Dependent Care Benefits Explained

Dependent care benefits are an important aspect of employee compensation that can greatly assist working parents in managing the costs of childcare. These benefits are typically offered by employers as a way to support their employees in balancing work and family responsibilities.

Dependent care benefits can come in various forms, such as flexible spending accounts (FSAs), employer-provided childcare, or subsidies for childcare expenses. The specific details and availability of these benefits may vary depending on the employer and the country in which they operate.

One of the main purposes of dependent care benefits is to help alleviate the financial burden of childcare expenses. By providing assistance or subsidies, employers can help employees afford quality childcare services, allowing them to focus on their work without worrying about the well-being of their children.

Dependent care benefits also contribute to employee satisfaction and retention. Working parents often face challenges in finding reliable and affordable childcare options. By offering these benefits, employers can attract and retain talented employees who value the support provided by their organization.

It is important for employees to understand the eligibility criteria and limitations of dependent care benefits. Typically, these benefits are available to employees with dependent children under a certain age, although some employers may extend coverage to other dependents, such as elderly parents. Employees should consult their employer’s policies and guidelines to determine their eligibility.

| Benefits of Dependent Care Benefits: |

|---|

| Financial assistance for childcare expenses |

| Improved work-life balance for working parents |

| Increased employee satisfaction and retention |

| Support for employees in managing family responsibilities |

Dependent care benefits refer to the assistance provided by employers to their employees to help them cover the costs of caring for their dependents, such as children, elderly parents, or disabled family members. These benefits are designed to alleviate the financial burden and stress associated with finding and paying for quality care for dependents.

Dependent care benefits can take various forms, including employer-provided daycare facilities, subsidies for childcare expenses, flexible spending accounts (FSAs), and tax credits. These benefits are typically offered as part of an employee’s overall compensation package and can vary depending on the employer’s policies and the employee’s specific needs.

One of the most common forms of dependent care benefits is employer-provided daycare facilities or subsidies. These can include on-site daycare centers or partnerships with local daycare providers to offer discounted rates to employees. By providing access to affordable and convenient childcare options, employers can help their employees balance their work and family responsibilities more effectively.

