What is Up-Market Capture Ratio?

The Up-Market Capture Ratio is a financial metric used to evaluate the performance of an investment portfolio in relation to a specific benchmark during periods of positive market returns. It measures the ability of a portfolio to outperform the benchmark during bullish market conditions.

When the market is experiencing an upswing, investors typically expect their portfolios to generate positive returns. The Up-Market Capture Ratio helps investors assess whether their portfolio is able to capture a significant portion of the market’s gains or if it lags behind the benchmark.

Importance of Up-Market Capture Ratio

The Up-Market Capture Ratio is an important tool for investors as it provides insights into how well a portfolio performs during favorable market conditions. It helps investors understand whether their investment strategy is effective in capitalizing on upward market movements and generating positive returns.

By analyzing the Up-Market Capture Ratio, investors can evaluate the skill of portfolio managers in selecting securities that outperform the market during bullish periods. It also helps investors compare different investment options and assess which ones have a higher potential for generating returns when the market is performing well.

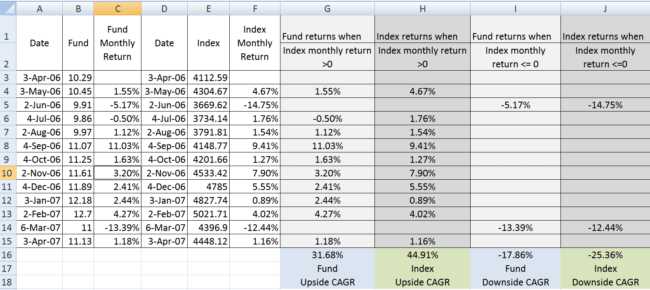

Calculation of Up-Market Capture Ratio

The Up-Market Capture Ratio is calculated by dividing the percentage return of the portfolio during up-market periods by the percentage return of the benchmark during the same periods. The formula is as follows:

| Up-Market Capture Ratio | = | (Portfolio Return during Up-Market Periods) / (Benchmark Return during Up-Market Periods) |

|---|

The Up-Market Capture Ratio is usually expressed as a percentage. A ratio greater than 100% indicates that the portfolio has outperformed the benchmark during up-market periods, while a ratio less than 100% suggests underperformance.

It is important to note that the calculation of the Up-Market Capture Ratio requires accurate data on the returns of both the portfolio and the benchmark during up-market periods.

Calculation of Up-Market Capture Ratio

The up-market capture ratio is a measure used in portfolio management to assess how well a portfolio performs relative to a benchmark during periods of positive market returns. It helps investors understand how much of the market’s upside potential a portfolio is able to capture.

To calculate the up-market capture ratio, you need to follow these steps:

Step 1: Determine the time period

First, you need to determine the time period for which you want to calculate the up-market capture ratio. This could be a month, a quarter, a year, or any other specific time frame.

Step 2: Collect the benchmark returns

Next, collect the returns of the benchmark index for the chosen time period. The benchmark index represents the overall market performance and serves as a comparison for the portfolio’s performance.

Step 3: Collect the portfolio returns

Collect the returns of the portfolio for the same time period. The portfolio returns represent the performance of the investment portfolio during the specified time frame.

Step 4: Calculate the up-market capture ratio

To calculate the up-market capture ratio, divide the portfolio’s returns by the benchmark’s returns and multiply by 100. The formula is as follows:

Up-Market Capture Ratio = (Portfolio Returns / Benchmark Returns) * 100

The resulting value represents the percentage of the benchmark’s returns that the portfolio was able to capture during the specified time period. A value greater than 100 indicates that the portfolio outperformed the benchmark, while a value less than 100 indicates underperformance.

For example, if the portfolio returns are 10% and the benchmark returns are 8%, the up-market capture ratio would be (10% / 8%) * 100 = 125%. This means that the portfolio captured 125% of the benchmark’s returns during the specified time period.

The up-market capture ratio is a useful tool for investors to evaluate the performance of their portfolio during positive market conditions. It provides insights into how well the portfolio is positioned to take advantage of upward market trends and can help investors make informed decisions about their investments.

How to Calculate Up-Market Capture Ratio

The Up-Market Capture Ratio is a measure used in portfolio management to evaluate how well a portfolio performs in comparison to a benchmark during periods of positive market returns. It helps investors understand the portfolio’s ability to capture the upside potential of the market.

To calculate the Up-Market Capture Ratio, you need to follow these steps:

Step 1: Gather the necessary data

Collect the historical returns of the portfolio and the benchmark for the desired period. Make sure the returns are for the same time frame and frequency (e.g., monthly, quarterly).

Step 2: Calculate the average returns

Calculate the average return of the portfolio and the benchmark for the specified period. This can be done by summing up all the returns and dividing them by the number of periods.

Step 3: Calculate the up-market return

Identify the periods when the benchmark had positive returns. Calculate the average return of the benchmark during those periods.

Step 4: Calculate the up-market capture ratio

Divide the average return of the portfolio during the up-market periods by the average return of the benchmark during the same periods. Multiply the result by 100 to get the percentage.

Up-Market Capture Ratio = (Average Portfolio Return during up-market periods / Average Benchmark Return during up-market periods) * 100

A ratio greater than 100% indicates that the portfolio outperformed the benchmark during positive market periods, while a ratio less than 100% suggests underperformance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.