What is BATNA and Why is it Important in Corporate Finance?

In corporate finance, BATNA stands for Best Alternative to a Negotiated Agreement. It refers to the course of action that a party can take if the current negotiation does not result in a satisfactory agreement. BATNA is an important concept in corporate finance because it helps parties assess their options and make informed decisions during negotiations.

How BATNA Can Lead to Successful Outcomes

Having a strong BATNA can significantly increase the chances of achieving successful outcomes in negotiations. When parties have a viable alternative to a negotiated agreement, they are less dependent on reaching an agreement with the other party. This reduces the likelihood of making concessions that may be unfavorable.

Furthermore, a strong BATNA provides parties with leverage during negotiations. If one party has a more favorable alternative, they can negotiate from a position of strength and potentially secure more favorable terms. This can lead to win-win outcomes where both parties feel satisfied with the agreement.

Factors to Consider when Determining BATNA

When determining their BATNA, parties should consider several factors. These include the feasibility and viability of the alternative options, the potential costs and benefits associated with each option, and the potential impact on the relationship with the other party. It is also important to consider the time and resources required to pursue the alternative options.

By carefully considering these factors, parties can assess the strength of their BATNA and make informed decisions during negotiations. This can help them achieve more favorable outcomes and protect their interests.

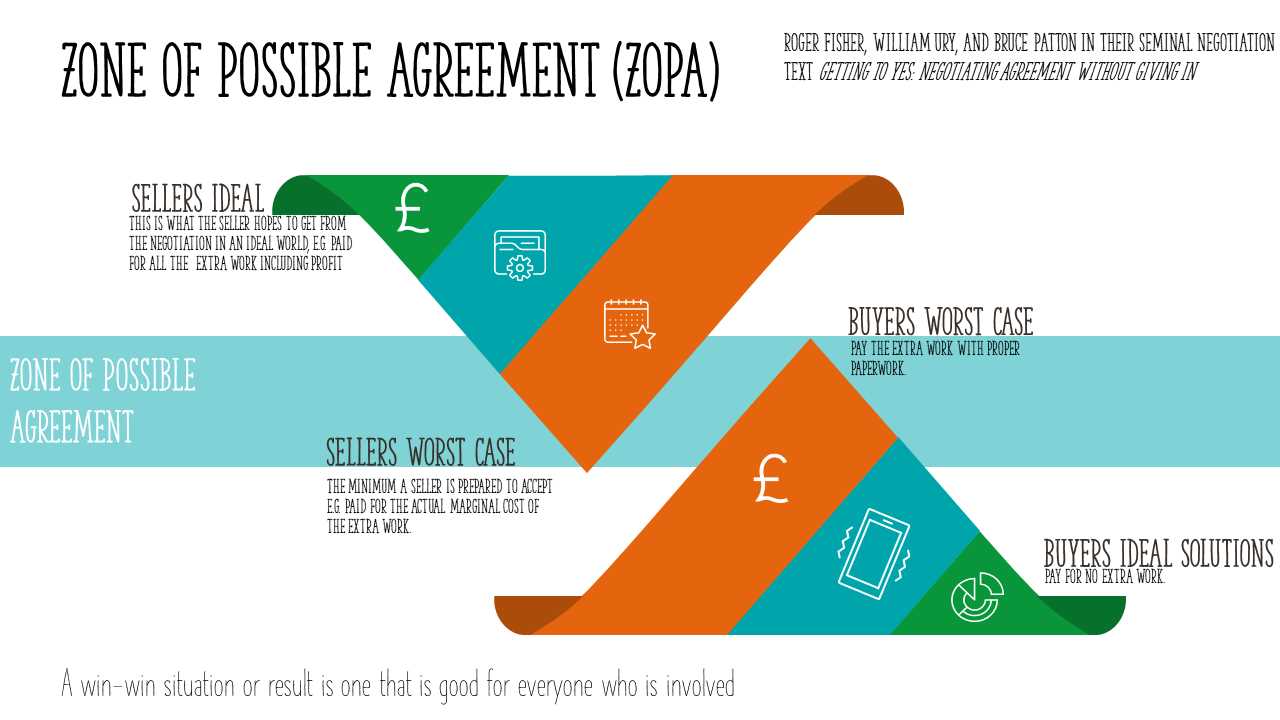

In corporate finance, BATNA stands for Best Alternative to a Negotiated Agreement. It is a term coined by Roger Fisher and William Ury in their book “Getting to Yes: Negotiating Agreement Without Giving In”. BATNA refers to the course of action that a party can take if the current negotiation or agreement fails to meet their needs or expectations.

