What are Discontinued Operations?

Discontinued operations refer to the cessation of a segment or business unit within a company. This can occur due to various reasons such as strategic decisions, changes in market conditions, or poor performance. When a company decides to discontinue an operation, it is required to report it separately in its financial statements.

Discontinued operations can include the sale or disposal of a business segment, the closure of a manufacturing facility, or the discontinuation of a product line. These operations are considered separate from the ongoing activities of the company and are reported separately to provide transparency to investors and stakeholders.

When an operation is classified as discontinued, the company needs to meet certain criteria. Firstly, the operation must represent a separate major line of business or a geographical area of operations. Secondly, the discontinuation must have a significant impact on the company’s financial results, either in terms of revenue or expenses. Finally, the operation must have been disposed of or be classified as held for sale.

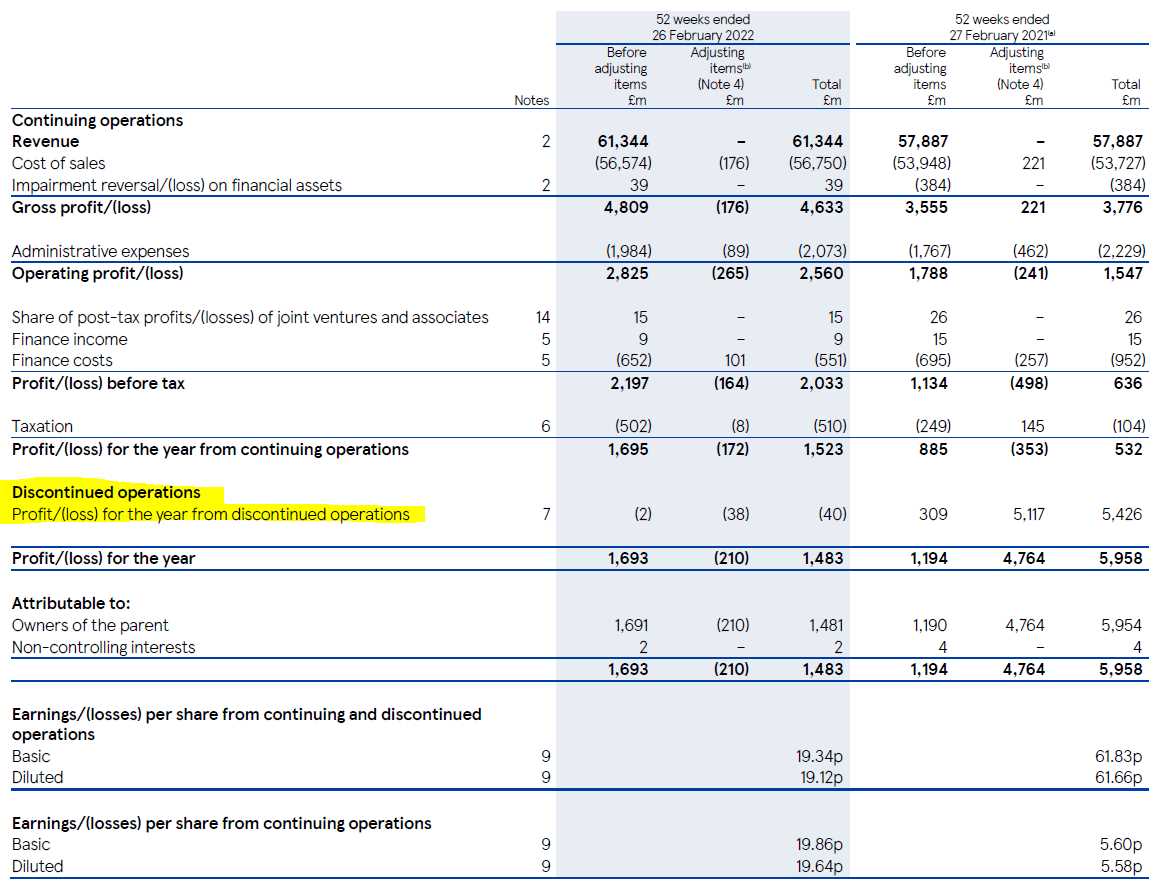

Once an operation is classified as discontinued, the company needs to report the financial results of that operation separately. This includes presenting the income, expenses, and taxes related to the discontinued operation as a separate line item in the income statement. Additionally, the company needs to disclose any gain or loss on the disposal of the operation and provide relevant details in the footnotes to the financial statements.

