Calculating Days Sales Outstanding

Days Sales Outstanding (DSO) is a financial metric used to measure the average number of days it takes for a company to collect payment from its customers after a sale has been made. It is an important indicator of a company’s liquidity and efficiency in managing its accounts receivable.

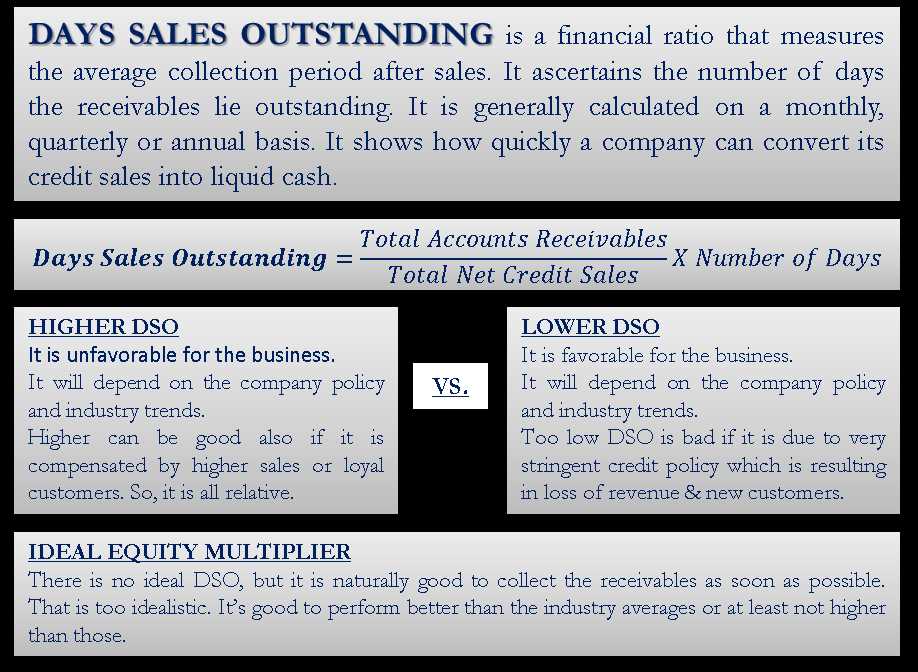

To calculate DSO, you need two key pieces of information: the total accounts receivable balance and the total credit sales for a specific period, usually a month or a quarter. The formula for calculating DSO is as follows:

DSO = (Accounts Receivable / Credit Sales) x Number of Days

Let’s break down the formula:

- Start by determining the accounts receivable balance, which represents the total amount of money owed to the company by its customers. This information can be found on the company’s balance sheet.

- Next, find the total credit sales for the period you are analyzing. Credit sales are sales made on credit, where customers are allowed to pay at a later date. This information can be obtained from the company’s income statement or sales records.

- Calculate the average number of days it takes for the company to collect payment from its customers. This can be done by dividing the total accounts receivable by the total credit sales and then multiplying the result by the number of days in the period you are analyzing.

For example, let’s say a company has an accounts receivable balance of $100,000 and total credit sales of $500,000 for the month of January. The number of days in January is 31. Using the formula, the DSO would be calculated as follows:

DSO = ($100,000 / $500,000) x 31 = 6.2 days

This means that, on average, it takes the company 6.2 days to collect payment from its customers after a sale has been made. A lower DSO indicates that the company is collecting payment more quickly, which is generally seen as a positive sign of efficient cash flow management.

It is important to note that DSO should be compared to industry benchmarks and historical data to gain meaningful insights. A high DSO may indicate issues with credit and collection policies, while a low DSO may suggest aggressive collection practices that could impact customer relationships.

By regularly calculating and monitoring DSO, companies can identify areas for improvement in their accounts receivable management and take necessary actions to optimize cash flow and working capital.

Applications of Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) is a financial metric that is widely used by businesses to evaluate their accounts receivable management and cash flow. It provides valuable insights into the efficiency of a company’s credit and collection policies, as well as its ability to convert sales into cash.

1. Assessing Credit Policies

One of the key applications of DSO is in assessing the effectiveness of a company’s credit policies. By monitoring the average number of days it takes for customers to pay their invoices, businesses can determine whether their credit terms are too lenient or too strict. A high DSO may indicate that customers are taking longer to pay, which could be a sign of poor credit policies or financial difficulties. On the other hand, a low DSO may suggest that credit terms are too strict, potentially hindering sales growth. By analyzing DSO, businesses can make informed decisions about adjusting their credit policies to optimize cash flow and minimize bad debts.

2. Cash Flow Management

DSO is also a valuable tool for managing cash flow. By tracking the average number of days it takes to collect payment from customers, businesses can better forecast their cash inflows and outflows. A high DSO indicates that cash collections are taking longer, which can put a strain on working capital and hinder the ability to meet financial obligations. By reducing DSO, businesses can improve their cash flow position and ensure they have sufficient funds to cover expenses, invest in growth opportunities, and meet debt obligations.

3. Identifying Collection Issues

Another important application of DSO is in identifying collection issues. A sudden increase in DSO may indicate that customers are experiencing financial difficulties or that collection efforts are not being effectively executed. By closely monitoring DSO, businesses can identify potential collection issues early on and take proactive measures to address them. This may involve implementing stricter credit control measures, offering incentives for early payment, or engaging in more aggressive collection efforts. By addressing collection issues promptly, businesses can minimize the risk of bad debts and improve their overall financial performance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.