What Is a Fixed Annuity?

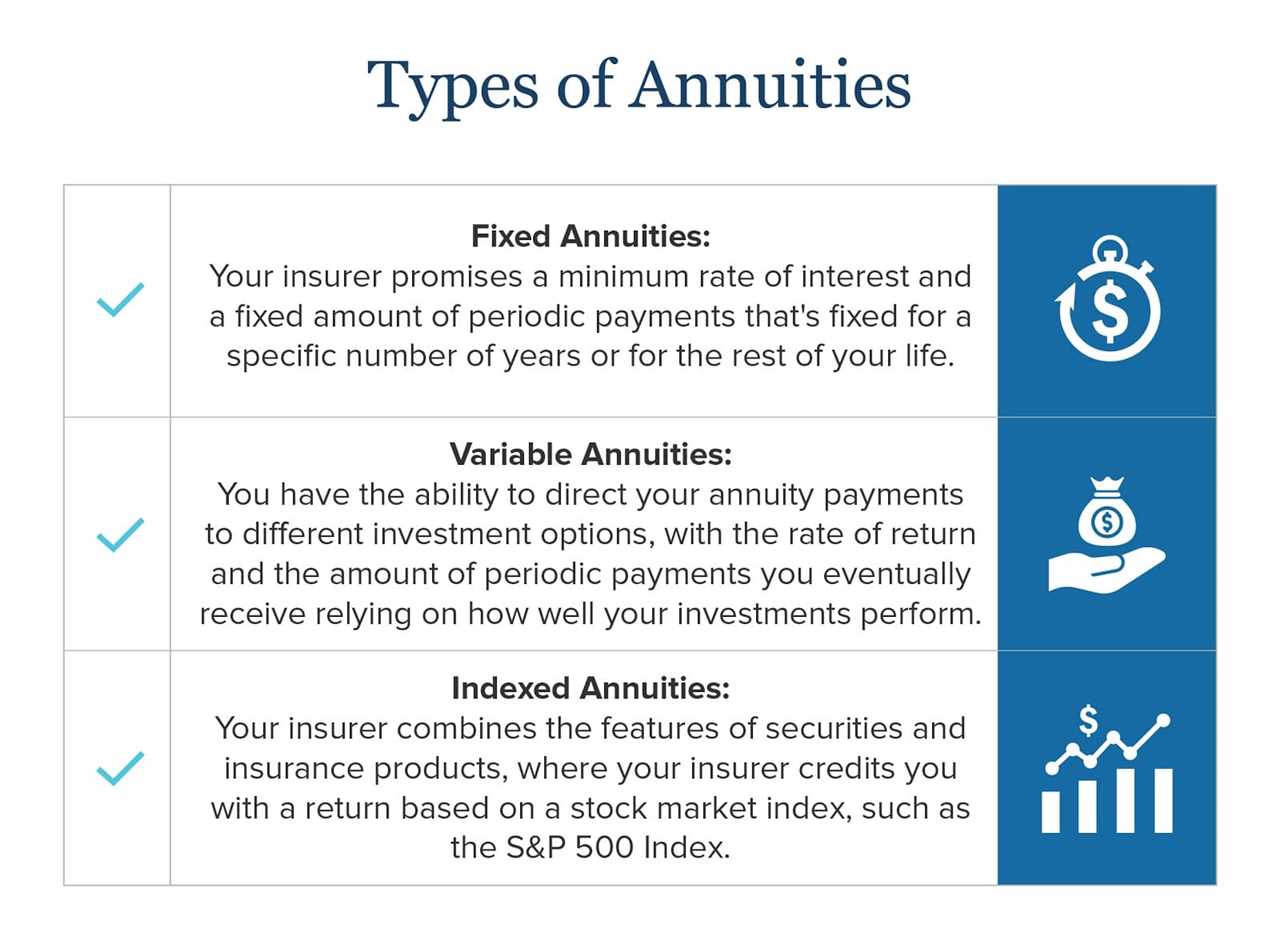

A fixed annuity is a type of investment product that offers a guaranteed rate of return over a specific period of time. It is a contract between an individual and an insurance company, where the individual makes a lump sum payment or a series of payments to the insurance company in exchange for a guaranteed income stream in the future.

Unlike variable annuities, which are tied to the performance of underlying investments, fixed annuities provide a fixed interest rate that is determined by the insurance company. This means that regardless of market fluctuations, the individual will receive a predetermined amount of income during the annuity’s payout phase.

One of the main advantages of fixed annuities is their stability and predictability. The guaranteed rate of return ensures that the individual will receive a consistent income stream, regardless of market conditions. This can provide peace of mind and financial security, especially for individuals who are risk-averse or nearing retirement.

However, there are also some drawbacks to consider. Fixed annuities typically have lower returns compared to other investment options, such as stocks or mutual funds. Additionally, there may be fees and penalties associated with early withdrawals or surrendering the annuity before the end of the contract term.

A fixed annuity is a type of investment product that provides a guaranteed income stream for a specified period of time. It is a contract between an individual and an insurance company, where the individual makes a lump sum payment or a series of payments to the insurance company, and in return, the insurance company promises to pay the individual a fixed amount of income on a regular basis.

Fixed annuities also offer the option to include a death benefit, which guarantees that the individual’s beneficiaries will receive a certain amount of money upon their death. This can provide peace of mind for individuals who want to ensure that their loved ones are financially protected.

