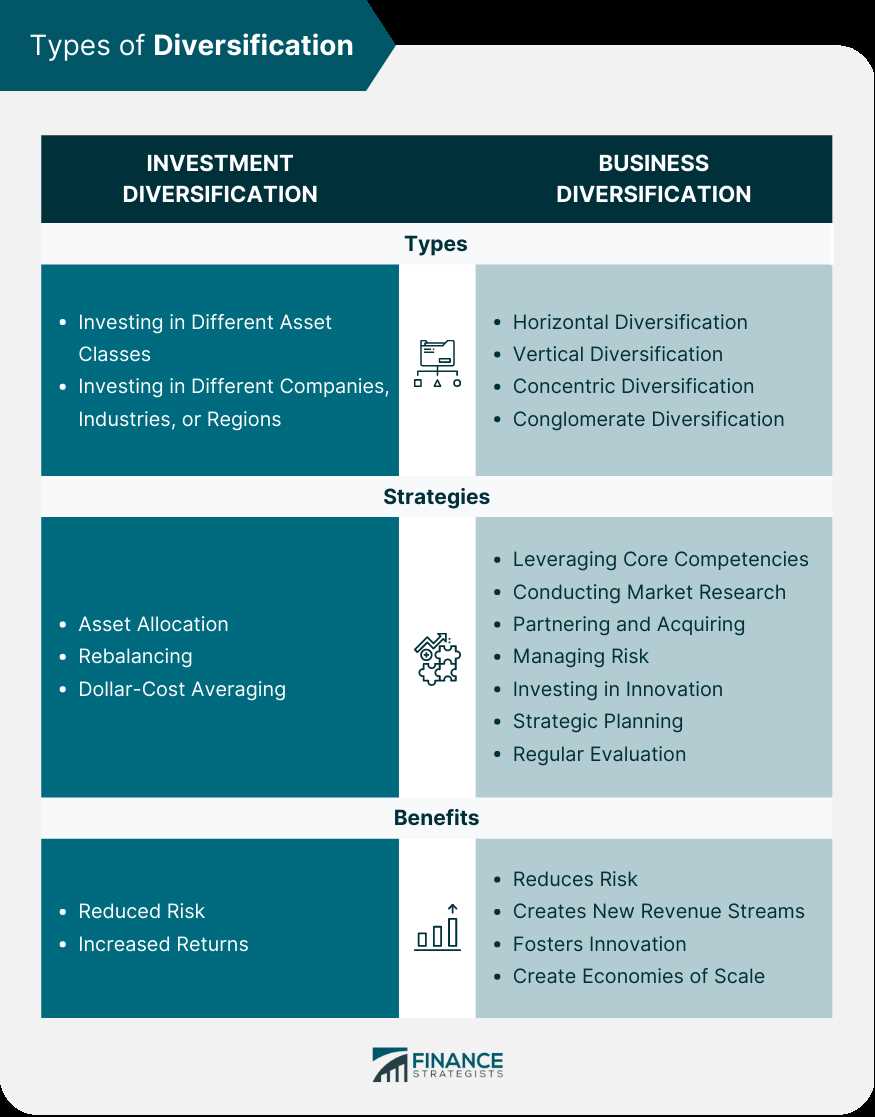

A diversified company is a business that operates in multiple industries or markets, offering a range of products or services. It is characterized by its ability to manage and leverage its diverse portfolio to mitigate risks and capitalize on opportunities.

A diversified company typically has different divisions or business units, each focused on a specific industry or market segment. These divisions may operate independently or collaboratively, depending on the company’s strategic goals and objectives.

Benefits of a Diversified Company

There are several benefits associated with being a diversified company:

- Risk Reduction: By operating in multiple industries or markets, a diversified company can spread its risks. If one industry or market experiences a downturn, the company can rely on its other divisions to offset the losses.

- Revenue Stability: Diversification allows a company to generate revenue from multiple sources. This can help stabilize its financial performance, as it is not solely reliant on the success of one product or market.

- Opportunity for Growth: A diversified company can identify and capitalize on growth opportunities in different industries or markets. It can leverage its existing resources, expertise, and customer base to expand into new areas.

- Synergies and Cost Savings: By sharing resources and capabilities across its divisions, a diversified company can achieve synergies and cost savings. This can lead to improved efficiency and profitability.

Downsides of a Diversified Company

While there are benefits to being a diversified company, there are also potential downsides:

- Complexity: Managing a diverse portfolio of businesses can be complex and challenging. It requires strong leadership, strategic planning, and effective coordination between divisions.

- Risk of Poor Performance: If one division of a diversified company performs poorly, it can have a negative impact on the overall financial performance of the company.

- Resource Allocation: Allocating resources among different divisions can be a complex task. It requires careful consideration of each division’s needs and priorities to ensure optimal resource allocation.

A diversified company is one that operates in multiple industries or markets, with the goal of spreading risk and maximizing opportunities for growth. However, not all companies that operate in multiple industries can be considered truly diversified. There are certain criteria that a company must meet in order to be classified as diversified.

Firstly, a diversified company should have a presence in at least two different industries. This means that it is involved in the production or provision of goods or services in more than one sector. For example, a company that manufactures both electronics and automobiles would be considered diversified.

