Canceled Check Definition

A canceled check is a check that has been processed by a bank and marked as “canceled” or “cleared.” When a check is canceled, it means that the funds have been successfully transferred from the payer’s account to the payee’s account.

When a check is deposited into a bank account, the bank verifies the payer’s account balance and ensures that there are sufficient funds to cover the check amount. If the funds are available, the bank will process the check, deduct the amount from the payer’s account, and credit it to the payee’s account.

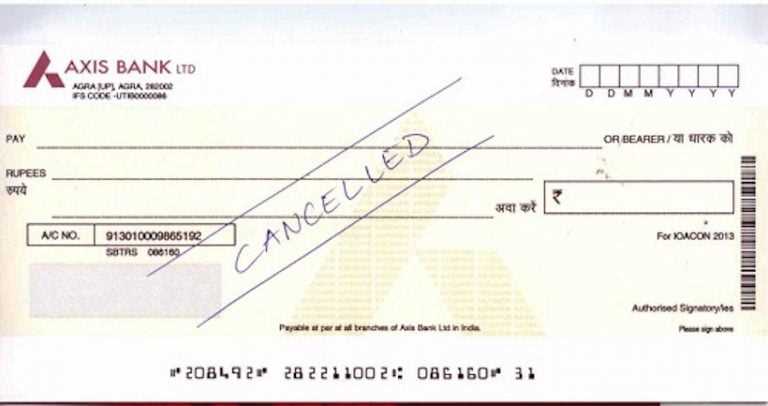

Once the check has been processed and the funds have been transferred, the bank will mark the check as “canceled” or “cleared.” This is typically done by stamping or writing the word “canceled” on the front of the check. The canceled check is then returned to the payer as proof of payment.

Overall, a canceled check serves as a record of a completed transaction and provides proof of payment for both the payer and the payee. It is often used for reconciliation purposes and can be helpful in resolving any disputes or discrepancies related to a particular payment.

What is a Canceled Check?

A canceled check is a physical check that has been processed and marked as “canceled” by the bank. Once a check has been canceled, it cannot be cashed or deposited again. The cancellation process involves the bank stamping or marking the check to indicate that it has been paid and processed.

When a check is canceled, the funds are deducted from the payer’s account and transferred to the payee’s account. This ensures that the payment has been made and recorded by both parties involved. Canceled checks serve as proof of payment and can be used as legal documentation if needed.

How is a Canceled Check Different from a Voided Check?

In contrast, a canceled check has been processed by the bank and serves as evidence of payment. It is a completed transaction that has been recorded by the bank and can be used as proof of payment.

Why are Canceled Checks Important?

Canceled checks are important for several reasons:

- Proof of Payment: Canceled checks provide evidence that a payment has been made and can be used as proof in case of any disputes or discrepancies.

- Record Keeping: Keeping canceled checks can help individuals and businesses maintain accurate financial records and track their expenses.

- Tax Purposes: Canceled checks can be used as supporting documentation when filing taxes, especially for deductible expenses.

- Legal Documentation: Canceled checks can serve as legal documentation in case of any legal disputes or audits.

Overall, canceled checks are essential for financial accountability and provide a paper trail for financial transactions.

Why are Canceled Checks Important?

Cancelled checks are an essential part of managing your finances and keeping track of your transactions. They provide a tangible record of payments made and serve as proof of payment in case of any disputes or discrepancies. Here are a few reasons why canceled checks are important:

1. Verification of Payment

When you write a check, it serves as a promise to pay the recipient. A canceled check provides evidence that the payment was indeed made and can be used to verify that the funds were transferred from your account to the payee.

2. Record Keeping

Canceled checks act as a paper trail for your financial transactions. They provide a physical record of the date, amount, and recipient of each payment you make. This can be helpful for budgeting, tax purposes, and overall financial organization.

