Causes of Demand Shock

A demand shock occurs when there is a sudden and significant change in the demand for goods and services in an economy. This can have a profound impact on businesses, consumers, and the overall economy. There are several factors that can cause a demand shock:

1. Changes in consumer preferences:

Changes in consumer preferences can lead to a sudden decrease in demand for certain products or an increase in demand for others. For example, if there is a shift towards more eco-friendly products, the demand for traditional gasoline-powered cars may decrease, while the demand for electric vehicles may increase.

2. Changes in income levels:

Changes in income levels can also have a significant impact on demand. If there is a decrease in income levels, consumers may cut back on their spending, leading to a decrease in demand for goods and services. Conversely, if there is an increase in income levels, consumers may have more disposable income, leading to an increase in demand.

3. Changes in government policies:

Government policies can also cause demand shocks. For example, changes in tax rates or regulations can affect consumer behavior and lead to changes in demand. If the government increases taxes on a particular product, consumers may be less likely to purchase it, leading to a decrease in demand.

4. Natural disasters or emergencies:

Natural disasters or emergencies can also cause demand shocks. For example, if there is a major earthquake or hurricane, consumers may need to spend their money on immediate necessities such as food, water, and shelter, leading to a decrease in demand for other goods and services.

5. Changes in technology:

Technological advancements can also lead to demand shocks. For example, the introduction of a new and innovative product can lead to a sudden increase in demand for that product, while older products may experience a decrease in demand.

Impact of Demand Shock

A demand shock refers to a sudden and significant change in the demand for goods and services in an economy. This can be caused by various factors, such as changes in consumer preferences, shifts in income distribution, or unexpected events like natural disasters or pandemics. The impact of a demand shock can have far-reaching consequences for businesses, consumers, and the overall economy.

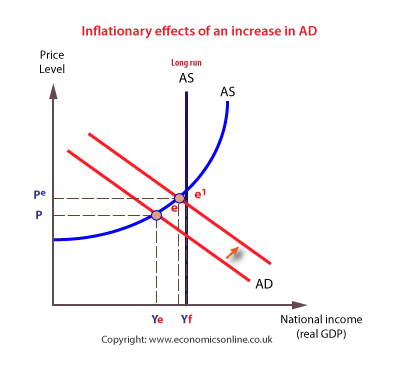

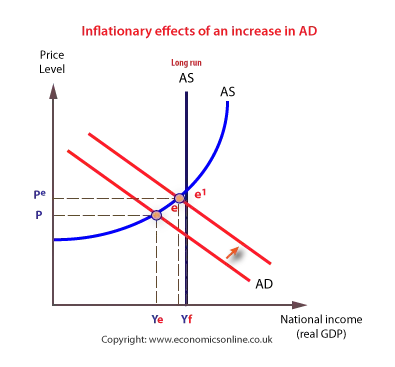

One of the primary impacts of a demand shock is on businesses. When there is a sudden decrease in demand, businesses may experience a decline in sales and revenue. This can lead to layoffs, reduced production, and even business closures. On the other hand, a sudden increase in demand can put pressure on businesses to ramp up production to meet the increased consumer demand. This can lead to supply shortages, price increases, and potential inflationary pressures.

Consumers are also directly affected by a demand shock. When there is a decrease in demand, consumers may benefit from lower prices as businesses try to stimulate demand. However, if there is a sudden increase in demand, consumers may face higher prices and potential shortages of goods and services. This can impact their purchasing power and overall standard of living.

Furthermore, a demand shock can have broader implications for the overall economy. When there is a decrease in demand, it can lead to a contraction in economic activity, lower GDP growth, and potentially a recession. On the other hand, a sudden increase in demand can lead to economic expansion, higher GDP growth, and potentially inflationary pressures.

Policy responses to a demand shock can vary depending on the specific circumstances. In the case of a decrease in demand, governments may implement fiscal and monetary stimulus measures to boost consumer spending and stimulate economic growth. On the other hand, if there is a sudden increase in demand, governments may implement measures to manage inflationary pressures and ensure price stability.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.