What is Debt Overhang?

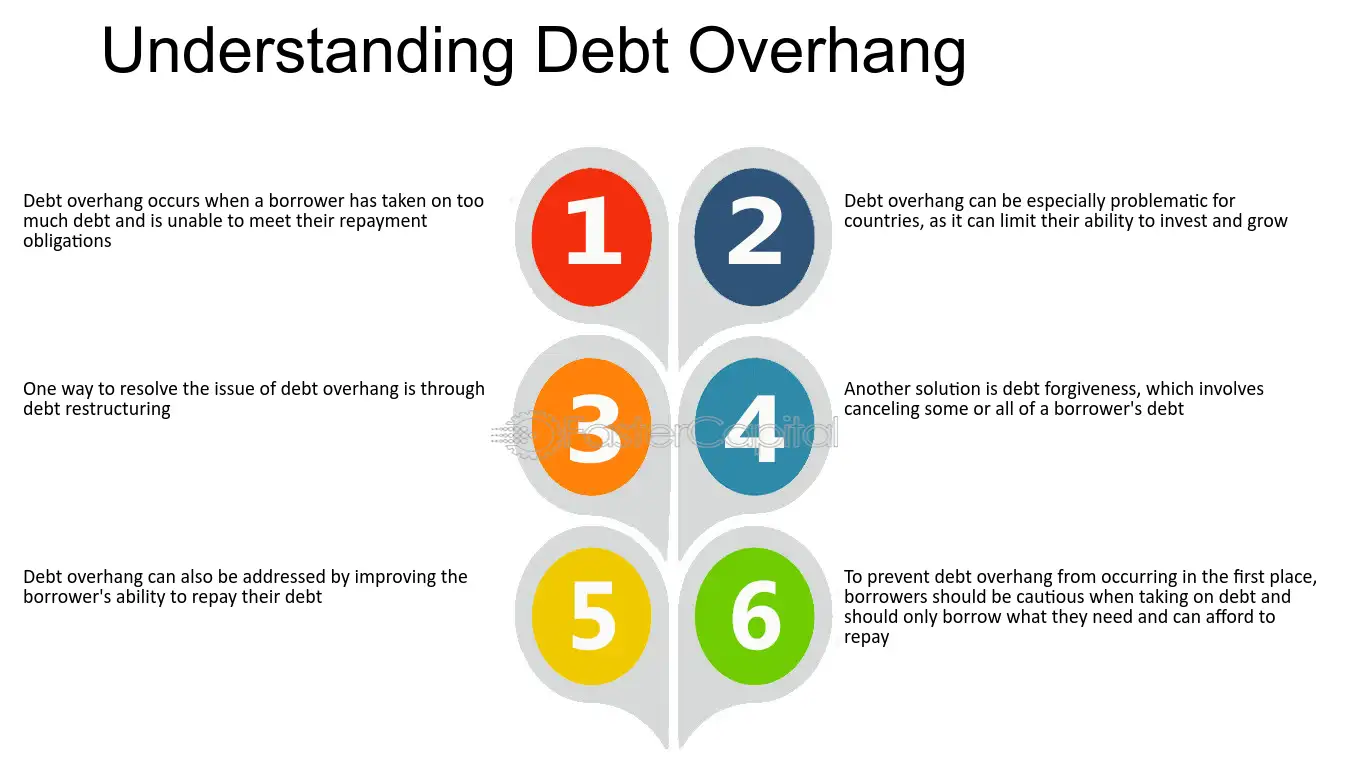

Debt overhang refers to a situation in which a company or an individual carries a significant amount of debt that hinders their ability to invest, grow, or make necessary financial decisions. It occurs when the burden of existing debt becomes so heavy that it limits the company’s ability to take on new debt or pursue profitable opportunities.

Debt overhang can occur in various forms, such as corporate debt, personal debt, or government debt. In the context of businesses, it typically refers to a situation where a company has taken on excessive debt, often due to poor financial management or economic downturns.

When a company is burdened with debt overhang, it faces several challenges. Firstly, it may have difficulty accessing new financing or credit, as lenders may view the company as high-risk. This can limit the company’s ability to invest in new projects, expand its operations, or even meet its day-to-day financial obligations.

Additionally, debt overhang can create a negative perception among investors and stakeholders, leading to a decline in the company’s stock price and overall market value. This can further exacerbate the company’s financial difficulties and make it even harder to recover from the debt burden.

To address debt overhang, companies may employ various strategies. One common approach is debt restructuring, which involves renegotiating the terms of existing debt or exchanging it for new debt with more favorable terms. Debt restructuring can help alleviate the burden of debt payments and provide the company with more financial flexibility.

Another strategy is asset sales or divestitures, where the company sells off non-core assets to generate cash and reduce its debt load. This can help improve the company’s financial position and reduce the impact of debt overhang.