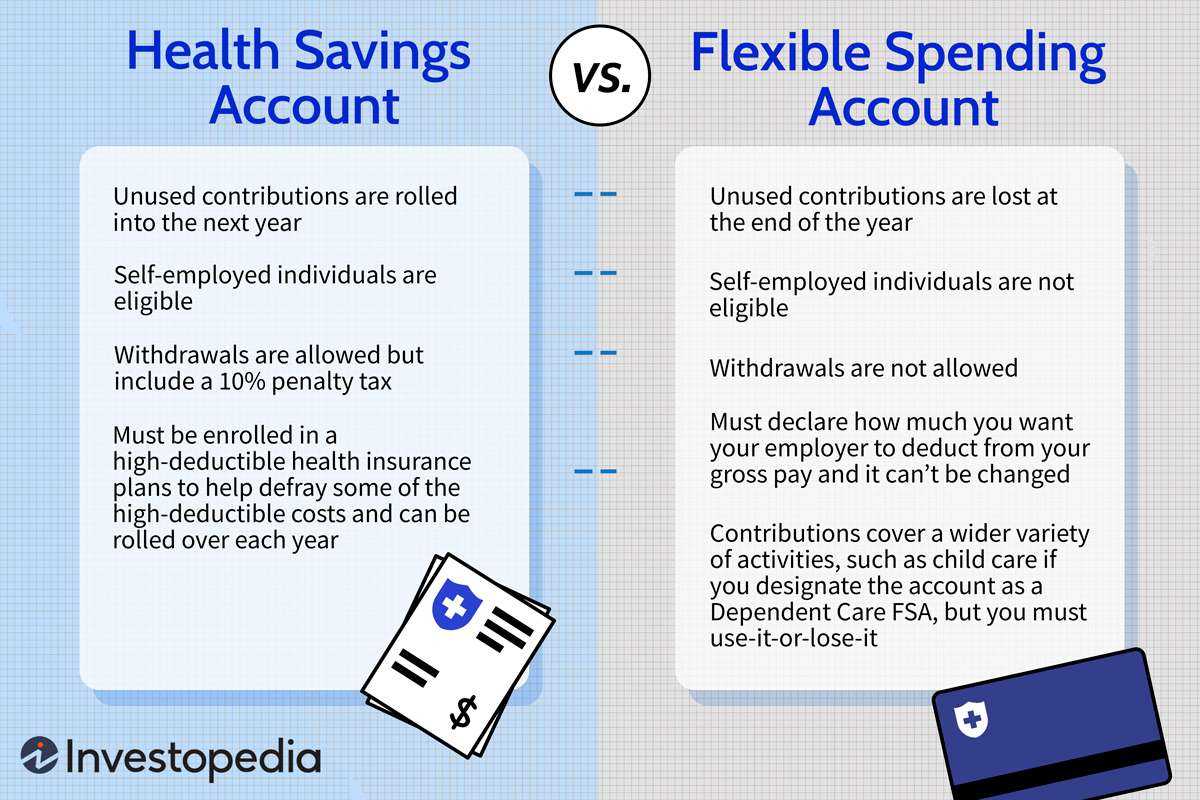

Flexible spending accounts (FSAs) are another popular form of dependent care benefits. These accounts allow employees to set aside a portion of their pre-tax income to cover eligible dependent care expenses. This can include expenses such as daycare, after-school programs, summer camps, and even eldercare. By using pre-tax dollars, employees can save on their overall tax liability and reduce their out-of-pocket costs for dependent care.

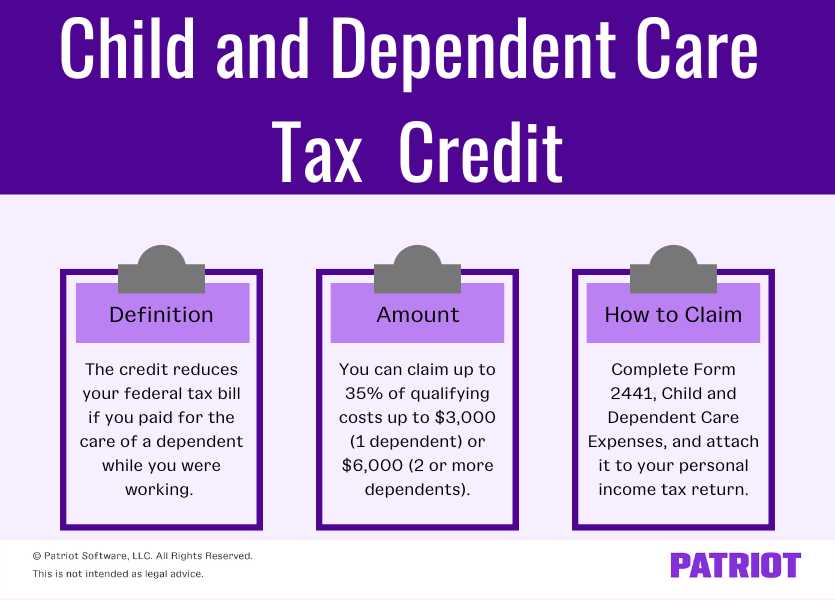

In addition to employer-provided benefits, there are also tax credits available to individuals who incur dependent care expenses. The Child and Dependent Care Credit (CDCC) is a federal tax credit that allows eligible taxpayers to claim a percentage of their qualifying expenses, up to certain limits. This credit can help offset the costs of dependent care and provide additional financial relief to families.

Overall, dependent care benefits play a crucial role in supporting employees and their families. By providing assistance with the costs of dependent care, employers can help reduce stress and improve work-life balance for their employees. This, in turn, can lead to increased employee satisfaction, productivity, and retention rates.

How Dependent Care Benefits Work

Dependent care benefits are a valuable resource for employees who have dependents, such as children or elderly parents, that require care while they are at work. These benefits are typically offered by employers as part of their overall compensation package, and they can help alleviate the financial burden of finding and paying for quality care.

Dependent care benefits can take different forms, but the most common is a dependent care flexible spending account (DCFSA). This account allows employees to set aside a certain amount of pre-tax dollars from their paycheck to be used for eligible dependent care expenses. These expenses can include daycare, preschool, before and after school programs, summer camps, and even in-home care.

When an employee enrolls in a DCFSA, they determine how much money they want to contribute to the account each pay period. This amount is deducted from their paycheck before taxes are taken out, which can result in significant tax savings. The money in the account can then be used to pay for eligible dependent care expenses throughout the year.

In order to access the funds in their DCFSA, employees typically submit a claim form or use a debit card provided by the plan administrator. The claim form requires documentation, such as receipts or invoices, to prove that the expenses were for eligible dependent care. Once the claim is approved, the funds are either reimbursed to the employee or paid directly to the care provider.

Overall, dependent care benefits are a valuable tool for employees who need assistance with the cost of caring for their dependents. By taking advantage of these benefits, employees can save money on their taxes and ensure that their loved ones receive the quality care they deserve.

The Importance of Dependent Care Benefits

Dependent care benefits play a crucial role in supporting working parents and caregivers by providing financial assistance for the care of their dependents. These benefits help alleviate the financial burden associated with child or elder care, allowing employees to focus on their work without worrying about the well-being of their loved ones.

One of the key benefits of dependent care benefits is that they enable employees to access quality care services for their dependents. This can include daycare centers, after-school programs, in-home care, or even summer camps. By providing financial assistance, employers make it easier for their employees to find and afford reliable care options, ensuring that their dependents are in safe and nurturing environments.

