What is Debt Restructuring?

Debt restructuring refers to the process of modifying the terms and conditions of existing debt agreements between a borrower and a lender. It is usually undertaken when a borrower is facing financial difficulties and is unable to meet its debt obligations as originally agreed upon.

The goal of debt restructuring is to provide the borrower with some relief by adjusting the terms of the debt, such as extending the repayment period, reducing the interest rate, or even forgiving a portion of the principal amount owed. This allows the borrower to have a more manageable repayment plan and avoid defaulting on the debt.

Debt restructuring can be initiated by either the borrower or the lender, depending on the circumstances. In some cases, the borrower may proactively approach the lender to negotiate new terms, while in other cases, the lender may initiate the process to protect its own interests and avoid potential losses.

The process of debt restructuring typically involves a series of negotiations between the borrower and the lender, where both parties try to reach an agreement that is mutually beneficial. This may involve analyzing the borrower’s financial situation, assessing the feasibility of the proposed restructuring plan, and evaluating the potential risks and benefits for both parties.

Debt restructuring is a complex process that requires careful consideration and expertise. It can involve legal and financial professionals who specialize in debt restructuring to ensure that the process is conducted in a fair and transparent manner.

Definition, Process, and Importance

Debt restructuring refers to the process of modifying the terms and conditions of existing debt obligations in order to alleviate financial distress and improve the borrower’s ability to repay the debt. It involves negotiations between the borrower and the lender to come up with a new agreement that better suits the borrower’s financial situation.

The process of debt restructuring typically begins when a borrower is facing difficulties in meeting their debt obligations, such as making timely interest or principal payments. This could be due to various reasons, including economic downturns, unexpected expenses, or poor financial management. In such cases, the borrower may approach the lender to discuss the possibility of restructuring the debt.

The negotiations involved in debt restructuring can be complex and may require the assistance of financial advisors or legal professionals. The borrower and the lender will need to assess the borrower’s financial situation, including their income, assets, and liabilities, to determine the feasibility of restructuring the debt. They will also need to consider the potential impact on the lender’s financial position and the borrower’s creditworthiness.

Once the negotiations are complete, a new agreement is reached that outlines the revised terms and conditions of the debt. This may include changes to the interest rate, repayment schedule, or even a reduction in the principal amount owed. The new agreement is legally binding and both parties are obligated to adhere to its terms.

The importance of debt restructuring lies in its ability to provide relief to borrowers who are struggling with their debt obligations. By modifying the terms of the debt, borrowers can potentially lower their monthly payments, extend the repayment period, or reduce the overall debt burden. This can help them regain control of their finances and avoid defaulting on their obligations.

Debt restructuring also benefits lenders by increasing the likelihood of repayment. By working with borrowers to find a mutually beneficial solution, lenders can minimize the risk of default and potential losses. It allows them to recover a portion of the outstanding debt and maintain a positive relationship with the borrower.

Conclusion

Debt restructuring is a vital tool for borrowers and lenders alike in managing financial difficulties. It provides a way to address unsustainable debt burdens and find a more manageable solution. Through negotiations and the creation of a new agreement, debt restructuring can help borrowers regain financial stability and allow lenders to mitigate potential losses. It is an important process that plays a crucial role in the overall functioning of the financial system.

How Debt Restructuring Works

Debt restructuring is a process that allows a borrower to modify the terms of their existing debt in order to make it more manageable and avoid default. It involves negotiations between the borrower and the lender to reach an agreement that benefits both parties.

The process of debt restructuring typically starts with the borrower assessing their financial situation and determining that they are unable to meet their current debt obligations. They may be facing financial difficulties due to factors such as a decrease in income, unexpected expenses, or a downturn in the economy.

Once the borrower has identified the need for debt restructuring, they will approach their lender and propose a new repayment plan. This plan may involve reducing the interest rate, extending the repayment period, or even forgiving a portion of the principal amount owed.

If the lender agrees to the proposed debt restructuring plan, they will draft a new agreement that outlines the modified terms. This agreement will specify the new repayment schedule, interest rate, and any other changes that have been agreed upon.

Once the new agreement is in place, the borrower will begin making payments according to the revised terms. It is important for the borrower to adhere to the new repayment plan in order to successfully complete the debt restructuring process.

