Calculating ROI: A Comprehensive Guide

Return on Investment (ROI) is a crucial metric that businesses use to evaluate the profitability of their investments. It measures the return generated from an investment relative to its cost. Calculating ROI accurately is essential for making informed financial decisions and assessing the success of various projects or initiatives.

Here is a step-by-step guide to help you understand and calculate ROI:

- Define your investment: Start by clearly defining the investment you want to evaluate. It could be a marketing campaign, a new product launch, or an equipment purchase.

- Identify the costs: Determine all the costs associated with the investment. This includes direct costs like purchasing expenses, labor costs, and overhead costs.

- Estimate the returns: Next, estimate the returns you expect to generate from the investment. This could include increased sales, cost savings, or any other financial benefits.

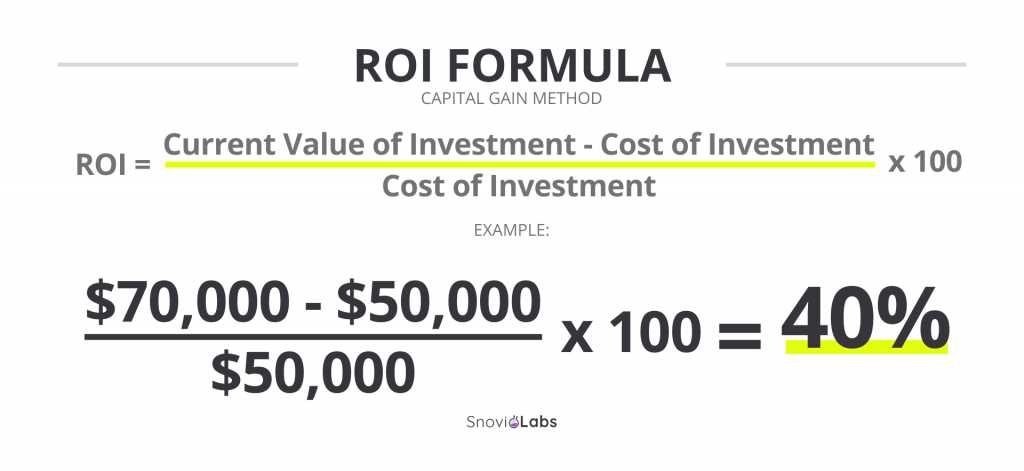

- Calculate the ROI: To calculate the ROI, use the following formula: ROI = (Net Profit / Cost of Investment) x 100. Net Profit is the returns minus the costs. Multiply the result by 100 to express it as a percentage.

- Analyze the results: Once you have calculated the ROI, analyze the results to determine the profitability of the investment. A positive ROI indicates that the investment is profitable, while a negative ROI suggests a loss.

- Consider other factors: While ROI is an important metric, it should not be the sole factor in decision-making. Consider other factors like the payback period, risk, and long-term strategic goals.

By following this comprehensive guide, you can accurately calculate and understand the ROI of your investments. This will enable you to make informed financial decisions and optimize your business’s profitability.

What is Return on Investment?

Return on Investment is a financial ratio that calculates the percentage return or profit generated from an investment relative to its cost. It is commonly used to compare the profitability of different investments and determine which ones are more lucrative.

The formula for calculating ROI is:

ROI = (Net Profit / Cost of Investment) * 100

Net Profit is the total profit earned from the investment, while the Cost of Investment includes all expenses associated with acquiring and maintaining the investment.

Why is ROI important?

ROI is important because it provides valuable insights into the profitability and efficiency of an investment. By calculating ROI, businesses and investors can assess the success of their investments and make data-driven decisions.

Here are some key reasons why ROI is important:

- Performance Evaluation: ROI allows businesses to evaluate the performance of their investments and determine if they are generating satisfactory returns.

- Comparison of Investments: ROI enables investors to compare the profitability of different investments and choose the ones that offer the highest returns.

- Resource Allocation: ROI helps businesses allocate their resources effectively by identifying investments that provide the best returns.

- Risk Assessment: ROI helps investors assess the risk associated with an investment by considering the potential returns it can generate.

Limitations of ROI

While ROI is a useful metric, it has some limitations that should be considered:

- Timeframe: ROI does not consider the time it takes to generate returns. It only provides a snapshot of the profitability at a specific point in time.

- Non-Financial Factors: ROI does not account for non-financial factors such as brand reputation, customer satisfaction, or environmental impact, which can also impact the overall success of an investment.

- Accuracy of Data: The accuracy of ROI calculations depends on the accuracy of the data used. Inaccurate or incomplete data can lead to misleading ROI figures.

Financial Ratios: A Key Component of ROI Analysis

What are Financial Ratios?

Financial ratios are mathematical calculations that compare different financial variables to provide meaningful information about a company’s financial performance and position. These ratios help assess a company’s profitability, liquidity, solvency, and efficiency.

There are various types of financial ratios, each focusing on different aspects of a company’s financial performance. Some common financial ratios include:

- Profitability ratios: These ratios measure a company’s ability to generate profits and include metrics such as gross profit margin, net profit margin, and return on equity.

- Liquidity ratios: These ratios assess a company’s ability to meet its short-term obligations and include metrics such as current ratio and quick ratio.

- Solvency ratios: These ratios evaluate a company’s long-term financial stability and include metrics such as debt-to-equity ratio and interest coverage ratio.

- Efficiency ratios: These ratios measure how effectively a company utilizes its assets and include metrics such as inventory turnover ratio and accounts receivable turnover ratio.

Importance of Financial Ratios in ROI Analysis

For example, profitability ratios can help determine how effectively a company generates profits from its sales. A high net profit margin indicates that a company is efficient in controlling its costs and generating profits, which can lead to a higher ROI. On the other hand, a low net profit margin may indicate inefficiencies that can negatively impact the ROI.

Likewise, liquidity ratios provide insights into a company’s ability to meet its short-term obligations. A high current ratio indicates that a company has enough current assets to cover its current liabilities, which can contribute to a positive ROI. Conversely, a low current ratio may indicate liquidity issues that can hinder the ROI.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.