Dependent care benefits also contribute to the overall well-being and productivity of employees. When employees have access to reliable and affordable care for their dependents, they experience less stress and can focus better on their work responsibilities. This leads to increased job satisfaction, higher employee morale, and improved productivity in the workplace.

In addition to supporting working parents and caregivers, dependent care benefits also promote diversity and inclusion in the workforce. By offering these benefits, employers demonstrate their commitment to creating a supportive and inclusive work environment that values the needs of all employees. This can help attract and retain top talent, particularly individuals who prioritize work-life balance and family-friendly policies.

Furthermore, dependent care benefits can have a positive impact on employee retention and loyalty. When employees feel supported in balancing their work and family responsibilities, they are more likely to stay with their current employer and remain committed to their roles. This reduces turnover rates and the associated costs of hiring and training new employees.

Overall, dependent care benefits are essential for creating a work environment that values the well-being of employees and their families. By providing financial assistance for dependent care, employers can support their employees in achieving a healthy work-life balance, improving job satisfaction, and promoting a diverse and inclusive workforce.

Eligibility for Dependent Care Benefits

Dependent care benefits are designed to assist employees in managing the costs of caring for their dependents, such as children or elderly parents. However, not all employees are eligible for these benefits. Eligibility criteria vary depending on the employer and the specific benefit program. Here are some common factors that determine eligibility for dependent care benefits:

Employment Status

Typically, only full-time employees are eligible for dependent care benefits. Part-time employees may not be eligible or may have limited access to these benefits. Employers may have specific requirements regarding the number of hours worked per week or the duration of employment to qualify for these benefits.

Dependent Status

Dependent care benefits are intended for employees who have dependents that require care. The definition of dependents may vary, but it usually includes children under a certain age and elderly parents or disabled family members who rely on the employee for care. Employers may require documentation or proof of dependent status to determine eligibility.

Income Level

Some employers may have income restrictions for employees to be eligible for dependent care benefits. These restrictions are in place to ensure that the benefits are provided to those who truly need assistance with dependent care expenses. Employees may need to provide proof of income or complete a financial assessment to determine eligibility.

Benefit Program Enrollment

Employees may need to enroll in their employer’s dependent care benefit program to be eligible for the benefits. This typically involves completing enrollment forms and providing necessary documentation. It is important for employees to be aware of the enrollment period and any deadlines to ensure they do not miss out on the opportunity to access these benefits.

Employer Policies

Each employer may have specific policies and guidelines regarding eligibility for dependent care benefits. It is important for employees to review their employer’s policies or consult with the human resources department to understand the eligibility requirements and any additional criteria that may apply.

| Eligibility Factors | Explanation |

|---|---|

| Employment Status | Determines if full-time employees are eligible for dependent care benefits. |

| Dependent Status | Determines if employees have dependents that require care. |

| Income Level | Some employers may have income restrictions for eligibility. |

| Benefit Program Enrollment | Employees may need to enroll in their employer’s program to be eligible. |

| Employer Policies | Each employer may have specific policies regarding eligibility. |

It is important for employees to understand the eligibility criteria for dependent care benefits to ensure they can take advantage of these valuable benefits. By meeting the necessary requirements and enrolling in the appropriate program, employees can receive financial assistance in managing the costs of caring for their dependents.

Maximizing Dependent Care Benefits

- Research available options: Start by researching the dependent care benefits offered by your employer. Understand the types of services covered, the eligibility criteria, and any limitations or restrictions.

- Plan ahead: Take the time to plan your dependent care needs in advance. Consider your work schedule, your child’s school or daycare schedule, and any other commitments. This will help you determine the amount of care needed and make informed decisions.

- Utilize flexible spending accounts: If your employer offers a dependent care flexible spending account (FSA), take advantage of it. FSAs allow you to set aside pre-tax dollars to pay for eligible dependent care expenses, reducing your taxable income and saving you money.

- Explore available resources: Look for additional resources that can help you maximize your dependent care benefits. This may include community programs, government assistance, or subsidies that can offset the cost of care.

- Consider alternative care options: Depending on your needs and budget, explore alternative care options such as in-home care, nanny sharing, or cooperative childcare. These options can be more cost-effective and flexible compared to traditional daycare centers.

- Communicate with your employer: Stay in touch with your employer regarding any changes in your dependent care needs. If your circumstances change, such as a change in work schedule or a new child, inform your employer to ensure your benefits are adjusted accordingly.

- Keep track of expenses: Maintain accurate records of your dependent care expenses. This includes receipts, invoices, and any other documentation. These records will be necessary for reimbursement or tax purposes.

- Stay informed: Stay updated on any changes or updates to your employer’s dependent care benefits. Attend informational sessions or meetings to learn about any new offerings or changes in policies.

By following these strategies, you can maximize your dependent care benefits and ensure that you are making the most of the resources available to you. Remember to regularly review and assess your dependent care needs to make any necessary adjustments and take full advantage of the benefits provided.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.