What is Accounting Rate of Return?

To calculate the ARR, the average annual profit is divided by the initial investment cost and multiplied by 100 to express it as a percentage. The formula for ARR is as follows:

ARR = (Average Annual Profit / Initial Investment Cost) * 100

ARR provides a simple way to assess the profitability of an investment. It is commonly used by businesses to compare different investment opportunities and make informed decisions. A higher ARR indicates a more profitable investment, while a lower ARR suggests a less profitable one.

However, ARR has some limitations. It does not consider the time value of money, which means it does not account for the fact that money received in the future is worth less than money received today. Additionally, ARR does not consider the duration of the investment or the risk associated with it.

Despite these limitations, ARR is still a useful tool for evaluating investment opportunities, especially for small businesses or projects with a shorter time horizon. It provides a quick and easy way to assess the potential profitability of an investment and make informed decisions.

Definition, Calculation, and Example of Accounting Rate of Return

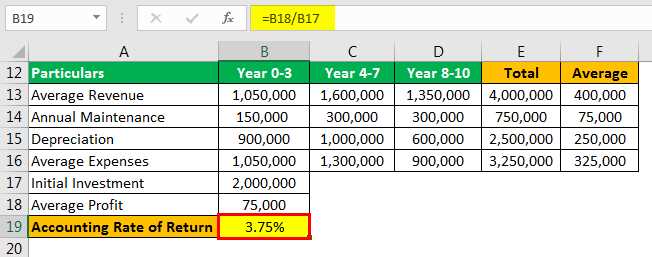

Calculation of Accounting Rate of Return

The formula to calculate the accounting rate of return is as follows:

ARR = (Average Annual Profit / Initial Investment) x 100

To calculate the average annual profit, you need to subtract the initial investment cost from the total profit generated over a specific period, usually the useful life of the investment. The initial investment cost includes the purchase price of assets, installation costs, and any other related expenses.

Once you have the average annual profit, divide it by the initial investment and multiply the result by 100 to get the ARR as a percentage.

Example of Accounting Rate of Return

Let’s say a company invests $100,000 in a new project. Over the next five years, the project generates a total profit of $50,000. To calculate the ARR, you need to find the average annual profit.

First, divide the total profit by the number of years:

Average Annual Profit = Total Profit / Number of Years

Average Annual Profit = $50,000 / 5 = $10,000

Next, calculate the ARR using the formula:

ARR = (Average Annual Profit / Initial Investment) x 100

ARR = ($10,000 / $100,000) x 100 = 10%

The ARR is useful for comparing different investment opportunities and determining their profitability. However, it has limitations and should be used in conjunction with other financial metrics to make informed investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.