Importance of BATNA in Corporate Finance

BATNA is particularly important in corporate finance as it helps businesses evaluate the potential outcomes of a negotiation or agreement. It provides a benchmark against which the proposed terms can be measured. If the terms of the agreement are not better than the BATNA, it may be more beneficial to pursue alternative options.

Having a strong BATNA also increases your negotiating power. It gives you leverage and allows you to set limits and walk away from unfavorable agreements. This can help prevent businesses from entering into agreements that may be detrimental to their financial well-being.

Factors to Consider when Determining BATNA

There are several factors to consider when determining your BATNA:

- Identify your alternatives: Start by identifying all possible alternatives to the current negotiation or agreement. This could include seeking other potential partners, exploring different financing options, or even pursuing independent growth strategies.

- Evaluate the feasibility: Assess the feasibility of each alternative option. Consider factors such as costs, timeframes, resources required, and potential risks involved. This evaluation will help you determine the viability of each alternative.

- Assess the potential outcomes: Analyze the potential outcomes of each alternative option. Consider the financial implications, strategic alignment, and long-term sustainability of each option. This assessment will help you determine the value and attractiveness of each alternative.

- Consider the risks: Evaluate the risks associated with each alternative option. Identify potential obstacles, uncertainties, and potential downsides. This risk assessment will help you make informed decisions and mitigate potential risks.

How BATNA Can Lead to Successful Outcomes

One of the main reasons why BATNA is important in corporate finance is because it gives you leverage during the negotiation process. When you have a strong BATNA, you have the confidence to walk away from a deal that doesn’t meet your needs or objectives. This puts you in a position of power and allows you to negotiate from a position of strength.

Having a well-defined BATNA also helps to prevent you from making concessions that are not in your best interest. It provides you with a clear benchmark against which you can evaluate the proposed agreement. If the proposed agreement falls short of your BATNA, you know that it is not the best option for you and can confidently reject it.

Furthermore, having a strong BATNA can help to improve the overall quality of the negotiated agreement. When both parties know that there are viable alternatives available, they are more likely to make reasonable concessions and strive for a mutually beneficial outcome. This can lead to a more balanced and fair agreement that satisfies the interests of both parties.

However, it is important to note that the success of your BATNA depends on how well you have prepared and researched your alternatives. It is crucial to identify and evaluate potential alternatives before entering into negotiations. This includes considering factors such as cost, timing, and feasibility.

Factors to Consider when Determining BATNA

When determining your Best Alternative to a Negotiated Agreement (BATNA) in corporate finance, there are several factors that need to be taken into consideration. These factors can greatly impact the success of your negotiation strategy and the outcome of the deal.

2. Industry Trends: It is crucial to consider the trends and developments in your industry. This includes technological advancements, regulatory changes, and shifts in consumer preferences. By staying updated on industry trends, you can identify potential alternative solutions that align with the changing landscape.

5. Relationships and Networks: Consider the relationships and networks you have built within your industry. This includes suppliers, customers, and strategic partners. Leveraging these relationships can provide you with alternative options and potential collaborations that can enhance your BATNA.

By considering these factors when determining your BATNA, you can develop a comprehensive and effective negotiation strategy. This will increase your chances of achieving successful outcomes in corporate finance deals.

Examples of Successful BATNA Strategies in Corporate Finance

| Example | Description |

|---|---|

| 1 | Exploring other potential investors |

| 2 | Considering alternative financing options |

| 3 | Seeking partnerships or joint ventures |

| 4 | Exploring mergers or acquisitions |

| 5 | Considering divestment or asset sales |

| 6 | Exploring international markets |

One successful BATNA strategy is to explore other potential investors. This can be done by reaching out to different investors who may be interested in the company or project. By having multiple potential investors, a company can increase its bargaining power and potentially secure a better deal.

Another successful BATNA strategy is to consider alternative financing options. This can include exploring different types of financing, such as debt financing or equity financing, or even crowdfunding. By considering alternative financing options, a company can have more flexibility in negotiations and potentially secure more favorable terms.

Seeking partnerships or joint ventures is also a successful BATNA strategy. By partnering with another company, a company can leverage the strengths and resources of both parties to achieve mutual benefits. This can include sharing costs, accessing new markets, or combining expertise.

Exploring mergers or acquisitions is another successful BATNA strategy. By considering the possibility of merging with or acquiring another company, a company can expand its market presence, gain access to new technologies or products, and potentially achieve economies of scale.

Considering divestment or asset sales is a successful BATNA strategy when a company is looking to reduce its risk or focus on core operations. By divesting non-core assets or selling off underperforming divisions, a company can streamline its operations and potentially improve its financial position.

Lastly, exploring international markets can be a successful BATNA strategy for companies looking to expand their reach. By entering new markets, a company can tap into new customer bases, access new resources, and potentially achieve higher growth rates.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.