3. Dispute Resolution

In case of any discrepancies or disputes, canceled checks can be used as evidence to resolve the issue. Whether it’s a billing error or a disagreement with a vendor, having the canceled check can help you prove that the payment was made correctly and resolve the matter more efficiently.

4. Audit Trail

If you ever face an audit from the IRS or any other financial institution, canceled checks can serve as crucial documentation to support your financial records. They provide a clear and verifiable trail of your transactions, ensuring transparency and accuracy.

How to Get a Copy of a Canceled Check

Getting a copy of a canceled check can be important for various reasons. Whether you need it for record-keeping purposes or to resolve a dispute, obtaining a copy is relatively straightforward. Here are a few methods you can use to get a copy of a canceled check.

1. Contact Your Bank

2. Request a Copy Online

Many banks now offer online banking services that allow you to access and manage your account from the comfort of your own home. If your bank provides this service, log in to your online banking account and navigate to the section where you can view your transaction history. Look for the specific check you want a copy of and select the option to request a copy. Follow the prompts to complete the request.

Note: Some banks may charge a fee for providing copies of canceled checks, so be sure to inquire about any associated costs before proceeding.

3. Visit Your Bank in Person

If you prefer a more personal approach, you can visit your bank in person and speak with a teller or customer service representative. They will be able to assist you in requesting a copy of the canceled check. Make sure to bring proper identification and any relevant account information to expedite the process.

Remember: It’s always a good idea to keep copies of your canceled checks for your own records. This can help you track your spending, reconcile your bank statements, and provide proof of payment if needed in the future.

By following these steps, you can easily obtain a copy of a canceled check when necessary. Whether you need it for personal or business purposes, having access to this information can be valuable in managing your finances effectively.

Requesting a Copy from Your Bank

If you need a copy of a canceled check, you can easily request one from your bank. Most banks keep records of canceled checks for a certain period of time, typically several years. Here are the steps to follow when requesting a copy:

Step 1: Contact Your Bank

Step 2: Provide Identification

For security purposes, the bank will require you to provide proper identification. This may include your account number, social security number, and a valid form of identification, such as a driver’s license or passport. Make sure to have these documents ready when you contact the bank.

Step 3: Pay the Fee

Some banks may charge a fee for providing copies of canceled checks. The fee amount can vary depending on the bank and the number of checks you need copies of. Make sure to inquire about the fee beforehand and be prepared to pay it when requested.

Step 4: Wait for Processing

After you have submitted your request and paid the necessary fee, the bank will begin processing your request. The time it takes to receive the copy of the canceled check can vary depending on the bank’s policies and procedures. In some cases, you may receive the copy immediately, while in others, it may take a few business days.

Once you receive the copy of the canceled check, make sure to review it carefully and compare it to your records. If you notice any discrepancies or have any further questions, don’t hesitate to contact your bank for clarification.

Requesting a copy of a canceled check from your bank is a straightforward process that can provide you with valuable information and documentation. Whether you need it for personal record-keeping or to resolve a dispute, having a copy of a canceled check can help ensure financial accuracy and peace of mind.

Using Online Banking Services

Online banking has become increasingly popular in recent years, offering a convenient and efficient way to manage your finances. One of the many benefits of online banking is the ability to access and view canceled checks without the need for physical copies.

Online banking platforms often provide additional features that can enhance your experience when dealing with canceled checks. For example, you may have the option to download or print copies of your canceled checks for your records. Some platforms even offer the ability to search for specific checks by check number, date, or amount.

Using online banking services to access your canceled checks offers several advantages. Firstly, it eliminates the need for physical storage of paper checks, reducing clutter and the risk of loss or damage. Additionally, it provides instant access to your canceled checks from anywhere with an internet connection, allowing you to quickly and easily retrieve the information you need.

Furthermore, online banking platforms often provide enhanced security measures to protect your financial information. These measures may include encryption, multi-factor authentication, and fraud detection systems. By utilizing these services, you can have peace of mind knowing that your canceled checks and other sensitive financial data are secure.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.