Add-On Interest: Definition, Formula, Cost vs Simple Interest

Add-On Interest is a method of calculating interest on a loan or investment that involves adding the interest to the principal amount upfront. This means that the interest is calculated on the total loan amount, including the interest that has already been added. It is commonly used in consumer loans, such as auto loans or personal loans.

The formula for calculating Add-On Interest is:

| Principal Amount | Interest Rate | Loan Term | Add-On Interest |

|---|---|---|---|

| $10,000 | 5% | 3 years | $10,000 * 5% * 3 = $1,500 |

In the example above, the principal amount is $10,000, the interest rate is 5%, and the loan term is 3 years. By using the Add-On Interest formula, we can calculate that the Add-On Interest for this loan would be $1,500.

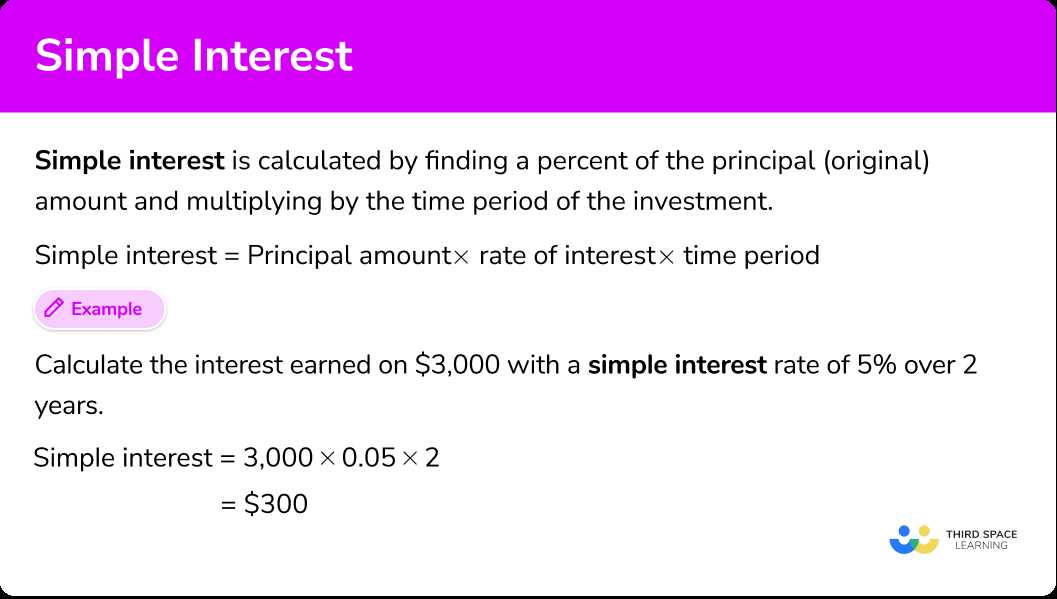

It is important to note that Add-On Interest is different from Simple Interest. With Simple Interest, the interest is calculated only on the principal amount. In contrast, Add-On Interest includes the interest that has already been added to the principal amount.

The cost of Add-On Interest can be higher compared to Simple Interest because the interest is calculated on the total loan amount upfront. This means that borrowers will end up paying more in interest over the life of the loan. Therefore, it is important for borrowers to carefully consider the cost of Add-On Interest before taking out a loan.

What is Add-On Interest?

Add-On Interest is a method of calculating interest on a loan or credit agreement. It is commonly used in consumer loans, such as car loans or personal loans. With add-on interest, the interest is calculated based on the original loan amount and then added to the principal. This total amount is then divided by the number of payments to determine the fixed monthly payment.

For example, let’s say you take out a $10,000 loan with an annual interest rate of 5% for a term of 3 years. With add-on interest, the interest is calculated based on the full $10,000 loan amount. So, the total interest would be $10,000 * 0.05 * 3 = $1,500. The total amount to be repaid would be $10,000 + $1,500 = $11,500. This total amount is then divided by the number of monthly payments to determine the fixed monthly payment.

Formula for Add-On Interest

The formula for calculating add-on interest is relatively simple. It involves multiplying the principal amount by the interest rate and the loan term, and then adding that result to the principal amount. The formula can be expressed as:

- Add-On Interest = Principal Amount * Interest Rate * Loan Term

Let’s break down the formula further:

- Principal Amount: This refers to the initial amount of money borrowed or invested.

- Interest Rate: This is the percentage charged on the principal amount for the loan term.

- Loan Term: This is the duration of the loan or investment, usually expressed in years or months.

For example, let’s say you borrow $10,000 with an interest rate of 5% for a loan term of 2 years. Using the add-on interest formula, the calculation would be:

- Add-On Interest = $10,000 * 0.05 * 2 = $1,000

Therefore, the total amount to be repaid would be $11,000 ($10,000 principal + $1,000 add-on interest).

Cost of Add-On Interest vs Simple Interest

When considering the cost of borrowing money, it is important to understand the difference between add-on interest and simple interest. While both methods determine the amount of interest paid on a loan, they calculate it in different ways, resulting in varying costs for the borrower.

Add-On Interest

Add-on interest is a method of calculating interest where the interest is determined at the beginning of the loan and added to the principal. This means that the borrower pays interest on the original principal amount for the entire loan term, regardless of whether the principal is paid off early or not. The interest is typically calculated based on the full loan term, even if the borrower plans to repay the loan sooner.

For example, let’s say you borrow $10,000 with a 5-year loan term and an interest rate of 10% per year. With add-on interest, the interest is calculated as 10% of the original principal ($10,000) for each year of the loan term. Therefore, the total interest paid would be $10,000 x 10% x 5 years = $5,000. This means that the total amount repaid would be $10,000 (principal) + $5,000 (interest) = $15,000.

Simple Interest

Using the same example as before, let’s say you borrow $10,000 with a 5-year loan term and an interest rate of 10% per year. With simple interest, the interest is calculated based on the outstanding principal balance each year. If you make regular monthly payments and reduce the principal balance over time, the total interest paid would be lower compared to add-on interest.

Cost Comparison

When comparing the cost of add-on interest vs simple interest, it is clear that add-on interest results in higher overall costs for the borrower. This is because the interest is calculated based on the original principal amount, regardless of whether the principal is paid off early or not. With simple interest, the interest is based on the outstanding principal balance, allowing borrowers to save on interest costs by paying off the loan sooner.

It is important for borrowers to carefully consider the type of interest being offered when taking out a loan. While add-on interest may seem convenient with its fixed interest amount, it can end up costing significantly more in the long run. Simple interest, on the other hand, offers more flexibility and potential savings for borrowers who are able to pay off their loans early.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.