Debt restructuring can provide several benefits for both the borrower and the lender. For the borrower, it can help alleviate financial stress, improve cash flow, and prevent default. It can also help them avoid bankruptcy and maintain a positive credit history.

For the lender, debt restructuring can help them recover a portion of the outstanding debt and avoid the costs and time associated with pursuing legal action. It can also help them maintain a positive relationship with the borrower and preserve their reputation.

Steps, Parties Involved, and Benefits of Debt Restructuring

Debt restructuring is a complex process that involves several steps and parties. It is important to understand these steps and the roles of each party involved in order to fully grasp the benefits of debt restructuring.

Steps of Debt Restructuring:

- Assessment: The first step in debt restructuring is to assess the financial situation of the debtor. This involves analyzing the current debt obligations, cash flow, and financial projections.

- Negotiation: Once the assessment is complete, the debtor and the creditor(s) enter into negotiations to reach an agreement on the terms of the debt restructuring. This may involve discussions on interest rates, repayment terms, and any potential changes to the loan agreement.

- Agreement: Once the negotiations are successful, a formal agreement is drafted and signed by all parties involved. This agreement outlines the new terms of the debt restructuring, including any changes to the repayment schedule or interest rates.

- Implementation: After the agreement is signed, the debtor begins implementing the new terms of the debt restructuring. This may involve making revised payments, adhering to new repayment schedules, or providing additional collateral.

- Monitoring: Throughout the debt restructuring process, both the debtor and the creditor(s) monitor the progress and compliance with the new terms. This ensures that the restructuring is being implemented effectively and that both parties are fulfilling their obligations.

- Completion: Once all the terms of the debt restructuring have been fulfilled, the process is considered complete. The debtor has successfully restructured their debt and can now focus on rebuilding their financial stability.

Parties Involved in Debt Restructuring:

Debt restructuring typically involves the following parties:

- Debtor: The individual or company that owes the debt and seeks to restructure it.

- Creditor(s): The individual, bank, or financial institution that holds the debt and agrees to restructure it.

- Financial Advisor: A professional who provides guidance and expertise throughout the debt restructuring process. They help assess the financial situation, negotiate with creditors, and develop a restructuring plan.

- Legal Advisor: A lawyer who provides legal advice and assistance in drafting the formal agreement and ensuring compliance with applicable laws and regulations.

- Third-Party Mediator: In some cases, a neutral third party may be involved to facilitate negotiations between the debtor and creditor(s) and help reach a mutually beneficial agreement.

Benefits of Debt Restructuring:

Debt restructuring can offer several benefits to both debtors and creditors:

- Debt Relief: Restructuring allows debtors to reduce their debt burden by renegotiating more favorable terms, such as lower interest rates or extended repayment periods.

- Improved Cash Flow: By restructuring their debt, debtors can improve their cash flow by reducing their monthly payments or extending the repayment period.

- Avoiding Default: Debt restructuring can help debtors avoid defaulting on their loans, which can have serious consequences such as damaged credit scores and legal actions by creditors.

- Preserving Relationships: Restructuring debt can help maintain positive relationships between debtors and creditors by finding a mutually agreeable solution.

- Financial Stability: By successfully restructuring their debt, debtors can regain financial stability and focus on their long-term financial goals.