Overall, debt overhang is a significant issue that can severely impact a company’s financial health and growth prospects. It is crucial for businesses to proactively manage their debt levels and take appropriate measures to address debt overhang in order to ensure long-term sustainability and success.

Debt overhang refers to a situation in which a company or an individual is burdened with excessive debt that hampers their ability to invest, grow, and make necessary financial decisions. It occurs when the level of debt is so high that it becomes a significant obstacle to future growth and profitability.

There are several causes of debt overhang. One of the main causes is excessive borrowing or taking on too much debt without considering the ability to repay it. This can happen when companies or individuals have overly optimistic expectations about future cash flows or when they underestimate the risks associated with their borrowing.

Another cause of debt overhang is economic downturns or financial crises. During these periods, companies may experience a decline in revenue and profitability, making it difficult for them to meet their debt obligations. This can lead to a vicious cycle where the company’s financial health deteriorates further, making it even harder to repay the debt.

Furthermore, debt overhang can be caused by poor financial management and decision-making. Companies that fail to effectively manage their debt levels and make strategic financial decisions may find themselves trapped in a situation of debt overhang. This can include taking on excessive debt to finance non-productive investments or failing to properly allocate resources to generate sufficient cash flow to service the debt.

It is important to note that debt overhang is not limited to companies alone. Individuals can also experience debt overhang when they accumulate excessive personal debt, such as credit card debt or mortgage debt, which becomes unmanageable and hinders their financial well-being.

Impact of Debt Overhang on Businesses

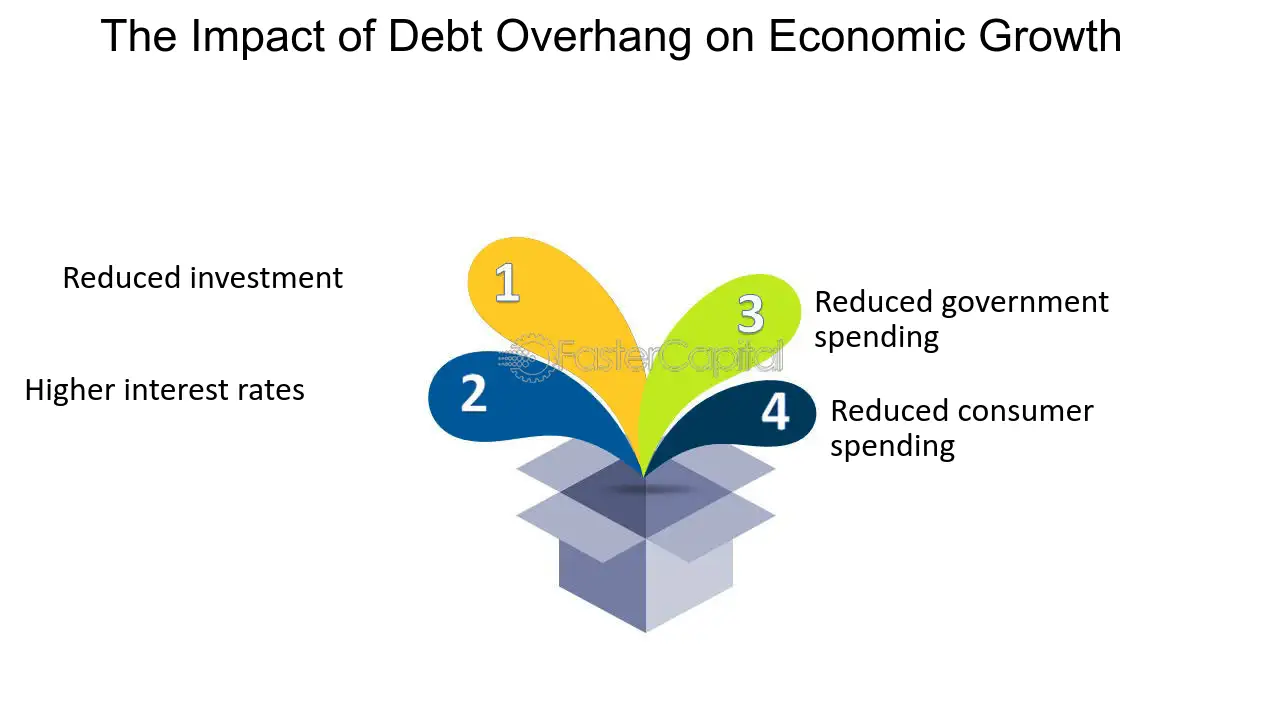

Debt overhang can have a significant impact on businesses, affecting their ability to grow, invest, and remain competitive in the market. It creates a burden that can hinder the company’s financial health and limit its strategic options.

1. Financial Constraints

One of the main consequences of debt overhang is the financial constraints it imposes on businesses. When a company has a high level of debt, it may struggle to access additional financing or credit, making it difficult to fund new projects, expand operations, or invest in research and development.