Secondly, a diversified company should have a significant portion of its revenue coming from each industry it operates in. This means that it is not simply dabbling in different industries, but rather has a substantial presence and investment in each sector. The exact percentage of revenue required may vary, but generally, a company should have a balanced revenue stream across its different industries.

Thirdly, a diversified company should have a separate management team and resources for each industry it operates in. This means that it has dedicated personnel and infrastructure for each sector, rather than trying to manage everything under one umbrella. This allows for focused attention and expertise in each industry, which can lead to better performance and decision-making.

Lastly, a diversified company should have a clear strategy for each industry it operates in. This means that it has identified the unique opportunities and challenges in each sector, and has developed specific plans and goals for each industry. This ensures that the company is not simply spreading itself thin, but rather leveraging its diversification to create value and competitive advantage in each market.

Key Criteria for a Diversified Company

A diversified company is characterized by its ability to operate in multiple industries or markets simultaneously. This diversification can bring numerous benefits, but it also requires certain criteria to be met in order for the company to be successful. Here are some key criteria that a diversified company should consider:

1. Market Opportunities: A diversified company should identify and target attractive market opportunities in different industries. This requires thorough market research and analysis to understand the potential for growth and profitability.

2. Core Competencies: The company should have a strong foundation of core competencies that can be leveraged across different industries. These core competencies can include technological expertise, operational efficiency, marketing capabilities, or strong customer relationships.

3. Resource Allocation: Proper allocation of resources is crucial for a diversified company. It should have the ability to allocate capital, human resources, and other assets effectively across different business units to maximize overall performance.

4. Risk Management: Diversification can help mitigate risks by spreading them across different industries. However, a diversified company should have effective risk management strategies in place to identify, assess, and mitigate potential risks associated with each business unit.

5. Synergies: A diversified company should seek to create synergies between its different business units. This can be achieved through cross-selling opportunities, shared resources, or knowledge transfer. Synergies can enhance operational efficiency, reduce costs, and improve overall performance.

6. Flexibility and Adaptability: The ability to adapt to changing market conditions and industry trends is essential for a diversified company. It should have a flexible organizational structure and a culture of innovation to respond quickly to new opportunities or challenges.

7. Strategic Focus: Despite operating in multiple industries, a diversified company should maintain a clear strategic focus. It should have a well-defined mission, vision, and set of strategic objectives that guide its decision-making process and ensure alignment across different business units.

8. Leadership and Management: Strong leadership and effective management are crucial for the success of a diversified company. The leadership team should have the ability to navigate complex business environments, make strategic decisions, and foster collaboration and synergy among different business units.

9. Performance Measurement: A diversified company should establish clear performance metrics and measurement systems to monitor the performance of each business unit and the overall company. This allows for timely identification of issues and the implementation of corrective actions.

10. Continuous Learning and Improvement: A diversified company should have a culture of continuous learning and improvement. It should encourage knowledge sharing, innovation, and the adoption of best practices across different business units to drive growth and competitiveness.

By considering these key criteria, a diversified company can increase its chances of success and achieve sustainable growth in multiple industries.

Benefits of a Diversified Company:

1. Risk Reduction: One of the main advantages of a diversified company is that it can help reduce risk. By operating in multiple industries, the company is less vulnerable to economic downturns or changes in a specific market. If one sector is performing poorly, the company can rely on other sectors to offset the losses.

2. Increased Stability: Diversification can provide stability to a company’s financial performance. When one sector is experiencing a decline, other sectors may be thriving, balancing out the overall performance of the company. This stability can help the company weather economic uncertainties and maintain profitability.

3. Synergy and Cross-Selling Opportunities: A diversified company can leverage synergies between its different business units. For example, a company that operates in both the automotive and energy sectors can benefit from sharing technology, resources, and knowledge between the two divisions. Additionally, cross-selling opportunities may arise, allowing the company to offer complementary products or services to its customers.

4. Competitive Advantage: Diversification can give a company a competitive advantage over its competitors. By operating in multiple industries, the company can gain a broader customer base and reach a larger market. This can lead to increased brand recognition, economies of scale, and improved bargaining power with suppliers.

Downsides of a Diversified Company:

1. Complexity and Management Challenges: Managing a diversified company can be complex and challenging. Each industry or sector may have its own unique characteristics, regulations, and market dynamics. This can require different strategies, resources, and expertise, making it difficult to effectively manage all areas of the business.

2. Lack of Focus: Diversification can sometimes lead to a lack of focus within the company. With multiple business units and industries to manage, it can be challenging to allocate resources and attention effectively. This lack of focus may result in suboptimal performance or missed opportunities in certain sectors.

3. Capital Intensive: Diversification often requires significant capital investments. Expanding into new industries or acquiring businesses in different sectors can be costly. This can strain the company’s financial resources and limit its ability to invest in other areas or pursue growth opportunities.

4. Limited Expertise: Operating in multiple industries may require expertise in various fields. A diversified company may need to hire or develop talent with diverse skill sets to effectively manage each business unit. This can be challenging and time-consuming, especially if the company lacks the necessary expertise in certain sectors.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.