What is a Blind Trust?

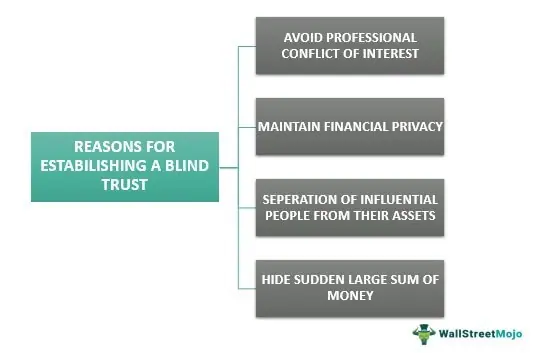

A blind trust is a financial arrangement in which a person’s assets are placed under the control of an independent trustee. The purpose of a blind trust is to avoid conflicts of interest and maintain the privacy of the individual. In a blind trust, the beneficiary is unaware of the specific investments made on their behalf, hence the term “blind.”

The trustee, who can be a financial institution or an individual, has full discretion over the management and investment of the assets in the blind trust. They make all investment decisions without consulting or seeking approval from the beneficiary. This separation of control helps to eliminate any potential bias or influence that the beneficiary may have over their investments.

Blind trusts are commonly used by politicians, high-ranking government officials, and business executives who want to avoid accusations of impropriety or conflicts of interest. By placing their assets in a blind trust, these individuals can distance themselves from their financial interests and focus on their public duties without the appearance of favoritism or personal gain.

Blind trusts are also used in estate planning to protect the assets of beneficiaries. By placing assets in a blind trust, the grantor can ensure that the beneficiary will not have direct control over the assets, which can be beneficial in situations where the beneficiary may not have the necessary financial knowledge or may be vulnerable to manipulation.

Overall, blind trusts provide a level of transparency and accountability in managing assets, while also protecting the privacy and integrity of the beneficiary. They serve as a tool to mitigate conflicts of interest and maintain public trust in individuals holding positions of power or influence.

How Does a Blind Trust Work?

A blind trust is a financial arrangement in which a trustee holds and manages assets on behalf of a beneficiary, without the beneficiary having knowledge or control over the specific investments. The purpose of a blind trust is to eliminate conflicts of interest and maintain the integrity of the beneficiary’s decision-making process.

When setting up a blind trust, the beneficiary transfers their assets, such as stocks, bonds, or real estate, to the trustee. The trustee, who can be an individual or a financial institution, then assumes responsibility for managing these assets according to a predetermined investment strategy.

Blind trusts are commonly used by politicians, high-ranking government officials, and individuals in sensitive positions to avoid potential conflicts of interest. By placing their assets in a blind trust, these individuals can separate themselves from their financial interests and focus on their public or professional duties without the perception of bias or impropriety.

Blind trusts typically have a specific duration, after which the assets are returned to the beneficiary. During this period, the trustee manages the assets based on the agreed-upon investment strategy, which may include diversification, risk management, and long-term growth objectives.

In some cases, blind trusts may include a provision for the trustee to consult with the beneficiary on certain decisions. However, the final decision-making authority lies with the trustee, ensuring that the beneficiary remains insulated from any conflicts of interest.

Overall, the functioning of a blind trust is designed to protect the beneficiary’s interests and maintain transparency in their financial affairs. By relinquishing control over their assets, the beneficiary can focus on their responsibilities without being influenced by personal financial considerations.

Real-Life Examples of Blind Trusts

Blind trusts are commonly used by politicians, high-profile individuals, and business executives to avoid conflicts of interest and maintain transparency in their financial dealings. Here are some real-life examples of blind trusts:

1. Warren Buffett

Warren Buffett, one of the world’s most successful investors, established a blind trust to manage his vast wealth. The trust was set up to ensure that his investments are made without his direct knowledge or involvement. This allows him to focus on his philanthropic activities and avoid any potential conflicts of interest.

2. Donald Trump

3. Mark Zuckerberg

4. Mitt Romney

During his presidential campaign in 2012, Mitt Romney placed his assets in a blind trust to avoid any conflicts of interest. The trust was managed by an independent trustee, who made investment decisions on Romney’s behalf without his knowledge or input. This allowed Romney to focus on his campaign without being influenced by his personal financial interests.

These examples highlight the importance of blind trusts in maintaining transparency and avoiding conflicts of interest in various fields. By delegating the management of their assets to independent trustees, individuals can ensure that their financial interests do not interfere with their professional responsibilities.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.