Furthermore, the interest payments on the existing debt can consume a significant portion of the company’s cash flow, leaving less money available for other essential activities. This can lead to a reduction in capital expenditures, delayed payments to suppliers, or even layoffs to cut costs.

2. Reduced Profitability

Debt overhang can also impact a company’s profitability. When a business is burdened with excessive debt, it may have to allocate a significant portion of its earnings towards debt servicing, leaving less profit for reinvestment or distribution to shareholders.

3. Limited Strategic Options

Another consequence of debt overhang is the limited strategic options available to the company. When a business is heavily indebted, it may be forced to prioritize debt repayment over other strategic initiatives, such as mergers and acquisitions, partnerships, or entering new markets.

This can hinder the company’s ability to adapt to changing market conditions, seize growth opportunities, or invest in innovation. It may also make the company more vulnerable to competitive pressures, as it lacks the financial flexibility to respond effectively.

4. Negative Impact on Credit Rating

Debt overhang can also have a negative impact on a company’s credit rating. When a business has a high level of debt relative to its earnings and assets, credit rating agencies may downgrade its creditworthiness, making it more expensive or even impossible to access new financing.

A lower credit rating can also affect the company’s relationships with suppliers, customers, and other stakeholders. Suppliers may demand stricter payment terms or higher prices, while customers may be hesitant to enter into long-term contracts or make large purchases from a financially unstable company.

Strategies to Address Debt Overhang

Debt overhang can be a significant burden for businesses, hindering their ability to grow and thrive. However, there are several strategies that can be implemented to address debt overhang and alleviate its negative effects.

1. Debt Restructuring: One of the most common strategies to address debt overhang is debt restructuring. This involves renegotiating the terms of the existing debt, such as extending the repayment period, reducing interest rates, or even forgiving a portion of the debt. Debt restructuring can provide businesses with the breathing room they need to regain financial stability and improve their cash flow.

2. Asset Sales: Another strategy to address debt overhang is to sell off assets. By selling non-essential assets, businesses can generate cash to pay off their debts and reduce their overall debt burden. However, it is important to carefully consider which assets to sell to ensure that the business can still operate effectively and maintain its competitive advantage.

3. Cost-cutting Measures: Implementing cost-cutting measures can also help businesses address debt overhang. This may involve reducing expenses, such as cutting back on non-essential spending, renegotiating contracts with suppliers, or even downsizing the workforce. By reducing costs, businesses can free up cash flow to allocate towards debt repayment.

4. Revenue Generation: Increasing revenue is another effective strategy to address debt overhang. This can be achieved through various means, such as expanding the customer base, launching new products or services, or entering new markets. By generating more revenue, businesses can improve their financial position and gradually pay off their debts.

5. Seek Professional Help: In some cases, businesses may need to seek professional help to address debt overhang. This can involve working with financial advisors, debt counselors, or even bankruptcy attorneys. These professionals can provide guidance and expertise in developing a comprehensive debt management plan and navigating the complex legal and financial aspects of debt restructuring.

It is important for businesses to carefully evaluate their financial situation and determine which strategies are most suitable for addressing their specific debt overhang. By taking proactive measures and implementing effective strategies, businesses can overcome debt overhang and position themselves for long-term success.

Benefits of Debt Restructuring

Debt restructuring is a financial strategy that can provide numerous benefits for businesses facing debt overhang. By restructuring their debt, companies can effectively manage their financial obligations and improve their overall financial health. Here are some key benefits of debt restructuring:

1. Improved Cash Flow

One of the main advantages of debt restructuring is that it can help improve a company’s cash flow. By renegotiating the terms of their debt, businesses can reduce their monthly payments, providing them with more available cash to invest in their operations, pay off other debts, or fund growth initiatives.

2. Lower Interest Rates

Debt restructuring often involves refinancing existing debt at lower interest rates. This can significantly reduce the cost of borrowing for businesses, allowing them to save money on interest payments over the long term. Lower interest rates can also make it easier for companies to meet their debt obligations and improve their financial stability.

3. Extended Repayment Period

Another benefit of debt restructuring is the ability to extend the repayment period of existing debt. This can provide businesses with more time to pay off their debt, reducing the strain on their cash flow and improving their ability to meet their financial obligations. By spreading out the repayment over a longer period, companies can better manage their debt and avoid defaulting on their payments.

4. Enhanced Financial Flexibility

Debt restructuring can also provide businesses with increased financial flexibility. By restructuring their debt, companies can reorganize their financial obligations in a way that aligns with their current financial situation and goals. This can include consolidating multiple debts into a single loan, converting short-term debt into long-term debt, or negotiating more favorable terms with creditors.

5. Preservation of Business Operations

For businesses facing severe debt overhang, debt restructuring can be a crucial step in preserving their operations. By restructuring their debt, companies can avoid bankruptcy or liquidation, allowing them to continue operating and potentially recover from their financial difficulties. Debt restructuring provides a lifeline for struggling businesses, giving them the opportunity to restructure their finances and regain their financial stability.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.