Venture Capitalists: Definition and Role

Venture capitalists play a crucial role in the business world, particularly in the realm of private equity and venture capital. They are individuals or firms that provide funding to startups and early-stage companies in exchange for equity or ownership stakes.

Unlike traditional lenders, venture capitalists take on higher risks by investing in companies that have limited operating history and uncertain future prospects. They provide not only financial support but also mentorship, industry expertise, and networking opportunities to help these companies grow and succeed.

One of the key roles of venture capitalists is to identify promising investment opportunities. They carefully evaluate business plans, market potential, and management teams to determine the viability of a startup. This due diligence process helps them make informed investment decisions and mitigate risks.

Once invested, venture capitalists actively participate in the strategic decision-making of the companies they fund. They provide guidance and support, helping entrepreneurs navigate challenges and capitalize on opportunities. Their experience and network can open doors to new partnerships, customers, and investors.

Furthermore, venture capitalists play a vital role in the growth and development of the overall economy. By funding innovative and high-potential startups, they fuel job creation, technological advancements, and economic growth. Their investments often have a ripple effect, attracting additional capital and fostering a thriving entrepreneurial ecosystem.

In summary, venture capitalists are essential players in the business world, driving innovation and growth. Through their financial backing, expertise, and guidance, they help startups and early-stage companies turn their ideas into successful businesses.

What is Venture Capital?

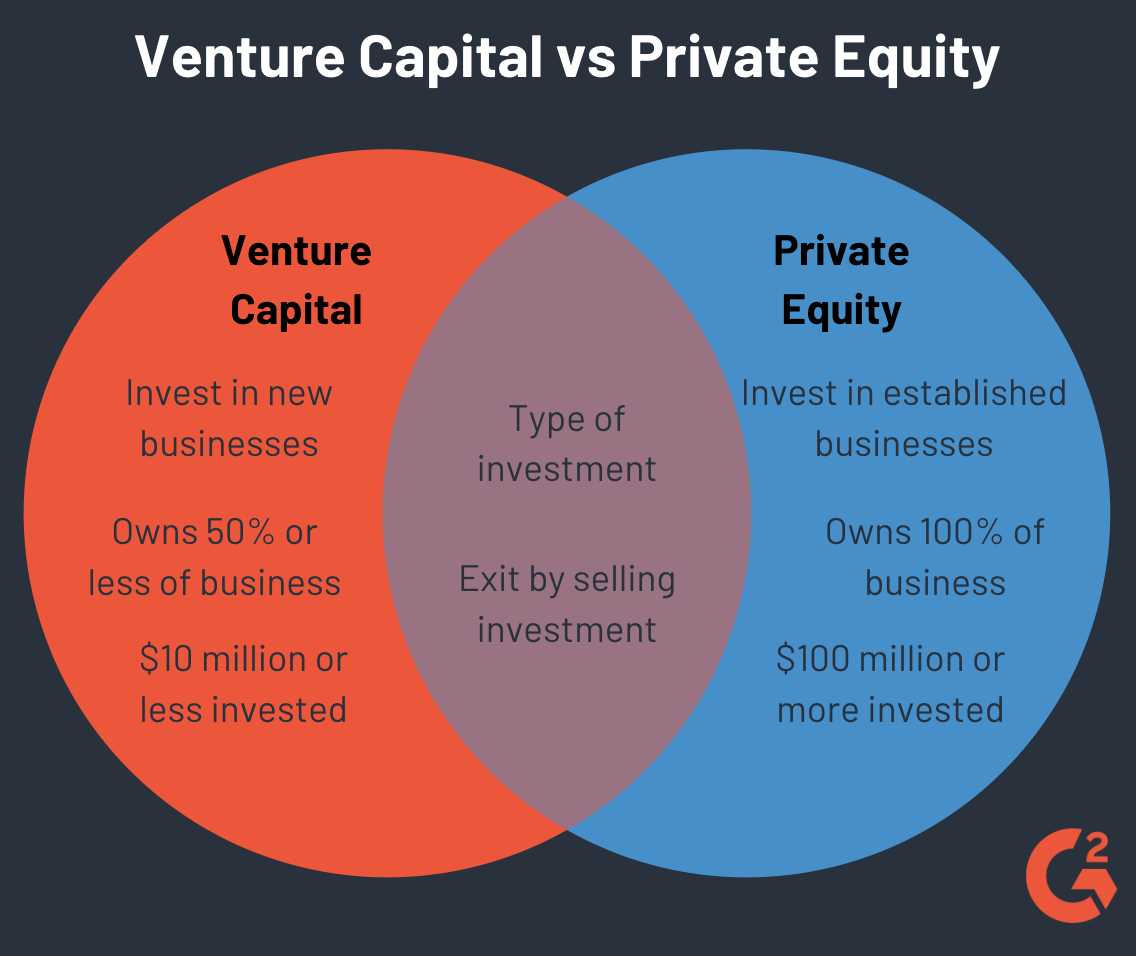

Venture capital is a form of private equity financing that is provided by investors to startup companies and small businesses that have the potential for high growth. It is typically provided to companies that are in the early stages of development and have a high risk of failure.

Unlike traditional bank loans, venture capital is not repaid through regular interest payments and principal repayments. Instead, venture capitalists invest in companies in exchange for equity or ownership stakes. This means that they become part owners of the company and share in its profits and losses.

Venture capital is often sought by entrepreneurs who have innovative ideas or business models that require a significant amount of capital to bring to market. It is also used by companies that are looking to expand rapidly or enter new markets.

