What is CIP?

CIP, or Carriage and Insurance Paid to, is an international trade term that defines the responsibilities and obligations of the seller and the buyer in a transaction. It is commonly used in contracts for the sale of goods, especially in international trade.

Carriage and Insurance Paid to means that the seller is responsible for delivering the goods to a named destination, as well as arranging and paying for transportation and insurance. The buyer, on the other hand, is responsible for any additional costs and risks that may arise after the goods have been delivered to the agreed destination.

This trade term provides clarity and transparency in terms of who is responsible for what during the transportation and insurance process. It ensures that both parties understand their obligations and can plan and budget accordingly.

In summary, CIP is a trade term that defines the responsibilities and obligations of the seller and the buyer in terms of transportation and insurance. It provides clarity and convenience for both parties, ensuring a smooth and secure transaction.

Importance of CIP

Carriage and Insurance Paid to (CIP) is a crucial term in international trade that ensures the safe and efficient transportation of goods. It provides both the buyer and the seller with valuable benefits and protections.

One of the key advantages of CIP is that it clearly defines the responsibilities and obligations of both parties involved in the transaction. The seller is responsible for arranging and paying for the carriage of the goods to the agreed-upon destination, as well as obtaining insurance coverage for the goods during transit. This ensures that the buyer does not have to worry about the logistics and associated costs of transportation and insurance.

Moreover, CIP offers a high level of security for both the buyer and the seller. By requiring the seller to provide insurance coverage for the goods, CIP protects the buyer from potential financial losses in case of damage or loss during transit. This gives the buyer peace of mind and confidence in the transaction.

For the seller, CIP provides a competitive advantage by demonstrating their commitment to delivering the goods safely and on time. It also helps build trust and credibility with the buyer, which can lead to long-term business relationships and repeat orders.

Carriage and Insurance Paid to (CIP)

Carriage and Insurance Paid to (CIP) is an international trade term that defines the responsibilities and obligations of the buyer and seller in a transaction. It is commonly used in contracts for the sale of goods where the seller is responsible for arranging and paying for the transportation and insurance of the goods until they reach the agreed-upon destination.

Carriage and Insurance Paid to (CIP) provides several benefits for both buyers and sellers. For buyers, it ensures that the goods are delivered to the agreed-upon destination and are insured against loss or damage during transit. This gives buyers peace of mind and reduces their financial risk. For sellers, CIP allows them to offer a complete package to buyers, including transportation and insurance, which can attract more customers and increase sales.

Definition of Carriage and Insurance Paid to (CIP)

Carriage and Insurance Paid to (CIP) is an international trade term that is part of the Incoterms rules established by the International Chamber of Commerce (ICC). It is used to define the responsibilities and obligations of the buyer and seller in a transaction involving the transportation of goods.

Explanation of Carriage and Insurance Paid to (CIP)

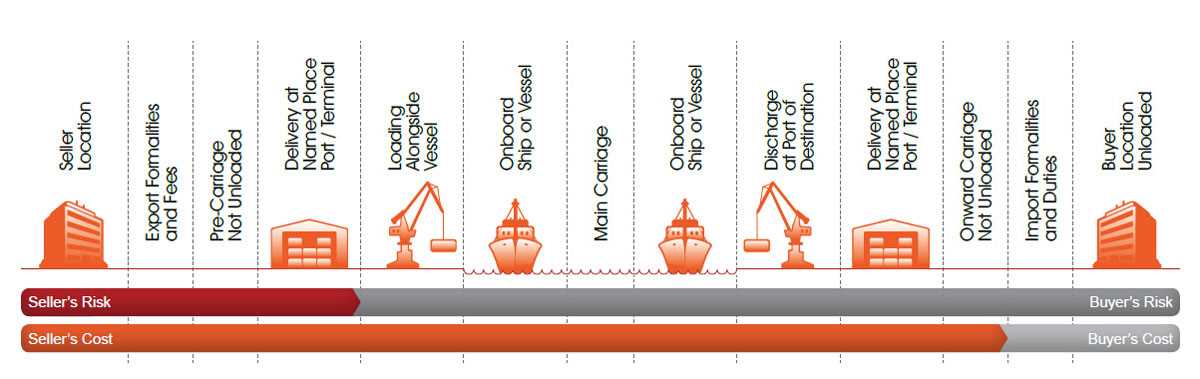

Under the CIP term, the seller is responsible for delivering the goods to a named destination and arranging transportation and insurance coverage for the goods until they reach that destination. The seller bears the risk of loss or damage to the goods during transit.

The CIP term requires the seller to contract for carriage of the goods to the named destination and to provide insurance coverage against the buyer’s risk of loss or damage to the goods during transit. The seller is responsible for obtaining and paying for the insurance coverage.

Benefits of Carriage and Insurance Paid to (CIP)

The CIP term provides several benefits for both buyers and sellers in international trade. For buyers, it offers the convenience of having the seller handle the transportation and insurance arrangements, reducing the buyer’s administrative burden and ensuring that the goods are adequately insured.

