Delta Hedging: Definition and Benefits

Delta hedging is a risk management strategy used by investors and traders to reduce or eliminate the risk associated with changes in the price of an underlying asset. It involves adjusting the portfolio’s delta, which measures the sensitivity of the portfolio’s value to changes in the price of the underlying asset.

Definition

Delta hedging involves buying or selling options or their underlying assets to offset the changes in the delta of the portfolio. By doing so, investors can neutralize the impact of price movements and maintain a more stable portfolio value.

Benefits

Delta hedging offers several benefits to investors and traders:

- Risk reduction: Delta hedging helps reduce the risk associated with price fluctuations in the underlying asset. By adjusting the portfolio’s delta, investors can minimize potential losses and protect their investments.

- Portfolio stability: Delta hedging allows investors to maintain a more stable portfolio value, even in volatile market conditions. By continuously adjusting the delta, investors can offset the impact of price movements and achieve a more consistent return on investment.

- Profit potential: Delta hedging can also be used to enhance profit potential. By strategically adjusting the portfolio’s delta, investors can take advantage of price movements in the underlying asset and generate additional returns.

Delta hedging is a risk management strategy used by investors and traders to reduce or eliminate the risk associated with changes in the price of an underlying asset. It involves taking offsetting positions in options and their underlying assets to create a neutral position.

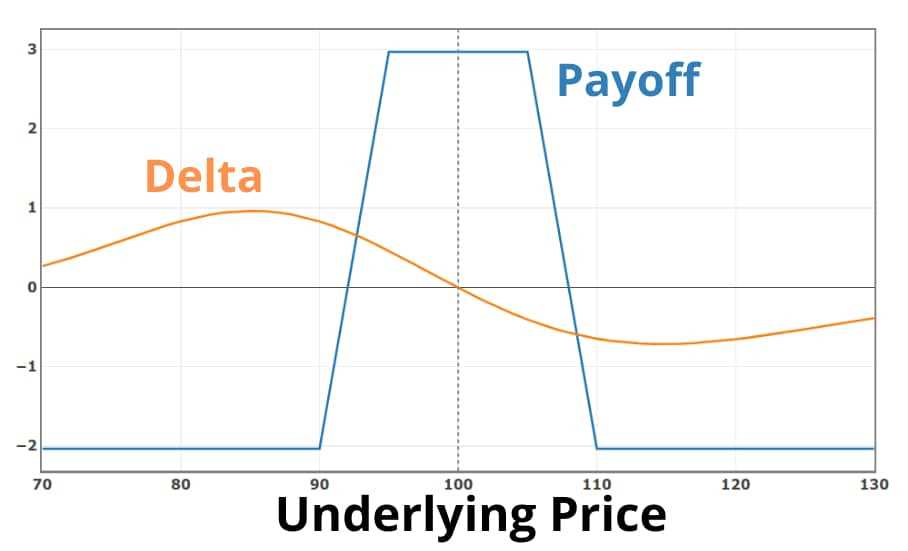

The concept of delta hedging is based on the delta of an option, which measures the sensitivity of the option’s price to changes in the price of the underlying asset. Delta is a number between -1 and 1, where a delta of 1 means that the option’s price will move in lockstep with the price of the underlying asset, and a delta of -1 means that the option’s price will move in the opposite direction of the price of the underlying asset.

By taking offsetting positions in options and their underlying assets, investors and traders can create a delta-neutral portfolio. This means that the portfolio’s overall delta is zero, and therefore, it is not affected by small changes in the price of the underlying asset. However, if there are larger price movements, the delta of the options will change, and the portfolio will need to be rebalanced to maintain a delta-neutral position.

Delta hedging can be used by investors and traders in various scenarios. For example, it can be used by options traders to hedge their positions against changes in the price of the underlying asset. It can also be used by portfolio managers to hedge their portfolios against market risks. Additionally, delta hedging can be used by market makers to manage their exposure to options and ensure liquidity in the market.

Overall, delta hedging is a powerful risk management strategy that allows investors and traders to reduce or eliminate the risk associated with changes in the price of an underlying asset. By creating a delta-neutral portfolio, they can protect their positions and potentially increase their returns.

How Delta Hedging Works

Delta hedging is a risk management strategy used by investors and traders to reduce or eliminate the risk associated with changes in the price of an underlying asset. It involves taking offsetting positions in options and their underlying assets to neutralize the delta, which represents the sensitivity of the option’s price to changes in the price of the underlying asset.

To understand how delta hedging works, let’s consider an example. Suppose an investor holds a call option on a stock with a delta of 0.6. This means that for every $1 increase in the stock price, the value of the call option will increase by $0.60. However, if the stock price decreases by $1, the value of the call option will decrease by $0.60.

To hedge the delta risk, the investor would take a short position in the stock. By selling the stock, the investor can offset the potential losses from a decrease in the stock price. If the stock price increases, the investor can still profit from the call option. This combination of a long call option and a short stock position creates a delta-neutral portfolio.

For example, if the stock price increases and the delta of the call option increases to 0.8, the investor would need to sell more of the stock to maintain a delta-neutral position. Conversely, if the stock price decreases and the delta of the call option decreases to 0.4, the investor would need to buy more of the stock.

By continuously adjusting the hedge position, delta hedging allows investors to protect their portfolios from changes in the price of the underlying asset. It can be particularly useful in volatile markets where the price of the underlying asset is likely to fluctuate significantly.

| Pros | Cons |

|---|---|

| – Reduces or eliminates the risk associated with changes in the price of the underlying asset | – Does not completely eliminate all risks |

| – Allows investors to protect their portfolios from price fluctuations | – Requires continuous monitoring and adjustment of the hedge position |

| – Can be particularly useful in volatile markets | – May still be residual risks, such as gamma risk |

Delta Hedging: Example and Implementation

Delta hedging is a risk management strategy used by investors and traders to reduce or eliminate the risk associated with changes in the price of an underlying asset. It involves adjusting the portfolio’s delta, which measures the sensitivity of the portfolio’s value to changes in the price of the underlying asset.

Let’s consider an example to understand how delta hedging works in practice. Suppose an investor holds a portfolio of call options on a particular stock. The delta of a call option is positive, meaning that the value of the option increases when the price of the underlying stock rises. However, if the stock price decreases, the value of the call option will also decrease.

To hedge against this risk, the investor can take a short position in the underlying stock. By doing so, the investor creates a delta-neutral position, where the changes in the value of the call options are offset by the changes in the value of the short position in the stock.

For example, let’s say the investor holds call options with a delta of 0.5 on a stock that is currently trading at $100. The investor would need to sell 50 shares of the stock (0.5 * 100) to create a delta-neutral position. If the stock price increases by $1, the value of the call options would increase by $0.5, but the short position in the stock would also increase by $0.5, resulting in no net change in the portfolio’s value.

Delta hedging can be an effective strategy for managing risk in options trading, as it helps to protect against adverse price movements. However, it is important to note that delta hedging is not a foolproof strategy and does not eliminate all risks. There may still be residual risks, such as changes in volatility or other market factors, that can impact the value of the portfolio.

| Pros of Delta Hedging | Cons of Delta Hedging |

|---|---|

| Reduces or eliminates the risk associated with changes in the price of the underlying asset. | Does not eliminate all risks, such as changes in volatility or other market factors. |

| Provides a way to protect against adverse price movements. | Requires continuous monitoring and adjustments to maintain a delta-neutral position. |

| Can be an effective strategy for managing risk in options trading. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.