What is Plain Vanilla?

Plain Vanilla is a term used in finance to describe a simple and basic financial instrument or investment strategy. It refers to a standard, straightforward, and commonly used financial product that does not have any special or unique features. The term “plain vanilla” is often used to contrast with more complex or exotic financial instruments.

Plain vanilla investments are typically characterized by their simplicity and low level of risk. They are commonly understood and widely available to investors. Examples of plain vanilla investments include stocks, bonds, mutual funds, and basic options contracts.

Characteristics of Plain Vanilla Investments

Plain vanilla investments have several key characteristics:

- Standardized: Plain vanilla investments have standardized terms and features, making them easy to understand and compare.

- Liquidity: They are typically highly liquid, meaning they can be easily bought or sold on the market.

- Low Complexity: Plain vanilla investments have a low level of complexity, making them suitable for investors with limited knowledge or experience.

- Low Cost: They often have lower fees and expenses compared to more complex financial products.

- Low Risk: Plain vanilla investments are generally considered to have lower risk compared to more complex or speculative investments.

Advantages of Plain Vanilla Investments

There are several advantages to investing in plain vanilla investments:

- Accessibility: Plain vanilla investments are widely available and accessible to a wide range of investors.

- Liquidity: They can be easily bought or sold, providing investors with flexibility and the ability to quickly access their funds.

- Transparency: Plain vanilla investments have clear and transparent terms, making it easier for investors to understand the risks and potential returns.

- Diversification: Plain vanilla investments can be used to build a diversified portfolio, spreading risk across different asset classes.

Disadvantages of Plain Vanilla Investments

While plain vanilla investments have their advantages, there are also some disadvantages to consider:

- Potential for Lower Returns: Plain vanilla investments may offer lower potential returns compared to more complex or higher-risk investments.

- Limited Customization: They may not offer the same level of customization or tailored features as more complex financial products.

- Market Volatility: Plain vanilla investments are still subject to market volatility and can experience fluctuations in value.

Definition of Plain Vanilla in Finance

In finance, the term “plain vanilla” refers to a basic, standard, or simple financial instrument or investment strategy that does not have any special features or complex structures. It is a term used to describe the most common and straightforward type of investment or financial product.

Characteristics of Plain Vanilla Investments

Plain vanilla investments can take various forms, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). These investments are typically characterized by the following:

- Standardized: Plain vanilla investments are standardized and widely available in the market. They have a common structure and are easily accessible to individual investors.

- Liquidity: They are highly liquid, meaning they can be easily bought or sold in the market without causing significant price fluctuations.

- Low Complexity: Plain vanilla investments have simple structures and are easy to understand. They do not involve complex derivatives or intricate features.

- Low Risk: These investments are generally considered to have lower levels of risk compared to more complex or speculative investments. They provide a stable and predictable return over time.

- Lower Returns: Due to their lower risk profile, plain vanilla investments may offer relatively lower returns compared to riskier investments. However, they are often preferred by conservative investors seeking stability and capital preservation.

Examples of Plain Vanilla Investments

Some examples of plain vanilla investments include:

- Stocks: Common shares of well-established companies that are traded on major stock exchanges.