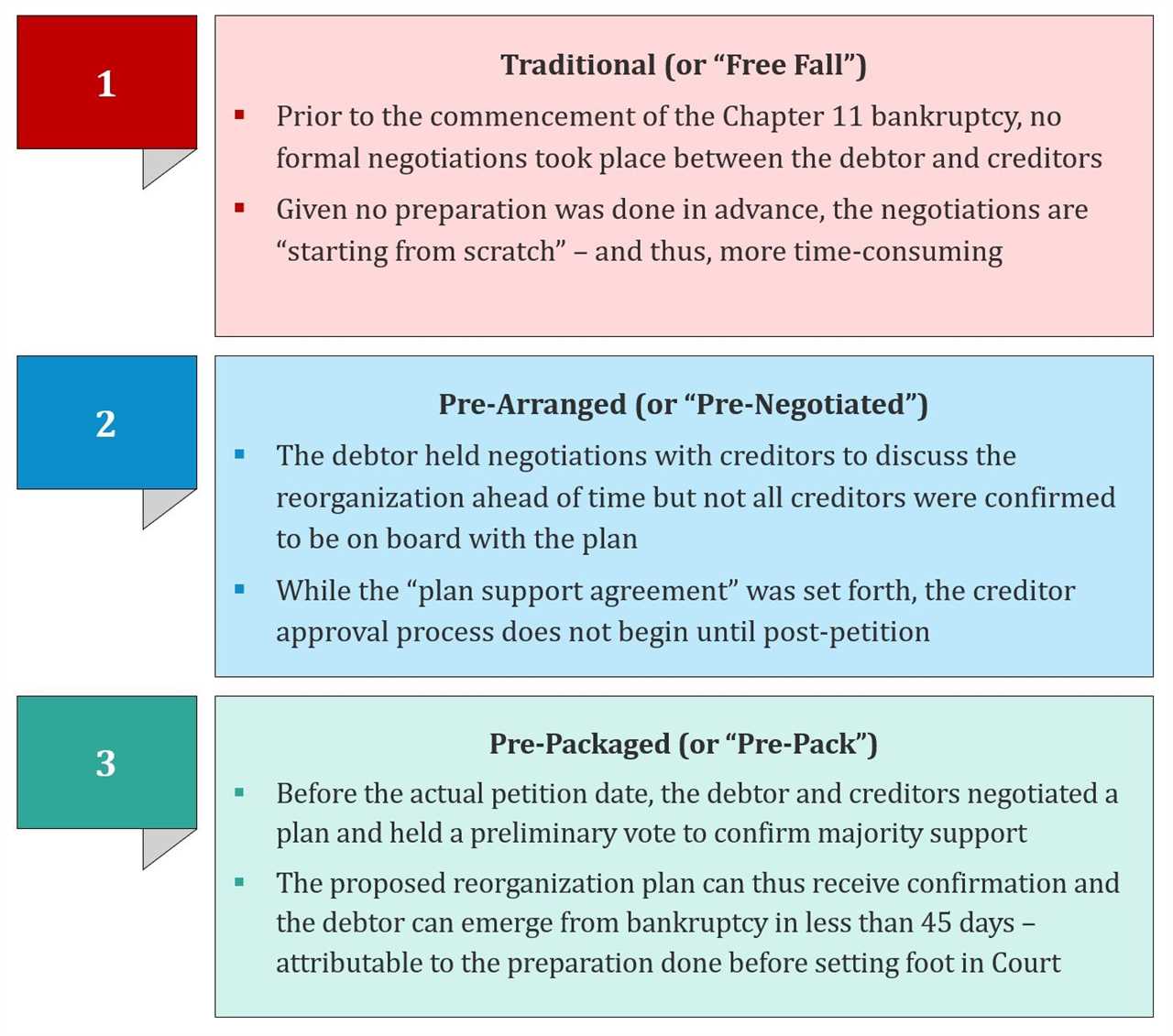

Types of Debt Restructuring

Debt restructuring is a process that allows a debtor to modify the terms of their existing debt in order to make it more manageable and avoid default. There are several types of debt restructuring that can be used depending on the specific circumstances of the debtor:

- Debt Consolidation: This type of debt restructuring involves combining multiple debts into a single loan with a lower interest rate. By consolidating their debts, the debtor can simplify their repayment process and potentially save money on interest.

- Debt Conversion: Debt conversion involves converting a portion of the debt into equity or another form of financial instrument. This type of debt restructuring is often used in corporate debt restructuring to improve the company’s financial position.

- Debt Forgiveness: Debt forgiveness is a type of debt restructuring where a portion of the debt is forgiven by the creditor. This can be done through negotiations or as part of a debt relief program. Debt forgiveness can provide significant financial relief to the debtor, but it may also have tax implications.

- Debt Repurchase: In debt repurchase, the debtor repurchases their own debt at a discounted price. This can be done through open market transactions or through negotiations with the creditor. Debt repurchase can help the debtor reduce their overall debt burden and improve their financial position.

Each type of debt restructuring has its own advantages and disadvantages, and the appropriate type will depend on the specific circumstances of the debtor. It is important for debtors to carefully consider their options and seek professional advice before proceeding with any debt restructuring plan.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.