When venture capitalists invest in a company, they typically provide not only financial capital but also strategic guidance and industry expertise. They often take an active role in the management of the company and help to shape its growth and development.

Overall, venture capital plays a crucial role in the business world by providing funding and support to startups and small businesses that have the potential to become successful and create jobs. It helps to fuel innovation and economic growth, and has been instrumental in the success of many well-known companies.

Role of Venture Capitalists

Venture capitalists play a crucial role in the business world by providing funding and support to start-up companies and small businesses. Their primary objective is to identify and invest in companies with high growth potential, in exchange for equity or ownership stakes.

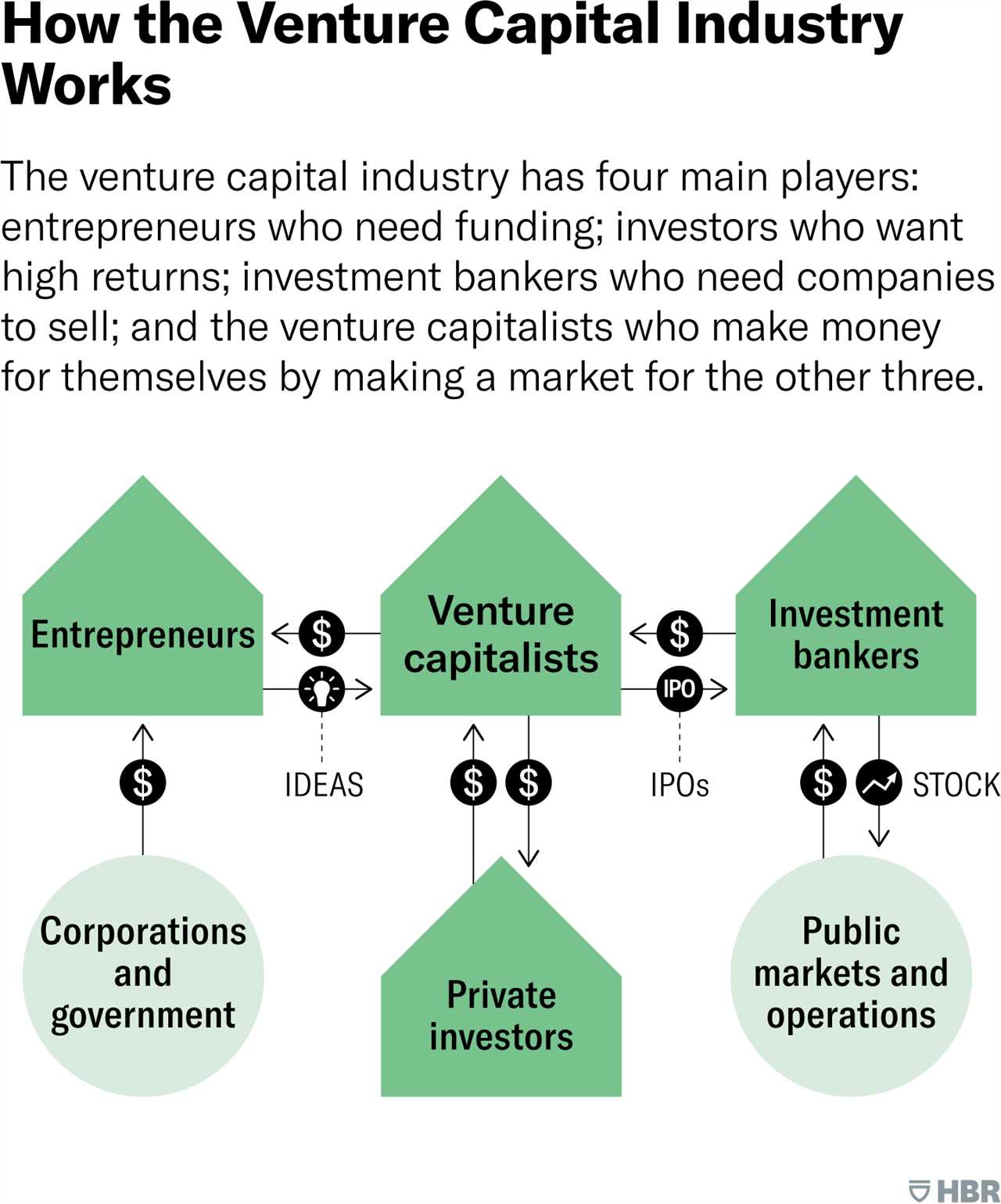

One of the key roles of venture capitalists is to act as financial intermediaries between investors and entrepreneurs. They raise capital from various sources, such as institutional investors, high-net-worth individuals, and corporate entities, and then allocate these funds to promising start-ups and early-stage companies.

In addition to providing capital, venture capitalists also offer valuable expertise, guidance, and mentorship to the companies they invest in. They often have extensive networks and industry knowledge, which they leverage to help their portfolio companies grow and succeed.

Furthermore, venture capitalists actively participate in the strategic decision-making process of the companies they invest in. They may sit on the company’s board of directors and provide input on key business decisions, such as product development, market expansion, and hiring strategies.

Another important role of venture capitalists is to help companies navigate the complex process of scaling their operations and achieving profitability. They provide ongoing support and resources to help companies overcome challenges and seize growth opportunities.

Overall, venture capitalists play a vital role in fostering innovation, job creation, and economic growth. By investing in early-stage companies and providing them with the necessary resources, they help drive entrepreneurial activity and contribute to the development of new technologies, products, and services.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.