For sellers, the CIP term allows for greater control over the transportation and insurance process, ensuring that the goods are delivered to the buyer’s specified destination and that they are adequately protected during transit. This can help to minimize the seller’s risk and liability.

| Advantages for Buyers | Advantages for Sellers |

|---|---|

| Convenience of seller handling transportation and insurance arrangements | Greater control over transportation and insurance process |

| Reduced administrative burden for buyers | Minimized risk and liability for sellers |

| Assurance of adequate insurance coverage for goods | Delivery of goods to buyer’s specified destination |

Overall, the CIP term provides a clear framework for the transportation and insurance of goods in international trade, ensuring that both buyers and sellers have their interests protected and their responsibilities defined.

How CIP Works

Carriage and Insurance Paid to (CIP) is a trade term that requires the seller to deliver the goods to a named destination, usually the buyer’s location, and be responsible for both the cost of transportation and the insurance coverage during transit.

When using CIP, the seller is responsible for arranging and paying for the carriage of the goods to the agreed-upon destination. This includes all costs associated with loading the goods onto the transportation vehicle, as well as any necessary documentation and customs clearance.

In addition to the transportation costs, the seller must also provide insurance coverage for the goods during transit. This ensures that the buyer is protected in case of any damage or loss that may occur during transportation.

The seller is responsible for obtaining the necessary insurance coverage and paying the insurance premium. The insurance should be sufficient to cover the value of the goods and any potential risks that may arise during transit.

Once the goods have been delivered to the agreed-upon destination, the buyer becomes responsible for any further transportation, insurance, and customs clearance costs. At this point, the risk of loss or damage to the goods also transfers from the seller to the buyer.

Corporate Insurance for CIP

Corporate Insurance plays a crucial role in ensuring the success of Carriage and Insurance Paid to (CIP) transactions. With the complexities involved in international trade, having the right insurance coverage is essential to protect your business interests.

Corporate insurance for CIP offers a range of benefits to businesses. Firstly, it helps mitigate the financial impact of any unforeseen events that may occur during transportation. Whether it’s damage caused by accidents, natural disasters, or theft, having insurance coverage ensures that you are not left to bear the financial burden alone.

Additionally, corporate insurance for CIP can help expedite the claims process in case of any losses or damages. Insurance providers have established procedures and networks that enable quick and efficient claims handling, allowing you to recover your losses and resume normal business operations as soon as possible.

Furthermore, having corporate insurance for CIP can enhance your business reputation and credibility. By demonstrating that you have taken steps to protect your goods and mitigate risks, you instill confidence in your customers and partners, making them more likely to choose your business over competitors.

Key Features of Corporate Insurance for CIP:

1. Coverage for goods in transit: Corporate insurance provides coverage for goods being transported under the CIP terms, protecting them against various risks.

2. Customizable insurance plans: Insurance providers offer flexible insurance plans that can be tailored to meet the specific needs of your business and the nature of the goods being transported.

3. Expert risk assessment: Insurance professionals assess the potential risks associated with your CIP transactions and provide recommendations to minimize those risks.

4. Claims assistance: In case of any losses or damages, insurance providers offer support and guidance throughout the claims process, ensuring a smooth and efficient resolution.

| Benefits of Corporate Insurance for CIP: |

|---|

| Financial protection against losses and damages |

| Quick and efficient claims handling |

| Enhanced business reputation and credibility |

| Customizable insurance plans |

| Expert risk assessment |

Overall, corporate insurance for CIP is a vital tool for businesses engaged in international trade. It provides the necessary protection and support to ensure the smooth and secure transportation of goods, allowing you to focus on growing your business without worrying about potential risks and losses.

Benefits of Corporate Insurance for CIP

Corporate Insurance for Carriage and Insurance Paid to (CIP) offers several key benefits for businesses involved in international trade and transportation. By securing comprehensive insurance coverage, companies can protect their financial interests and mitigate potential risks associated with the transportation of goods.

1. Financial Protection

Corporate Insurance for CIP provides financial protection for businesses by covering any potential loss or damage to goods during transit. This insurance coverage ensures that companies are not left with significant financial losses in the event of accidents, theft, or other unforeseen circumstances.

2. Peace of Mind

Having Corporate Insurance for CIP gives businesses peace of mind, knowing that their goods are protected throughout the entire transportation process. This allows companies to focus on their core operations and business growth without worrying about potential risks or liabilities associated with the shipment of goods.

3. Enhanced Reputation and Trust

By opting for Corporate Insurance for CIP, businesses demonstrate their commitment to ensuring the safe and secure transportation of goods. This commitment enhances their reputation and builds trust among customers, suppliers, and other stakeholders. It also gives businesses a competitive edge by assuring partners that they prioritize the protection of goods.

Overall, Corporate Insurance for CIP is an essential investment for businesses engaged in international trade. It provides financial protection, peace of mind, and enhances reputation and trust. By securing comprehensive insurance coverage, companies can safeguard their interests and ensure the smooth transportation of goods.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.