Reporting discontinued operations is important as it allows investors and stakeholders to understand the financial impact of the discontinued operation on the company’s overall performance. It provides transparency and helps in making informed investment decisions. It also helps in evaluating the company’s strategic decisions and its ability to manage and adapt to changing market conditions.

Importance of Reporting Discontinued Operations

Reporting discontinued operations is an essential part of financial reporting for businesses. It provides transparency and clarity to stakeholders, including investors, creditors, and regulators. The reporting process allows these parties to understand the financial impact of discontinued operations on the overall performance of the company.

There are several reasons why reporting discontinued operations is important:

| 1. Decision-making: | Reporting discontinued operations helps stakeholders make informed decisions about the company. It provides them with information about the financial consequences of discontinuing a particular segment or business line. This information is crucial for investors and creditors when evaluating the company’s future prospects and assessing its risk profile. |

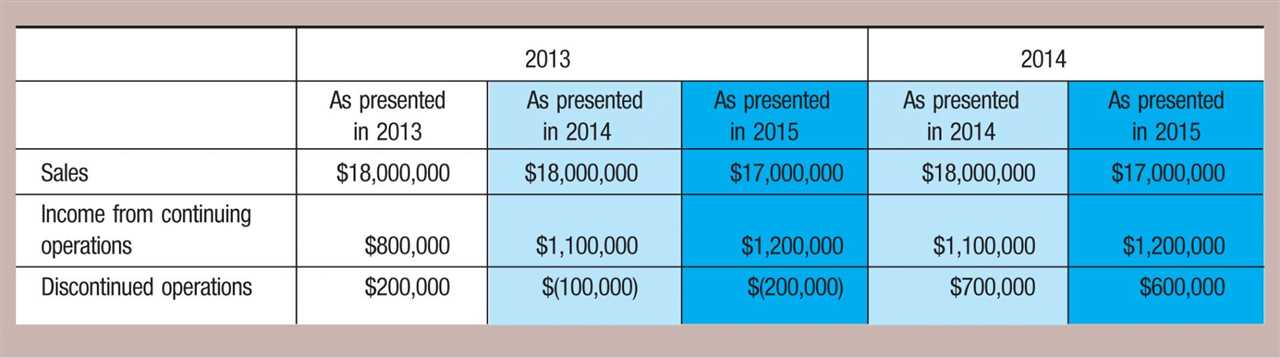

| 2. Comparability: | By reporting discontinued operations separately, companies ensure comparability of financial statements over time. This allows stakeholders to analyze the performance of the ongoing operations without the influence of discontinued operations. It also helps in evaluating the company’s ability to generate sustainable profits. |

| 3. Transparency: | Reporting discontinued operations enhances the transparency of financial reporting. It provides a clear picture of the company’s financial performance and allows stakeholders to understand the reasons behind the discontinuation of a particular segment or business line. This transparency builds trust and confidence among stakeholders. |

| 4. Compliance: | Reporting discontinued operations is a requirement under accounting standards, such as International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). Companies need to comply with these standards to ensure the accuracy and reliability of their financial statements. Non-compliance can result in penalties and legal consequences. |

Reporting Process for Discontinued Operations

When a company decides to discontinue a segment of its business, it is important to follow a proper reporting process to ensure transparency and accuracy in financial statements. The reporting process for discontinued operations typically involves the following steps:

- Identification: The first step is to identify the specific segment or business unit that is being discontinued. This could be a product line, a division, or an entire subsidiary.

- Measurement: Once the discontinued segment has been identified, it is necessary to measure its assets, liabilities, and any associated costs. This includes determining the fair value of any assets to be sold or disposed of.

- Separate Presentation: The financial results of the discontinued segment should be presented separately from the continuing operations in the company’s financial statements. This allows investors and stakeholders to clearly see the impact of the discontinued operations on the company’s overall performance.

- Disclosure: The company must provide detailed disclosures about the discontinued operations in the footnotes to the financial statements. This includes information about the reasons for the discontinuation, the financial impact, and any significant risks or uncertainties associated with the discontinuation.

- Gain or Loss Calculation: If the discontinued segment is sold or disposed of, the company must calculate any gain or loss on the transaction. This involves comparing the fair value of the assets sold or disposed of with their carrying value on the company’s books.

- Reporting: The gain or loss from the discontinued operations, as well as any related tax effects, should be reported separately on the company’s income statement. This allows investors and stakeholders to easily assess the financial impact of the discontinued operations.

Following this reporting process ensures that the financial statements accurately reflect the impact of discontinued operations on a company’s financial performance. It provides transparency to investors and stakeholders, allowing them to make informed decisions about the company’s future prospects.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.