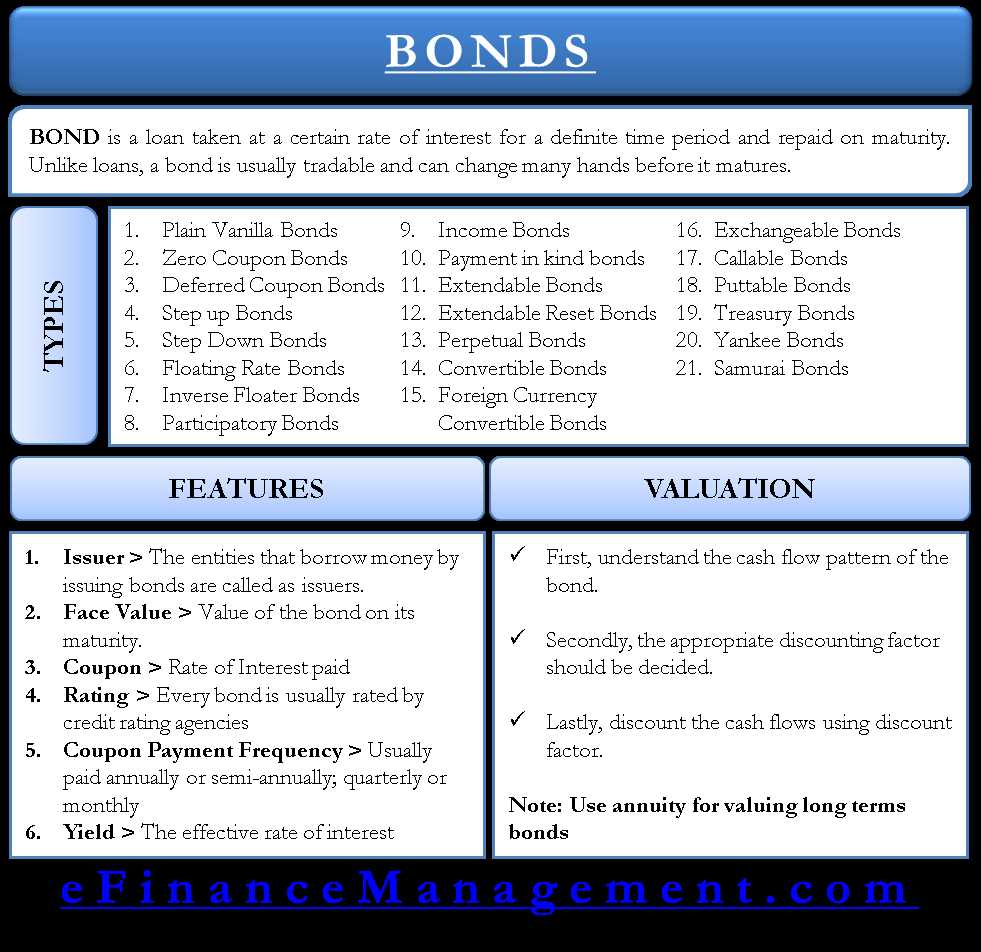

- Bonds: Government or corporate bonds with fixed interest payments and a predetermined maturity date.

- Mutual Funds: Investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

- ETFs: Exchange-traded funds that track a specific index or sector and can be bought or sold on stock exchanges.

Overall, plain vanilla investments provide a simple and straightforward way for investors to participate in the financial markets without the complexities and risks associated with more exotic or specialized investments. They are suitable for conservative investors who prioritize stability and capital preservation over higher returns.

How Plain Vanilla is Used in Investing

Another way plain vanilla investments are used is through bonds. Government bonds, for example, are considered plain vanilla because they are issued by a government entity and have a fixed interest rate and maturity date. These bonds are seen as low-risk investments and are often used by investors who prioritize capital preservation.

Plain vanilla investments are also commonly used in retirement savings accounts, such as 401(k)s and IRAs. These accounts often offer a selection of plain vanilla investment options, such as mutual funds and target-date funds. These options provide investors with a diversified portfolio and a long-term investment strategy.

One of the advantages of using plain vanilla investments is their simplicity. They are easy to understand and require minimal research and analysis. This makes them suitable for beginner investors or those who prefer a hands-off approach to investing.

However, there are also some disadvantages to plain vanilla investments. They may not offer the potential for high returns compared to more complex investment strategies. Additionally, they may not be suitable for investors who have specific investment goals or risk tolerance.

Advantages and Disadvantages of Plain Vanilla Investments

Advantages

1. Simplicity: Plain vanilla investments are straightforward and easy to understand. They typically involve buying and holding common investment vehicles such as stocks, bonds, or mutual funds. This simplicity makes them accessible to a wide range of investors, including those with limited investment knowledge or experience.

2. Liquidity: Plain vanilla investments are often highly liquid, meaning they can be easily bought or sold on the market. This liquidity provides investors with flexibility and the ability to quickly access their funds when needed.

3. Diversification: Plain vanilla investments offer opportunities for diversification. By investing in a variety of assets, such as stocks from different sectors or bonds with different maturities, investors can spread their risk and potentially reduce the impact of any single investment’s performance on their overall portfolio.

Disadvantages

1. Limited Potential for High Returns: Plain vanilla investments are generally considered to have lower potential for high returns compared to more complex investment strategies. While they offer stability and consistency, they may not provide the same level of growth as riskier or more specialized investments.

2. Lack of Customization: Plain vanilla investments are standardized and offer limited customization options. This means that investors may not be able to tailor their investments to their specific needs or preferences. They are typically designed to meet the needs of a broad range of investors, which may not align with individual goals or risk tolerance.

3. Market Volatility: Plain vanilla investments are still subject to market volatility and fluctuations. While they may be considered less risky than some alternative investment strategies, they are not immune to market downturns. Investors should be prepared for potential losses and be able to weather market fluctuations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.