Investing in Fixed Annuities: Benefits and Risks

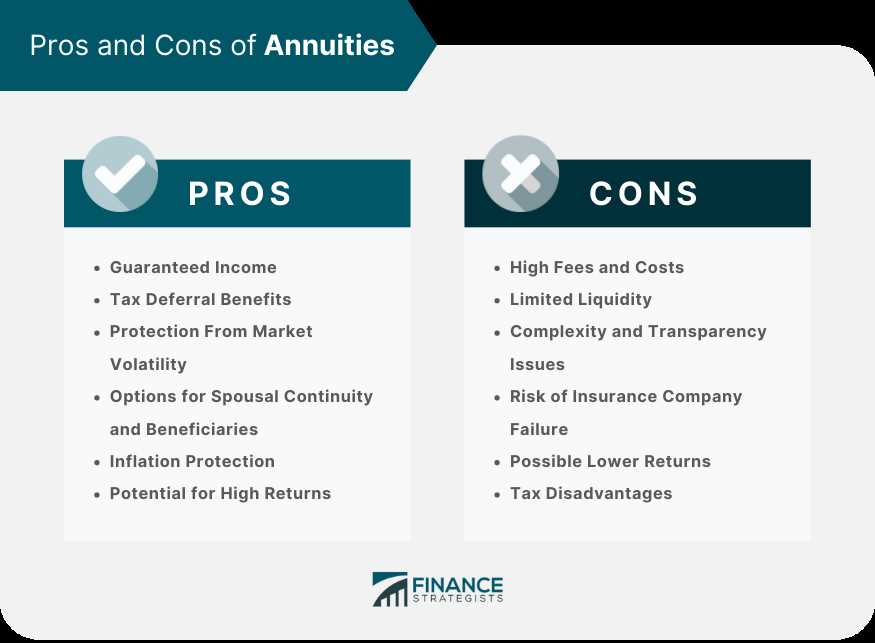

Benefits of Investing in Fixed Annuities:

2. Tax-Deferred Growth: Fixed annuities offer tax-deferred growth, meaning that you do not have to pay taxes on the earnings until you withdraw the funds. This can be advantageous for individuals looking to maximize their investment returns.

3. Protection Against Market Volatility: Unlike other investment options such as stocks or mutual funds, fixed annuities are not subject to market fluctuations. This can be appealing for individuals who are risk-averse and want to protect their principal investment.

Risks of Investing in Fixed Annuities:

1. Limited Growth Potential: While fixed annuities provide a guaranteed rate of return, the growth potential is often lower compared to other investment options. This means that individuals may not be able to fully capitalize on market upswings.

2. Lack of Liquidity: Fixed annuities typically have a surrender period, which is a specific period of time during which you cannot access your funds without incurring penalties. This lack of liquidity can be a disadvantage for individuals who may need immediate access to their money.

3. Inflation Risk: Fixed annuities may not keep pace with inflation, meaning that the purchasing power of your income stream may decrease over time. It is important to consider inflation when evaluating the long-term viability of fixed annuities.

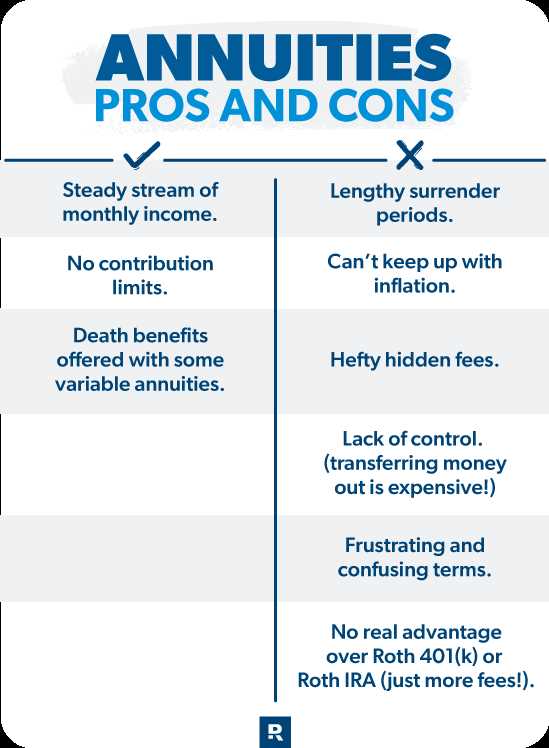

Exploring the Pros and Cons of Fixed Annuities

Pros of Fixed Annuities

- Guaranteed Income: One of the biggest advantages of fixed annuities is the guaranteed income they provide. With a fixed annuity, you receive a predetermined amount of money at regular intervals, typically monthly or annually. This can provide a stable source of income during retirement.

- Tax-Deferred Growth: Another benefit of fixed annuities is the tax-deferred growth they offer. The money you invest in a fixed annuity grows tax-free until you start making withdrawals. This can help your investment grow faster over time.

- Protection from Market Volatility: Fixed annuities offer protection from market volatility. Unlike other investments, the value of a fixed annuity is not affected by changes in the stock market. This can provide peace of mind, especially during times of economic uncertainty.

- Flexibility in Payout Options: Fixed annuities offer flexibility in payout options. You can choose to receive a fixed amount of income for a specific period of time or for the rest of your life. This allows you to tailor your annuity to meet your individual needs and financial goals.

Cons of Fixed Annuities

- Low Potential for Growth: While fixed annuities offer guaranteed income, they typically have a lower potential for growth compared to other investment options. The interest rates on fixed annuities are often lower than the returns you could potentially earn from stocks or mutual funds.

- Limited Access to Funds: Fixed annuities have a surrender period, which is a predetermined length of time during which you cannot access your funds without incurring penalties. This lack of liquidity can be a disadvantage if you need immediate access to your money.

- Loss of Purchasing Power: Inflation can erode the purchasing power of the fixed income provided by annuities. If the rate of inflation exceeds the rate of return on your annuity, your income may not keep up with rising living expenses.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.