Structure of Bank Account Numbers

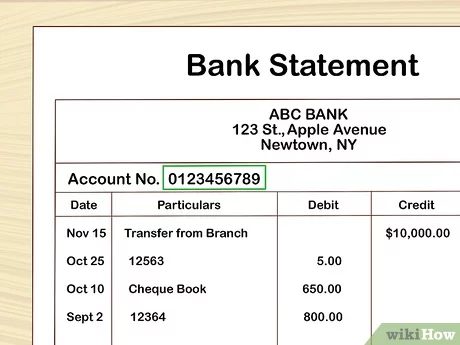

Bank account numbers typically consist of a series of digits that are arranged in a specific format. The structure of a bank account number can vary depending on the country and the financial institution. However, there are some common elements that can be found in most bank account numbers.

1. Bank Identifier

The first few digits of a bank account number usually represent the bank identifier. This is a code that identifies the financial institution where the account is held. The bank identifier can be used to determine the bank’s name, location, and other relevant information.

2. Branch Identifier

Following the bank identifier, there is often a branch identifier. This is a code that identifies the specific branch of the bank where the account is held. The branch identifier can provide information about the location and operations of the branch.

3. Account Type

Next, there may be a code that indicates the type of account. This can include savings accounts, checking accounts, or other specialized accounts offered by the financial institution. The account type code can provide information about the features and benefits associated with the account.

4. Account Number

The remaining digits in the bank account number typically represent the account number itself. This is a unique identifier that distinguishes one account from another within the same branch and financial institution. The account number can be used to access and manage the account.

It is important to note that the specific structure of a bank account number can vary depending on the country and the financial institution. Some countries may have longer or shorter account numbers, and some financial institutions may use additional codes or identifiers in their account numbers.

How to Read a Bank Account Number

1. Bank Identifier: The first few digits of a bank account number typically represent the bank identifier. This identifies the specific bank where the account is held. It is important to note that different banks may have different lengths for their bank identifiers.

2. Branch Identifier: Following the bank identifier, there may be additional digits that represent the branch identifier. This helps identify the specific branch or location of the bank where the account is held. Not all bank account numbers include a branch identifier, as it depends on the bank’s format.

3. Account Type: Some bank account numbers may include digits that indicate the type of account. For example, a savings account may have a different account type digit than a checking account. This can provide additional information about the account and its purpose.

4. Account Number: The remaining digits in the bank account number represent the unique account number assigned to an individual. This is the specific identifier for the account and is used for transactions and other banking activities.

5. Check Digit: In some cases, a bank account number may include a check digit at the end. This digit is used as a form of error detection, ensuring that the account number is entered correctly. The check digit is calculated using a specific algorithm and can help prevent errors in processing.

When reading a bank account number, it is important to pay attention to each element and understand its significance. This can help ensure that the account number is entered correctly and that transactions are processed accurately. If you are unsure about any part of the bank account number, it is best to contact your bank for clarification.

Importance of Bank Account Numbers

Bank account numbers play a crucial role in the banking system and are essential for various financial transactions. They serve as unique identifiers for individual bank accounts and help ensure accuracy and security in financial transactions.

Here are some key reasons why bank account numbers are important:

1. Identification

Bank account numbers are used to identify individual bank accounts. Each account is assigned a unique number, which helps distinguish it from other accounts held by the same bank or other financial institutions. This identification is crucial for accurate and efficient processing of transactions.

2. Fund Transfers

Bank account numbers are necessary for transferring funds between different accounts. When initiating a transfer, the sender needs to provide the recipient’s bank account number to ensure that the funds are deposited into the correct account. Without the correct account number, the transfer may fail or be sent to the wrong account.

3. Direct Deposits

Many individuals receive their salaries, pensions, or other regular payments through direct deposit. In such cases, the payer needs the recipient’s bank account number to deposit the funds directly into their account. This eliminates the need for physical checks and enables faster and more convenient payment processing.

4. Automatic Bill Payments

Bank account numbers are also used for setting up automatic bill payments. By providing their account number to service providers, individuals can authorize them to deduct the payment amount directly from their bank account. This ensures timely payment of bills and eliminates the need for manual intervention.

5. Account Verification

Bank account numbers are often used to verify the authenticity of an account. When conducting financial transactions or applying for certain services, individuals may be required to provide their bank account number as a form of verification. This helps prevent fraudulent activities and ensures that only authorized individuals can access the account.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.